Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company XYZ conducts treasury futures arbitrage. Information pertinent to the T-bond futures and the underlying bonds are shown below. Current date & repo rate:

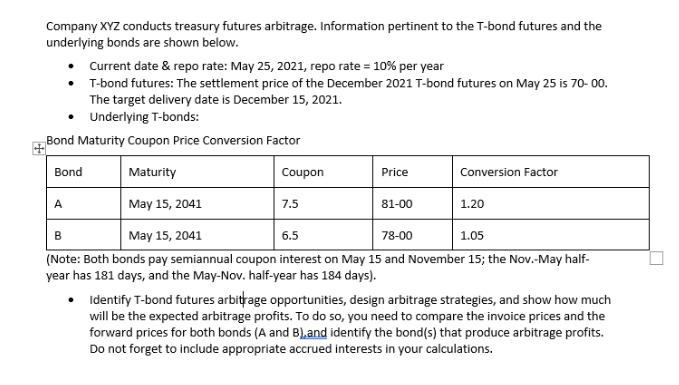

Company XYZ conducts treasury futures arbitrage. Information pertinent to the T-bond futures and the underlying bonds are shown below. Current date & repo rate: May 25, 2021, repo rate = 10% per year T-bond futures: The settlement price of the December 2021 T-bond futures on May 25 is 70-00. The target delivery date is December 15, 2021. Underlying T-bonds: Bond Maturity Coupon Price Conversion Factor Conversion Factor Bond Maturity Coupon Price A May 15, 2041 7.5 81-00 1.20 B May 15, 2041 6.5 78-00 1.05 (Note: Both bonds pay semiannual coupon interest on May 15 and November 15; the Nov.-May half- year has 181 days, and the May-Nov. half-year has 184 days). Identify T-bond futures arbitrage opportunities, design arbitrage strategies, and show how much will be the expected arbitrage profits. To do so, you need to compare the invoice prices and the forward prices for both bonds (A and B),and identify the bond(s) that produce arbitrage profits. Do not forget to include appropriate accrued interests in your calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To identify Tbond futures arbitrage opportunities we need to compare the invoice prices and the forward prices for both bonds A and B and see if there ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started