Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Company XYZ is considering expanding its capacity with a capital outlay of $25 million. The purchased equipment would be depreciated over its 4-year life

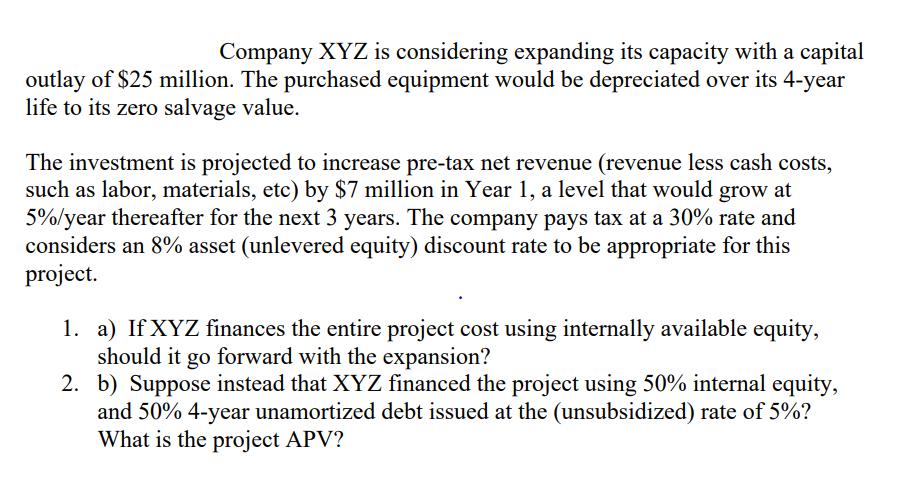

Company XYZ is considering expanding its capacity with a capital outlay of $25 million. The purchased equipment would be depreciated over its 4-year life to its zero salvage value. The investment is projected to increase pre-tax net revenue (revenue less cash costs, such as labor, materials, etc) by $7 million in Year 1, a level that would grow at 5%/year thereafter for the next 3 years. The company pays tax at a 30% rate and considers an 8% asset (unlevered equity) discount rate to be appropriate for this project. 1. a) If XYZ finances the entire project cost using internally available equity, should it go forward with the expansion? 2. b) Suppose instead that XYZ financed the project using 50% internal equity, and 50% 4-year unamortized debt issued at the (unsubsidized) rate of 5%? What is the project APV?

Step by Step Solution

★★★★★

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a To determine whether XYZ should go forward with the expansion using internally available equity we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started