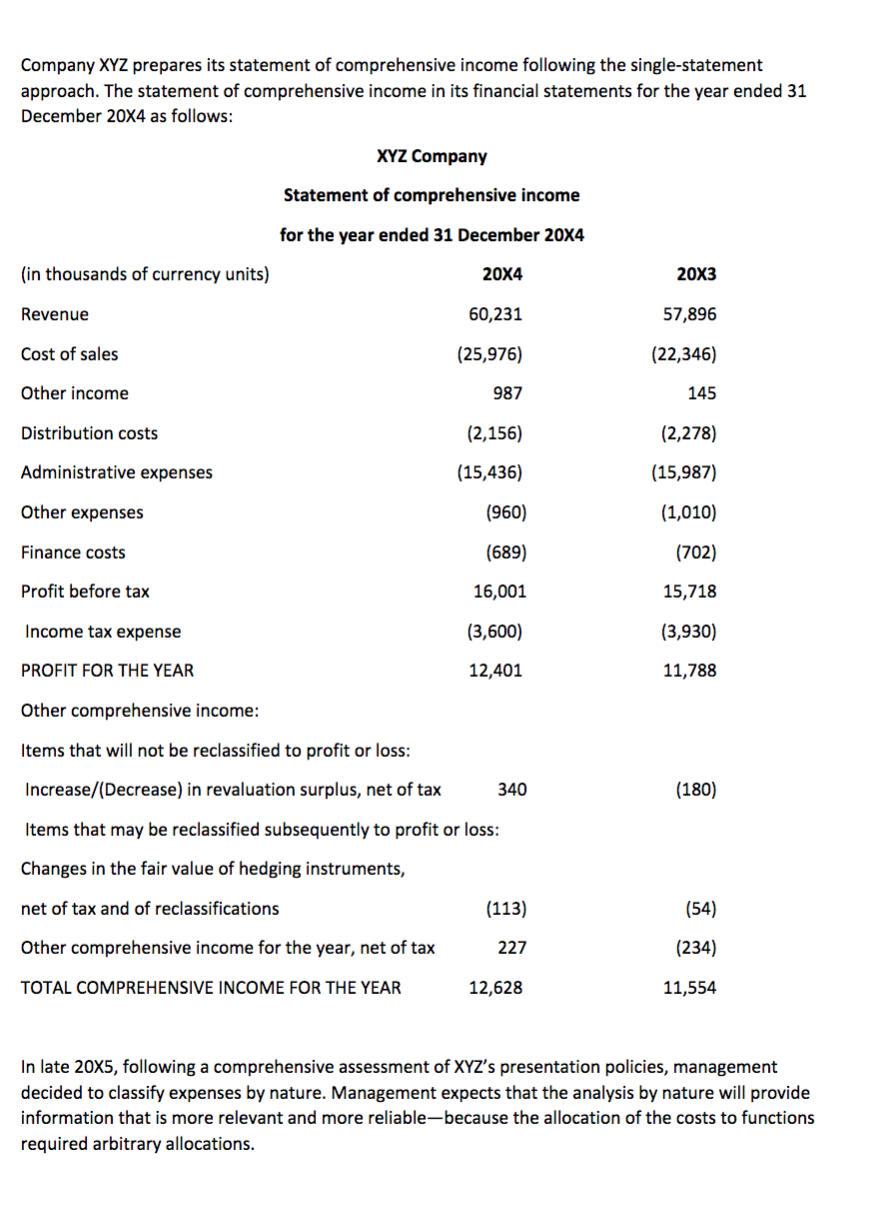

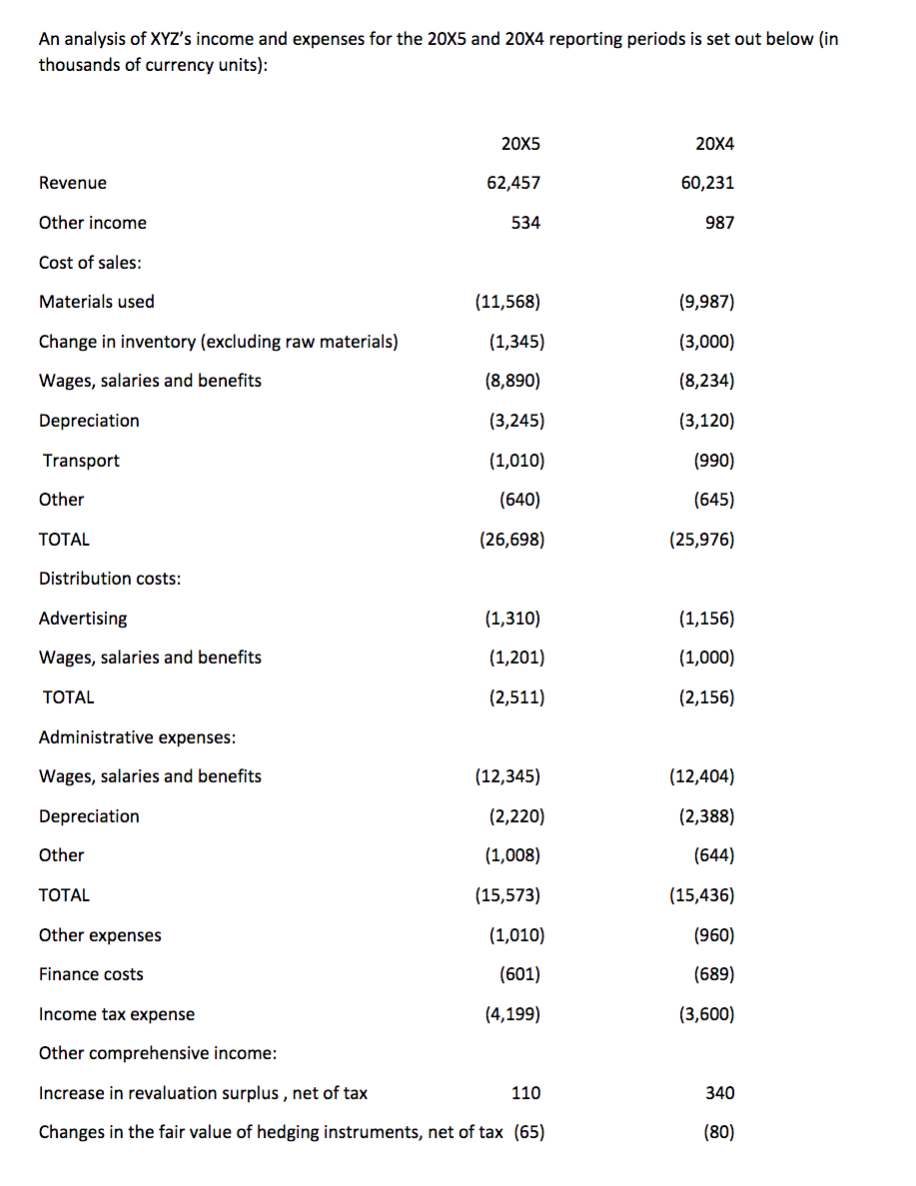

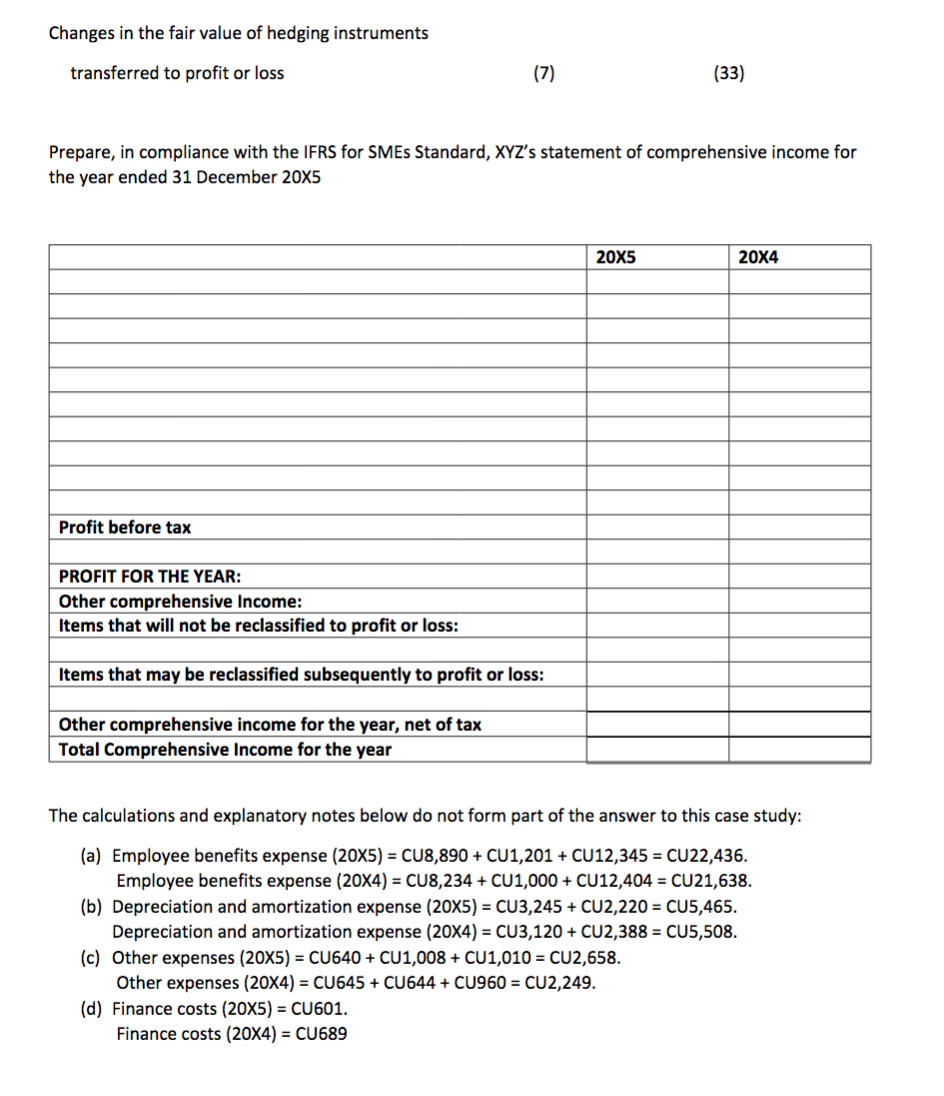

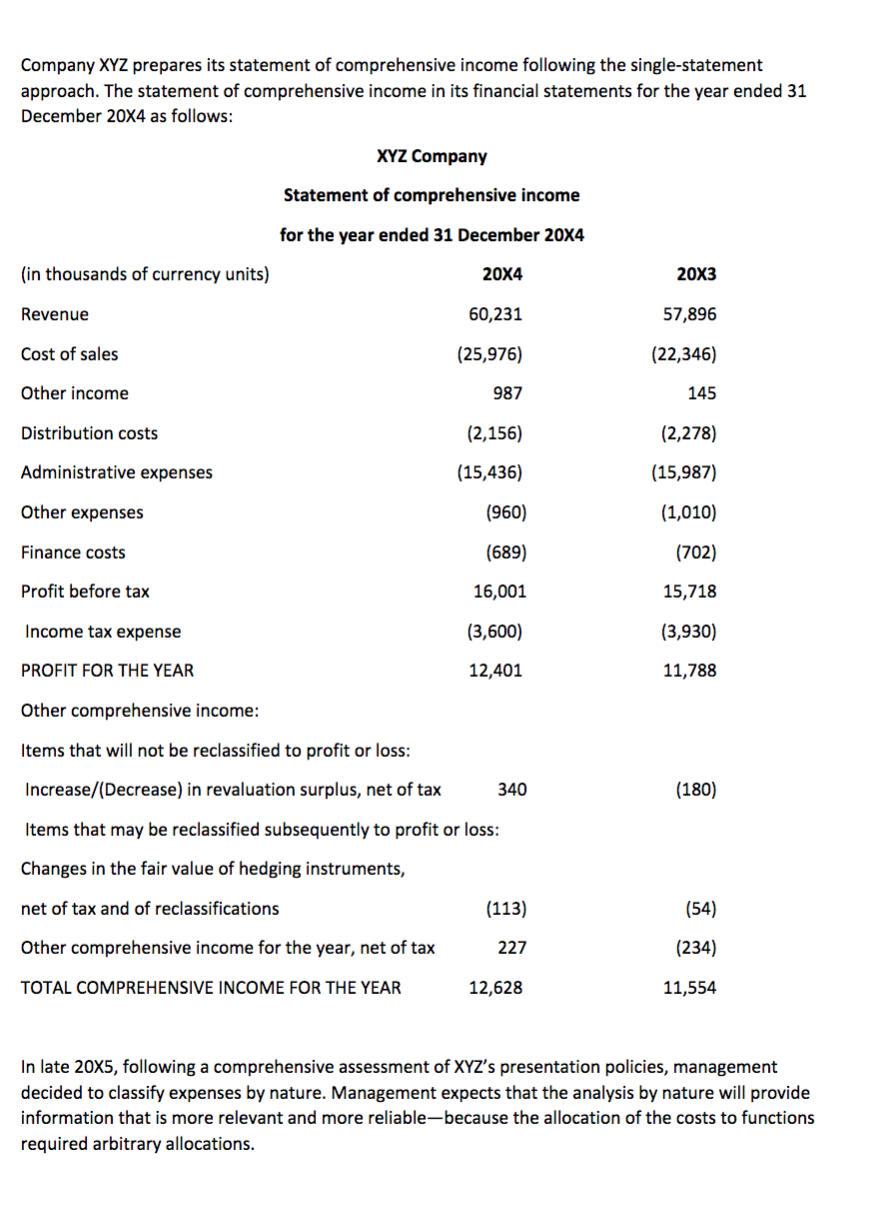

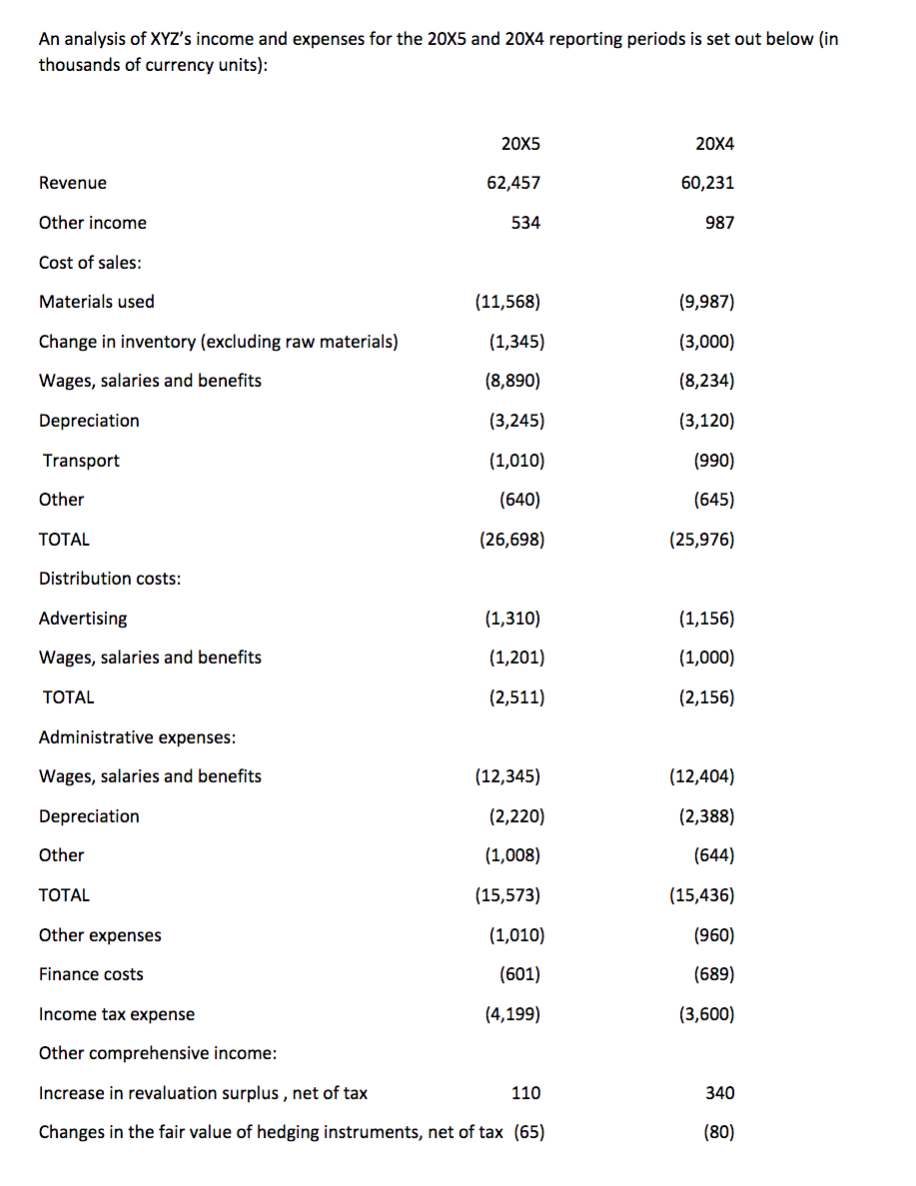

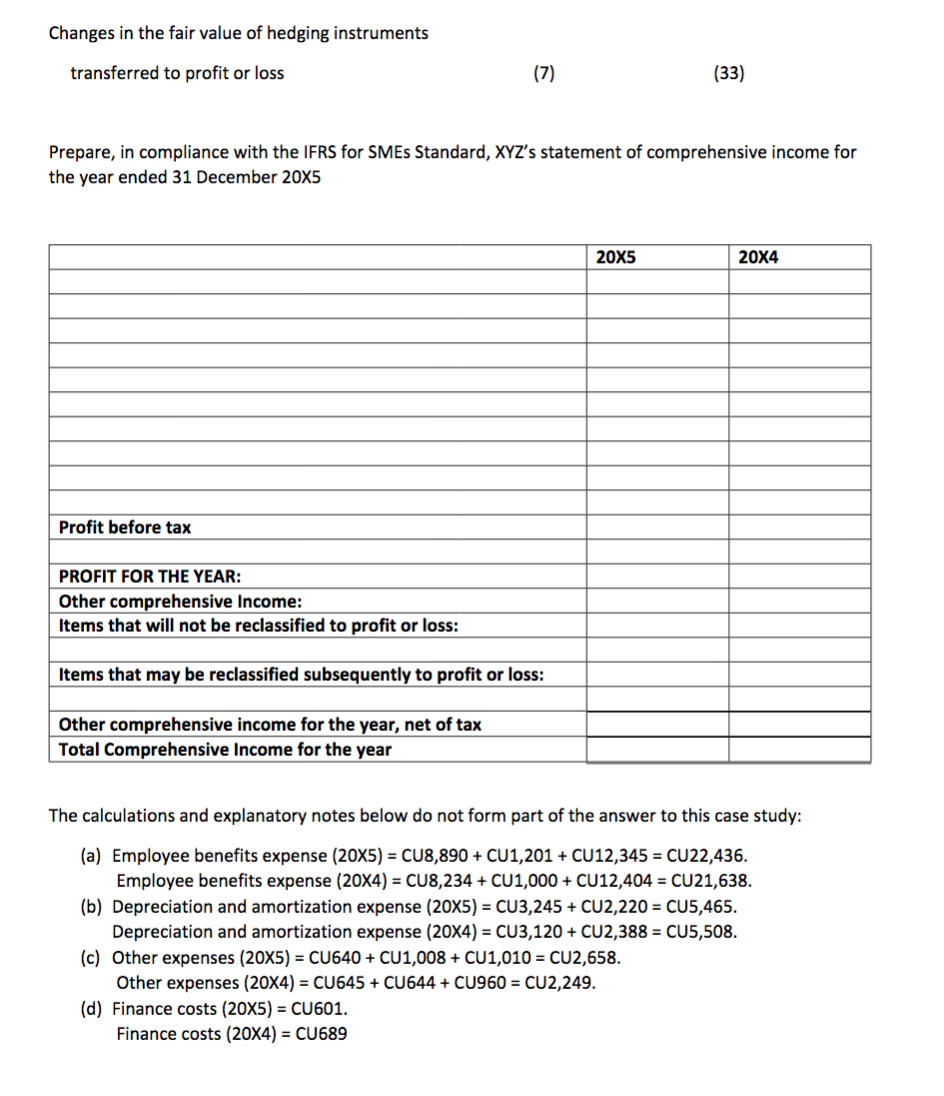

Company XYZ prepares its statement of comprehensive income following the single-statement approach. The statement of comprehensive income in its financial statements for the year ended 31 December 20X4 as follows: XYZ Company Statement of comprehensive income for the year ended 31 December 20X4 (in thousands of currency units) 20X4 20X3 Revenue 60,231 57,896 Cost of sales (25,976) (22,346) Other income 987 145 Distribution costs (2,156) (2,278) Administrative expenses (15,436) (15,987) Other expenses (960) (1,010) Finance costs (689) (702) Profit before tax 16,001 15,718 Income tax expense (3,600) (3,930) PROFIT FOR THE YEAR 12,401 11,788 Other comprehensive income: Items that will not be reclassified to profit or loss: Increase/(Decrease) in revaluation surplus, net of tax 340 (180) Items that may be reclassified subsequently to profit or loss: Changes in the fair value of hedging instruments, net of tax and of reclassifications (113) (54) Other comprehensive income for the year, net of tax 227 (234) TOTAL COMPREHENSIVE INCOME FOR THE YEAR 12,628 11,554 In late 20x5, following a comprehensive assessment of XYZ's presentation policies, management decided to classify expenses by nature. Management expects that the analysis by nature will provide information that is more relevant and more reliable-because the allocation of the costs to functions required arbitrary allocations. An analysis of XYZ's income and expenses for the 20x5 and 20x4 reporting periods is set out below (in thousands of currency units): 20X5 20X4 Revenue 62,457 60,231 Other income 534 987 Cost of sales: Materials used (11,568) (9,987) Change in inventory (excluding raw materials) (1,345) (3,000) Wages, salaries and benefits (8,890) (8,234) Depreciation (3,245) (3,120) Transport (1,010) (990) Other (640) (645) TOTAL (26,698) (25,976) Distribution costs: Advertising (1,310) (1,156) Wages, salaries and benefits (1,201) (1,000) TOTAL (2,511) (2,156) Administrative expenses: Wages, salaries and benefits (12,345) (12,404) Depreciation (2,220) (2,388) Other (1,008) (644) TOTAL (15,573) (15,436) Other expenses (1,010) (960) Finance costs (601) (689) Income tax expense (4,199) (3,600) Other comprehensive income: Increase in revaluation surplus, net of tax 110 340 Changes in the fair value of hedging instruments, net of tax (65) (80) Changes in the fair value of hedging instruments transferred to profit or loss (7) (33) Prepare, in compliance with the IFRS for SMEs Standard, XYZ's statement of comprehensive income for the year ended 31 December 20X5 20X5 20X4 Profit before tax PROFIT FOR THE YEAR: Other comprehensive Income: Items that will not be reclassified to profit or loss: Items that may be reclassified subsequently to profit or loss: Other comprehensive income for the year, net of tax Total Comprehensive Income for the year The calculations and explanatory notes below do not form part of the answer to this case study: (a) Employee benefits expense (2005) = CU8,890 + CU1,201 + CU12,345 = CU22,436. Employee benefits expense (20X4) = CU8,234 +CU1,000 + CU12,404 = CU21,638. (b) Depreciation and amortization expense (20x5) = CU3,245 + CU2,220 = CU5,465. Depreciation and amortization expense (20X4) = CU3,120 + CU2,388 = CU5,508. (c) Other expenses (20x5) = CU640 + CU1,008 + CU1,010 = CU2,658. Other expenses (20X4) = CU645 + CU644 + CU960 = CU2,249. (d) Finance costs (20X5) = CU601. Finance costs (20X4) = CU689 Company XYZ prepares its statement of comprehensive income following the single-statement approach. The statement of comprehensive income in its financial statements for the year ended 31 December 20X4 as follows: XYZ Company Statement of comprehensive income for the year ended 31 December 20X4 (in thousands of currency units) 20X4 20X3 Revenue 60,231 57,896 Cost of sales (25,976) (22,346) Other income 987 145 Distribution costs (2,156) (2,278) Administrative expenses (15,436) (15,987) Other expenses (960) (1,010) Finance costs (689) (702) Profit before tax 16,001 15,718 Income tax expense (3,600) (3,930) PROFIT FOR THE YEAR 12,401 11,788 Other comprehensive income: Items that will not be reclassified to profit or loss: Increase/(Decrease) in revaluation surplus, net of tax 340 (180) Items that may be reclassified subsequently to profit or loss: Changes in the fair value of hedging instruments, net of tax and of reclassifications (113) (54) Other comprehensive income for the year, net of tax 227 (234) TOTAL COMPREHENSIVE INCOME FOR THE YEAR 12,628 11,554 In late 20x5, following a comprehensive assessment of XYZ's presentation policies, management decided to classify expenses by nature. Management expects that the analysis by nature will provide information that is more relevant and more reliable-because the allocation of the costs to functions required arbitrary allocations. An analysis of XYZ's income and expenses for the 20x5 and 20x4 reporting periods is set out below (in thousands of currency units): 20X5 20X4 Revenue 62,457 60,231 Other income 534 987 Cost of sales: Materials used (11,568) (9,987) Change in inventory (excluding raw materials) (1,345) (3,000) Wages, salaries and benefits (8,890) (8,234) Depreciation (3,245) (3,120) Transport (1,010) (990) Other (640) (645) TOTAL (26,698) (25,976) Distribution costs: Advertising (1,310) (1,156) Wages, salaries and benefits (1,201) (1,000) TOTAL (2,511) (2,156) Administrative expenses: Wages, salaries and benefits (12,345) (12,404) Depreciation (2,220) (2,388) Other (1,008) (644) TOTAL (15,573) (15,436) Other expenses (1,010) (960) Finance costs (601) (689) Income tax expense (4,199) (3,600) Other comprehensive income: Increase in revaluation surplus, net of tax 110 340 Changes in the fair value of hedging instruments, net of tax (65) (80) Changes in the fair value of hedging instruments transferred to profit or loss (7) (33) Prepare, in compliance with the IFRS for SMEs Standard, XYZ's statement of comprehensive income for the year ended 31 December 20X5 20X5 20X4 Profit before tax PROFIT FOR THE YEAR: Other comprehensive Income: Items that will not be reclassified to profit or loss: Items that may be reclassified subsequently to profit or loss: Other comprehensive income for the year, net of tax Total Comprehensive Income for the year The calculations and explanatory notes below do not form part of the answer to this case study: (a) Employee benefits expense (2005) = CU8,890 + CU1,201 + CU12,345 = CU22,436. Employee benefits expense (20X4) = CU8,234 +CU1,000 + CU12,404 = CU21,638. (b) Depreciation and amortization expense (20x5) = CU3,245 + CU2,220 = CU5,465. Depreciation and amortization expense (20X4) = CU3,120 + CU2,388 = CU5,508. (c) Other expenses (20x5) = CU640 + CU1,008 + CU1,010 = CU2,658. Other expenses (20X4) = CU645 + CU644 + CU960 = CU2,249. (d) Finance costs (20X5) = CU601. Finance costs (20X4) = CU689