Question

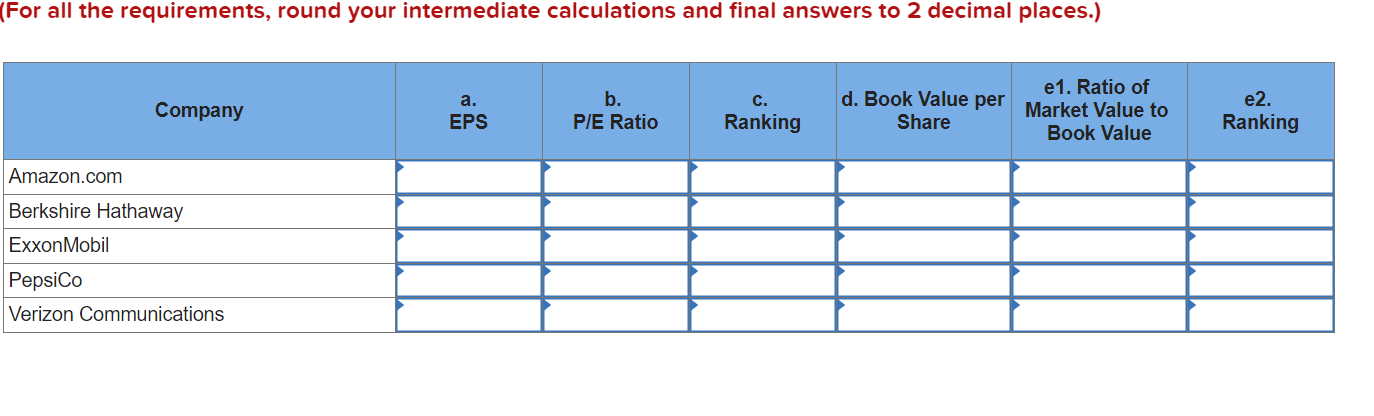

CompanyNet EarningsStockholders EquityShares OutstandingMarket Price per ShareAmazon.com$ 11,588$ 62,060498$ 2,004.20Berkshire Hathaway81,417428,5631.634333,190ExxonMobil14,340198,9384,23460.73PepsiCo7,35314,8681,391146.99Verizon Communications5,21762,8354,13958.51 Required a. Compute the earnings per share (EPS) for each company. b. Compute

CompanyNet EarningsStockholders EquityShares OutstandingMarket Price per ShareAmazon.com$ 11,588$ 62,060498$ 2,004.20Berkshire Hathaway81,417428,5631.634333,190ExxonMobil14,340198,9384,23460.73PepsiCo7,35314,8681,391146.99Verizon Communications5,21762,8354,13958.51

Required

a. Compute the earnings per share (EPS) for each company. b. Compute the P/E ratio for each company. c. Using the P/E ratios, rank the companies stock in the order that the stock market appears to value the companies, from most valuable to least valuable. d. Compute the book value per share for each company. e-1. Compute the ratio of Market Value to Book Value of each company. e-2. Based on the data, rank the companies from most valuable to least valuable. (The higher the ratio of market value to book value, the greater the value the stock market appears to be assigning to a companys stock.)

(For all the requirements, round your intermediate calculations and final answers to 2 decimal places.)

(For all the requirements, round your intermediate calculations and final answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started