Answered step by step

Verified Expert Solution

Question

1 Approved Answer

company's most profitable product; Z is the least profitable. Which The installation of new computer-controlled machinery and Which of the following would decrease unit contribution

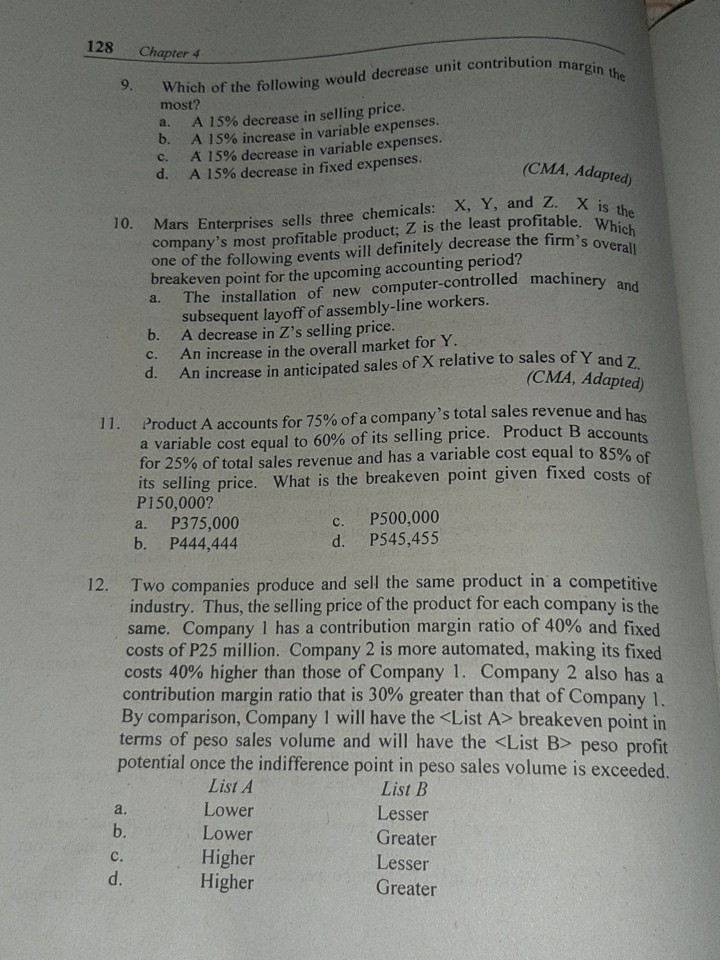

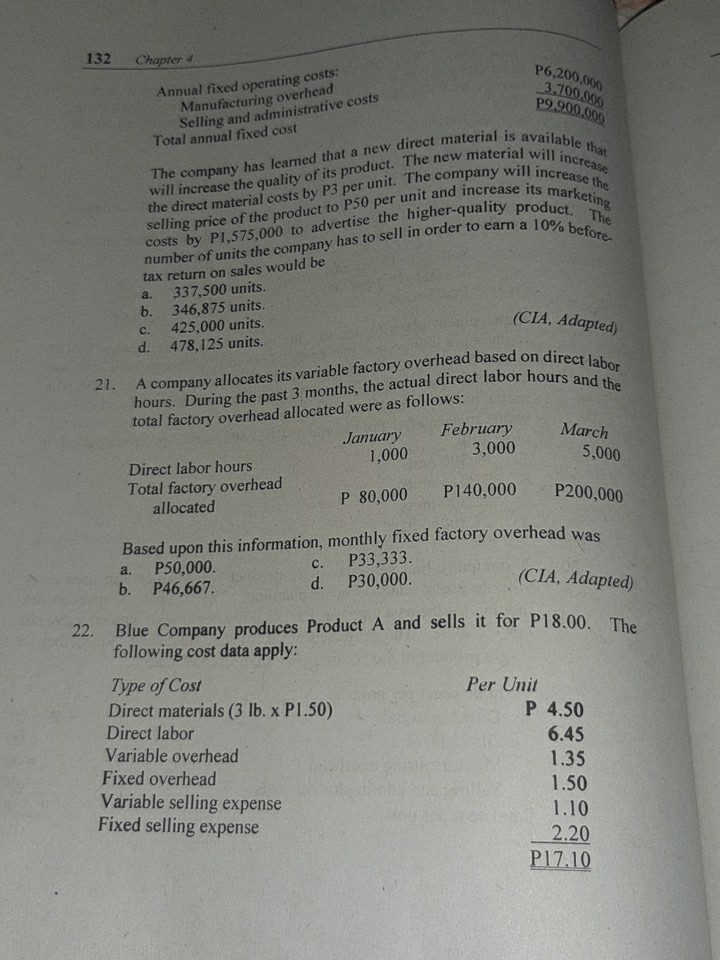

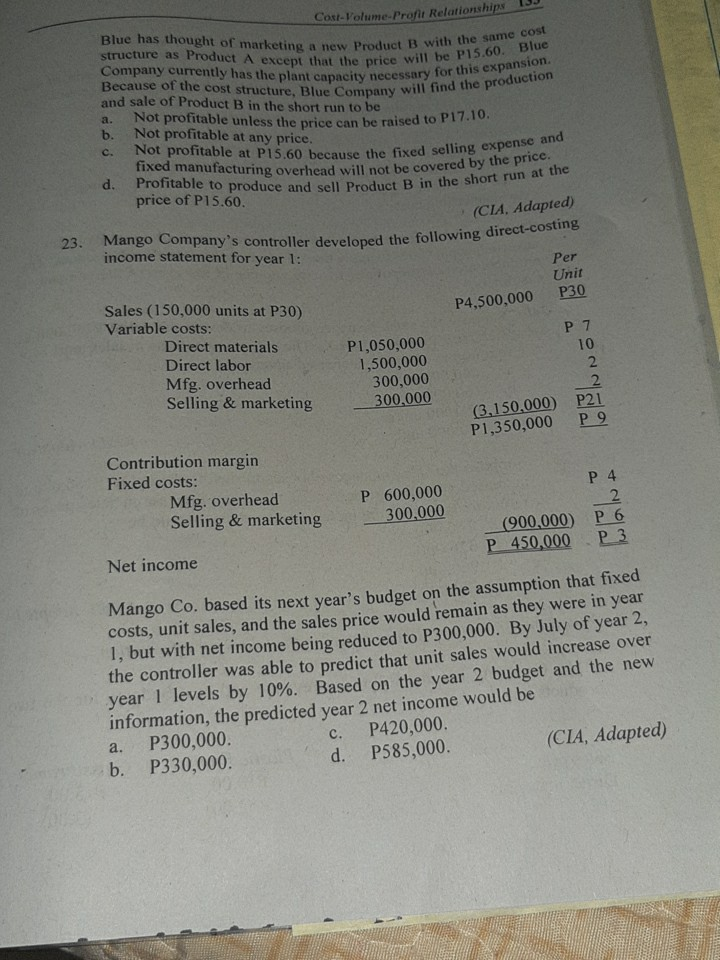

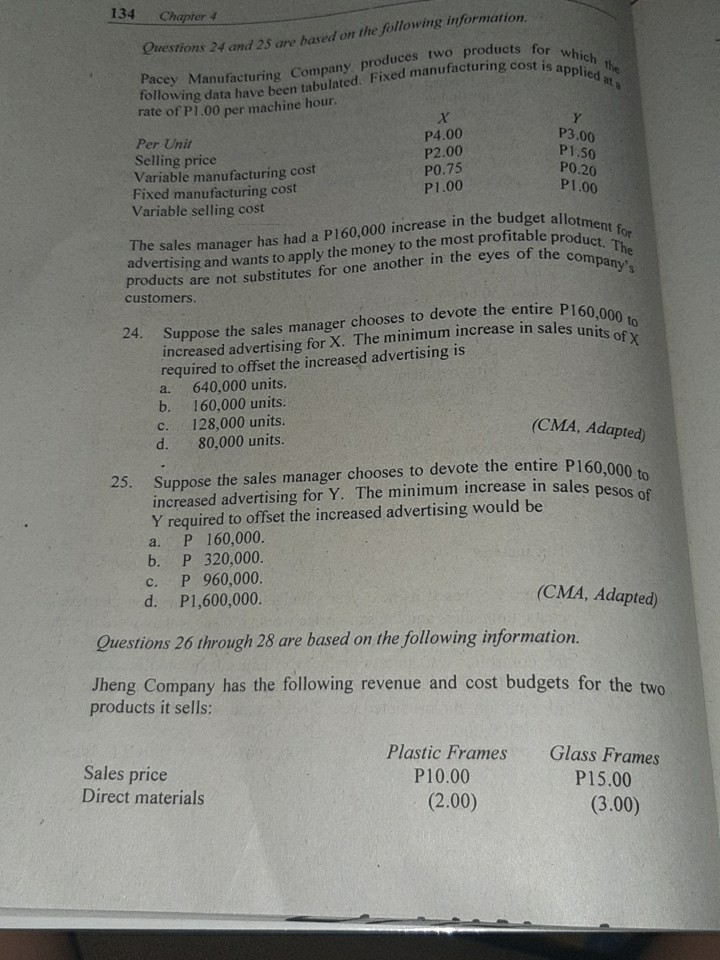

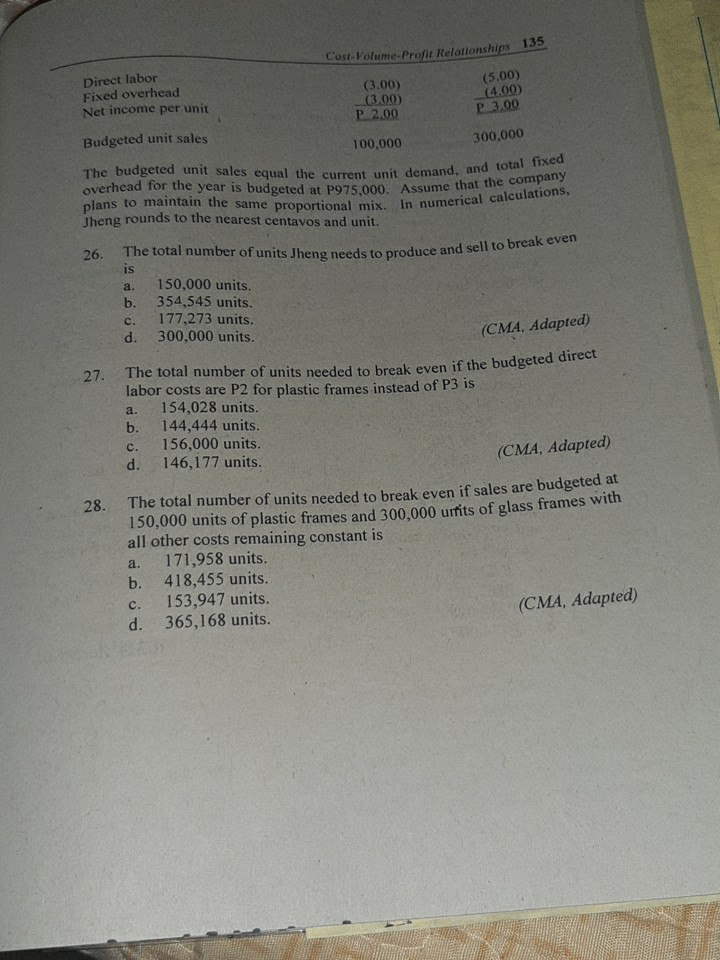

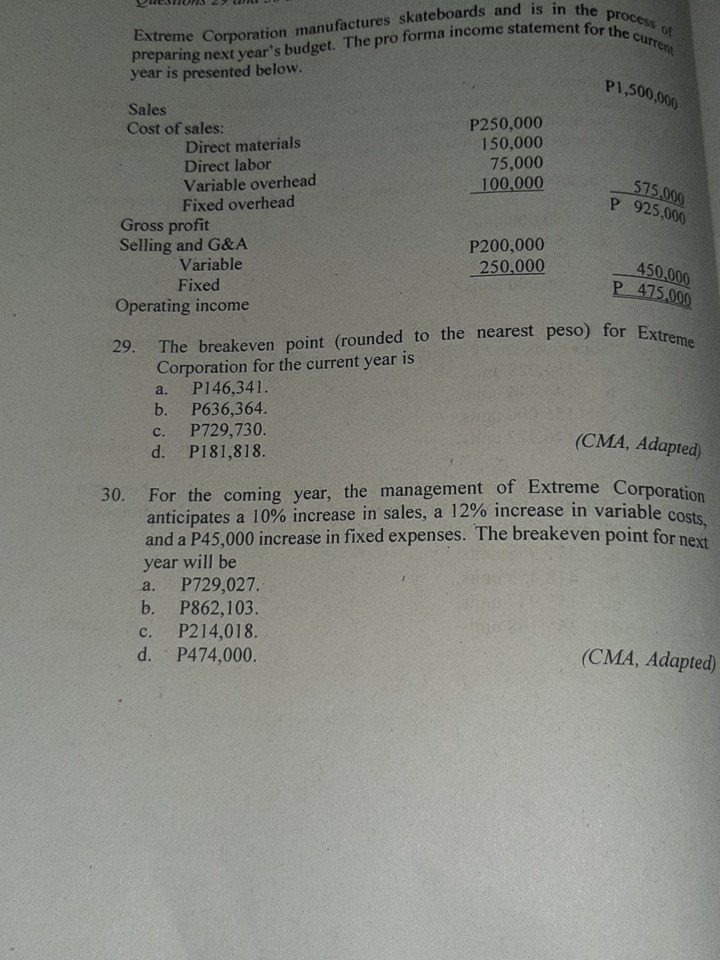

company's most profitable product; Z is the least profitable. Which The installation of new computer-controlled machinery and Which of the following would decrease unit contribution margin the 10. Mars Enterprises sells three chemicals: X, Y, and Z. X is the one of the following events will definitely decrease the firm's overall 128 Chapter 4 9. most? b. c. d. A 15% decrease in selling price. A 15% increase in variable expenses. 15% decrease in variable expenses. A 15% decrease in fixed expenses. (CMA, Adapted) a. b. c. d. breakeven point for the upcoming accounting period? subsequent layoff of assembly-line workers. A decrease in Z's selling price. An increase in the overall market for Y. An increase in anticipated sales of X relative to sales of Y and Z. (CMA, Adapted) 11. Product A accounts for 75% of a company's total sales revenue and has a variable cost equal to 60% of its selling price. Product B accounts for 25% of total sales revenue and has a variable cost equal to 85% of its selling price. What is the breakeven point given fixed costs of P150,000? P375,000 P500,000 b. P444,444 d. P545,455 a. C. . Two companies produce and sell the same product in a competitive industry. Thus, the selling price of the product for each company is the same. Company 1 has a contribution margin ratio of 40% and fixed costs of P25 million. Company 2 is more automated, making its fixed costs 40% higher than those of Company 1. Company 2 also has a contribution margin ratio that is 30% greater than that of Company 1. By comparison, Company I will have the

- breakeven point in terms of peso sales volume and will have the

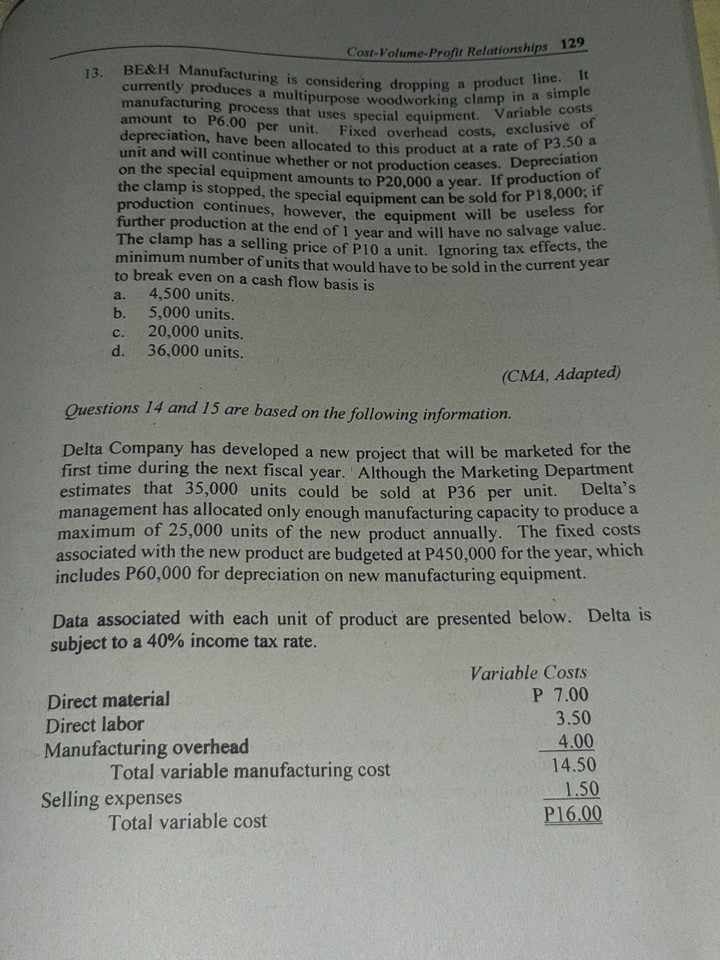

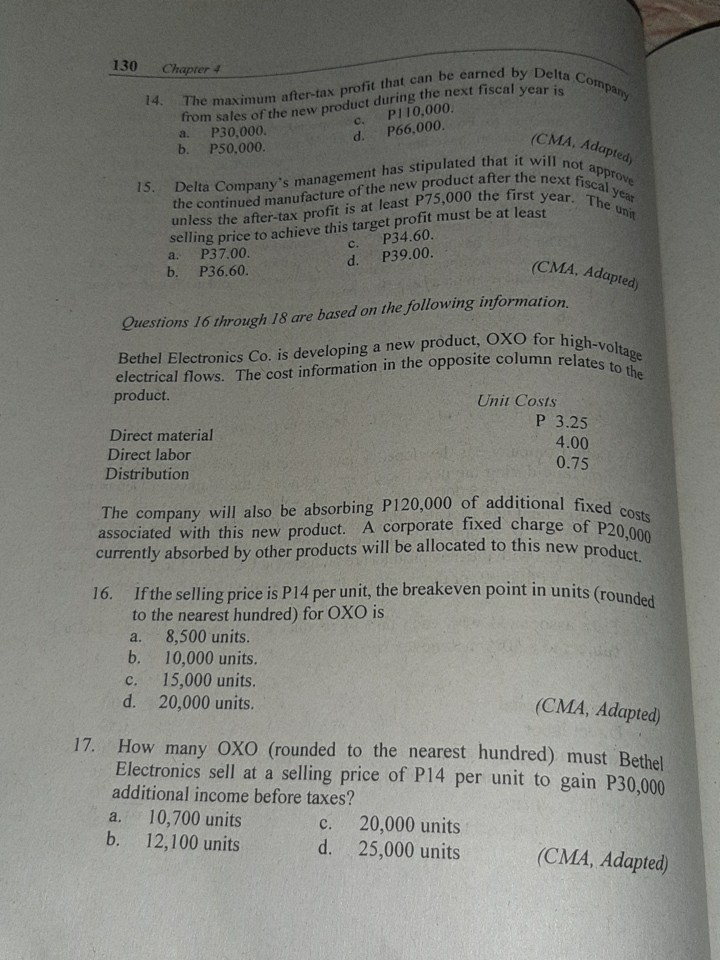

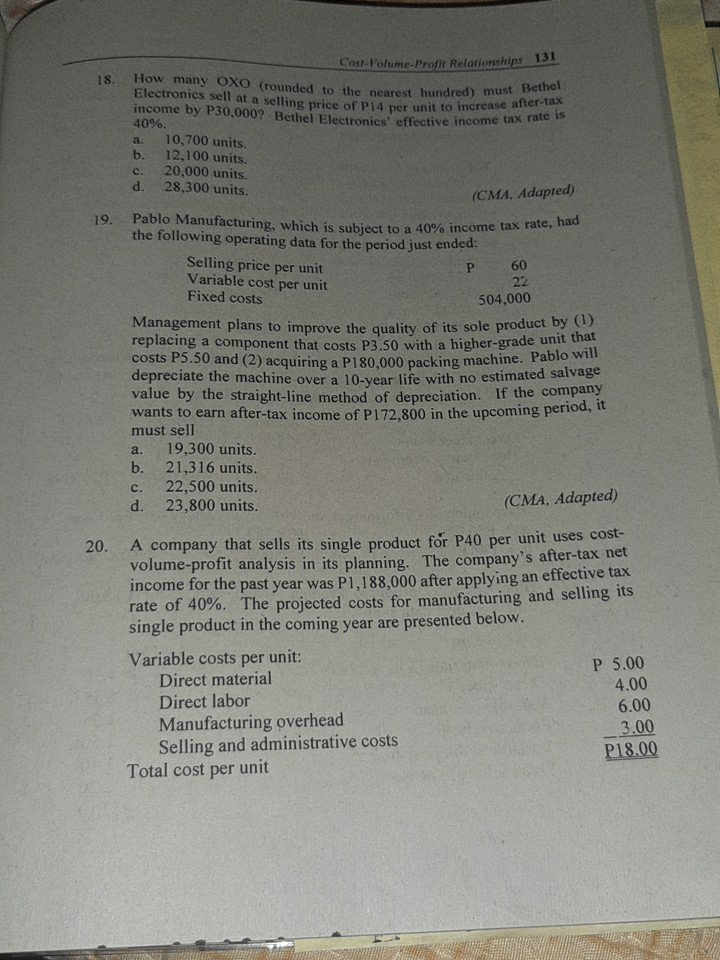

- peso profit potential once the indifference point in peso sales volume is exceeded. List A List B Lower Lesser b. Lower Greater c. Higher Lesser d. Higher Greater a. 13. It BE&H Manufacturing is considering dropping a product line. manufacturing process that uses special equipment. Variable costs currently produces a multipurpose woodworking clamp in a simple unit and will continue whether or not production ceases. Depreciation on the special equipment amounts to P20,000 a year. If production of the clamp is stopped, the special equipment can be sold for P18,000; if Cost-Volume-Profit Relationships 129 depreciation, have been allocated to this product at a rate of P3.54cm Fixed overhead costs, exclusive of further production at the end of 1 year and will have no salvage valute The clamp has a selling price of P10 a unit. Ignoring tax effects, the minimum number of units that would have to be sold in the current year to break even on a cash flow basis is a. 4,500 units. b. 5,000 units. c. 20,000 units. d. 36,000 units. (CMA, Adapted) Questions 14 and 15 are based on the following information. Delta Company has developed a new project that will be marketed for the first time during the next fiscal year. Although the Marketing Department estimates that 35,000 units could be sold at P36 per unit. Delta's management has allocated only enough manufacturing capacity to produce a maximum of 25,000 units of the new product annually. The fixed costs associated with the new product are budgeted at P450,000 for the year, which includes P60,000 for depreciation on new manufacturing equipment. Data associated with each unit of product are presented below. Delta is subject to a 40% income tax rate. Variable Costs Direct material P 7.00 Direct labor Manufacturing overhead 4.00 Total variable manufacturing cost 14.50 Selling expenses 1.50 Total variable cost P16.00 3.50 0. d. P110,000 P66.000. (CMA. Adapted year C a. selling price to achieve this target profit must be at least P34.60. d. P39.00 (CMA, Adapted) Questions 16 through 18 are based on the following information. The maximum after-tax profit that can be earned by Delta Company from sales of the new product during the next fiscal year is Delta Company's management has stipulated that it will not approve the continued manufacture of the new product after the next fiscal y unless the after-tax profit is at least P75,000 the first year. The unin electrical flows. The cost information in the opposite column relates to the Bethel Electronics Co. is developing a new product, OXO for high-voltage The company will also be absorbing P120,000 of additional fixed costs associated with this new product. A corporate fixed charge of P20,000 If the selling price is P14 per unit, the breakeven point in units (rounded 130 Chapter 1 14. a. P30,000 b. P50,000. 15. P37.00. b. P36.60 product. Direct material Direct labor Distribution 16. to the nearest hundred) for OXO is a. 8,500 units. b. 10,000 units. c. 15,000 units. d. 20,000 units. Unit Costs P 3.25 4.00 0.75 currently absorbed by other products will be allocated to this new product. (CMA, Adapted) 17. How many OXO (rounded to the nearest hundred) must Bethel Electronics sell at a selling price of P14 per unit to gain P30,000 additional income before taxes? 10,700 units 20,000 units b. 12,100 units d. 25,000 units (CMA, Adapted) a. c. Pablo Manufacturing, which is subject to a 40% income tax rate, had Cost-Volume-Profit Relationships 131 18. How many OXO (rounded to the nearest hundred) must Bethel Electronics sell at a selling price of P14 per unit to increase after-tax income by P30,000? Bethel Electronics' effective income tax rate is a. b. c. d. 40% 10,700 units. 12,100 units. 20,000 units. 28,300 units (CMA, Adapted) 19. the following operating data for the period just ended: Selling price per unit Variable cost per unit Fixed costs P 60 22 504,000 Management plans to improve the quality of its sole product by ( replacing a component that costs P3.50 with a higher-grade unit that costs P5.50 and (2) acquiring a P180,000 packing machine. Pablo will depreciate the machine over a 10-year life with no estimated salvage value by the straight-line method of depreciation. If the company wants to earn after-tax income of P172,800 in the upcoming period, it must sell a. 19,300 units. b. 21,316 units. C. 22,500 units. d. 23,800 units. (CMA, Adapted) 20. A company that sells its single product for P40 per unit uses cost- volume-profit analysis in its planning. The company's after-tax net income for the past year was P1,188,000 after applying an effective tax rate of 40%. The projected costs for manufacturing and selling its single product in the coming year are presented below. Variable costs per unit: Direct material P 5.00 Direct labor 4.00 Manufacturing overhead 6.00 Selling and administrative costs 3.00 Total cost per unit P18.00 P6,200.000 3.700.8206 P9.900.000 Annual fixed operating costs: Manufacturing overhead Selling and administrative costs Total annual fixed cost The company has learned that a new direct material is available that the direct material costs by P3 per unit. The company will increase the will increase the quality of its product. The new material will increase selling price of the product to P50 per unit and increase its marketing costs by P1,575,000 to advertise the higher-quality product. The number of units the company has to sell in order to earn a 10% before A company allocates its variable factory overhead based on direct labor hours. During the past 3 months, the actual direct labor hours and the 132 Chapter b. c. d. 21. total factory overhead allocated were as follows: January February 1,000 3,000 Direct labor hours Total factory overhead P140,000 P 80,000 allocated tax return on sales would be a. 337,500 units 346,875 units. 425,000 units. 478,125 units. (CIA, Adapted) March 5,000 P200,000 Based upon this information, monthly fixed factory overhead was P50,000. P33,333. b. P46,667 d. P30,000 a. c. (CIA, Adapted) 22. Blue Company produces Product A and sells it for P18.00. The following cost data apply: Type of Cost Per Unit Direct materials (3 lb. x P1.50) P 4.50 Direct labor 6.45 Variable overhead 1.35 Fixed overhead 1.50 Variable selling expense 1.10 2.20 P17.10 Fixed selling expense Not profitable unless the price can be raised to P17.10. Blue has thought of marketing a new Product B with the same cost structure as Product A except that the price will be P15.60. Blue Company currently has the plant capacity necessary for this expansion Because of the cost structure, Blue Company will find the production Not profitable at P15.60 because the fixed selling expense and fixed manufacturing overhead will not be covered by the price. Profitable to produce and sell Product B in the short run at the Mango Company's controller developed the following direct-costing Cox-Volume-Profit Relationships and sale of Product B in the short run to be a. b. Not profitable at any price. c. d. price of P15.60. income statement for year 1: (CIA, Adapted) 23. Per Unit P30 P4,500,000 Sales (150,000 units at P30) Variable costs: Direct materials Direct labor Mfg. overhead Selling & marketing P7 10 2 P1,050,000 1,500,000 300,000 300,000 2 (3,150,000 P21 P1,350,000 P9 Contribution margin Fixed costs: Mfg. overhead Selling & marketing P 600,000 300,000 P4 2 (900,000) P6 P450,000 P 3 Net income Mango Co. based its next year's budget on the assumption that fixed costs, unit sales, and the sales price would remain as they were in year 1, but with net income being reduced to P300,000. By July of year 2, the controller was able to predict that unit sales would increase over year 1 levels by 10%. Based on the year 2 budget and the new information, the predicted year 2 net income would be a. P300,000 P420,000 b. P330,000. d. P585,000. (CIA, Adapted) c. X P4.00 P2.00 P0.75 P1.00 Y P3.00 P1.50 P0.20 P1.00 Pacey Manufacturing Company produces two products for which the Questions 24 and 25 are based on the following information. following data have been tabulated. Fixed manufacturing cost is applied advertising and wants to apply the money to the most profitable product. The The sales manager has had a P160,000 increase in the budget allotment for products are not substitutes for one another in the eyes of the company's Suppose the sales manager chooses to devote the entire P160,000 to increased advertising for X. The minimum increase in sales units of X 25. Suppose the sales manager chooses to devote the entire P160,000 to increased advertising for Y. The minimum increase in sales pesos of 134 Chapter rate of P1.00 per machine hour. Per Unit Selling price Variable manufacturing cost Fixed manufacturing cost Variable selling cost customers. 24. required to offset the increased advertising is a. 640,000 units. b. 160,000 units. c. 128,000 units. d. 80,000 units. (CMA, Adapted) a. Y required to offset the increased advertising would be P160,000. b. P 320,000. P 960,000 d. P1,600,000 C. (CMA, Adapted) Questions 26 through 28 are based on the following information. Jheng Company has the following revenue and cost budgets for the two products it sells: Glass Frames Sales price Direct materials Plastic Frames P10.00 (2.00) P15.00 (3.00) (5.00) (4.00) P 3.00 300.000 The budgeted unit sales equal the current unit demand, and total fixed overhead for the year is budgeted at P975,000. Assume that the company plans to maintain the same proportional mix. In numerical calculations, The total number of units Jheng needs to produce and sell to break even Cost-Volume-Profit Relationships 135 Direct labor Fixed overhead (3.00) (3.00) Net income per unit P2.00 Budgeted unit sales 100,000 Jheng rounds to the nearest centavos and unit. 26. is a. 150,000 units. b. 354,545 units. c. 177,273 units. d. 300,000 units. 27. The total number of units needed to break even if the budgeted direct labor costs are P2 for plastic frames instead of P3 is a. 154,028 units. b. 144,444 units. c. 156,000 units. d. 146,177 units. (CMA, Adapted) (CMA, Adapted) 28. The total number of units needed to break even if sales are budgeted at 150,000 units of plastic frames and 300,000 urtits of glass frames with all other costs remaining constant is 171,958 units. b. 418,455 units. 153,947 units. d. 365,168 units. (CMA, Adapted) a. c. P1,500,000 Extreme Corporation manufactures skateboards and is in the process of preparing next year's budget. The pro forma income statement for the cutrem The breakeven point (rounded to the nearest peso) for Extreme year is presented below. Sales Cost of sales: Direct materials Direct labor Variable overhead Fixed overhead Gross profit Selling and G&A Variable Fixed Operating income P250,000 150,000 75,000 100,000 575.000 P 925,000 P200,000 250,000 450.000 P. 475.000 29. a. Corporation for the current year is P146,341. b. P636,364. P729,730. d. P181,818. c. (CMA, Adapted) 30. For the coming year, the management of Extreme Corporation anticipates a 10% increase in sales, a 12% increase in variable costs. and a P45,000 increase in fixed expenses. The breakeven point for next year will be P729,027. b. P862,103. P214,018. d. P474,000. a. c. (CMA, Adapted)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started