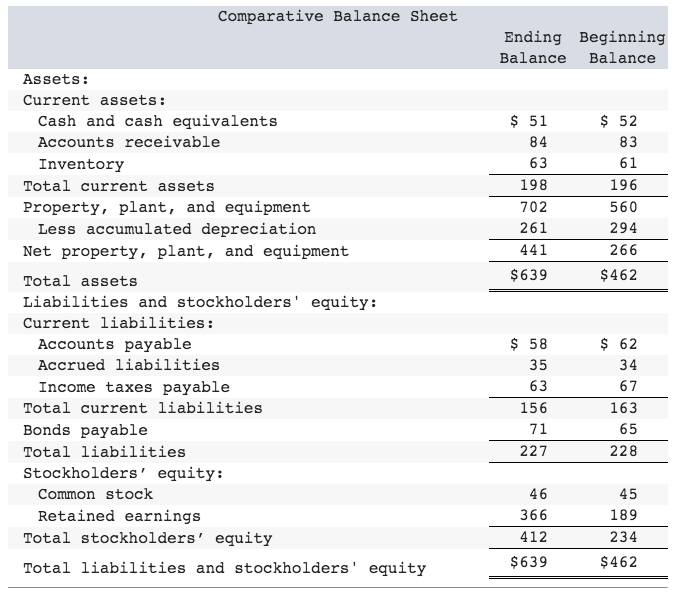

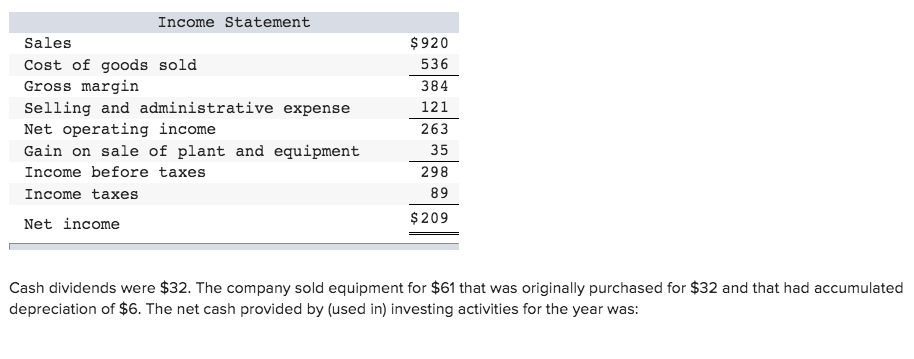

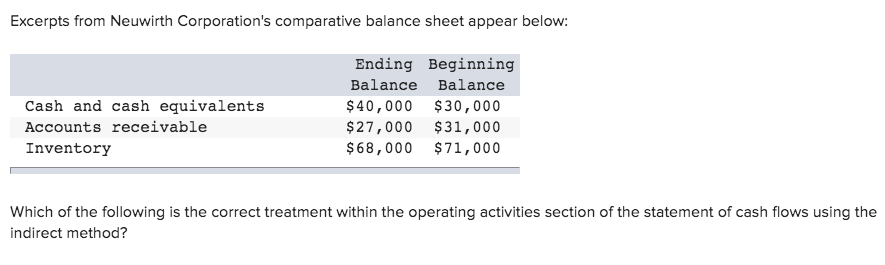

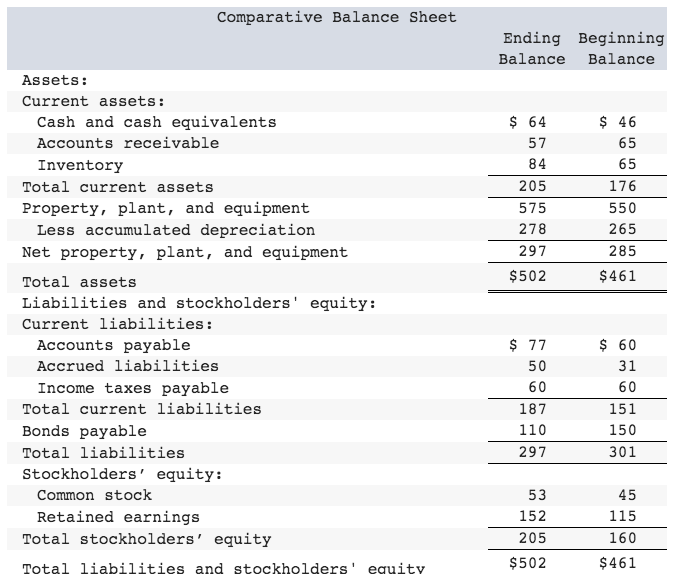

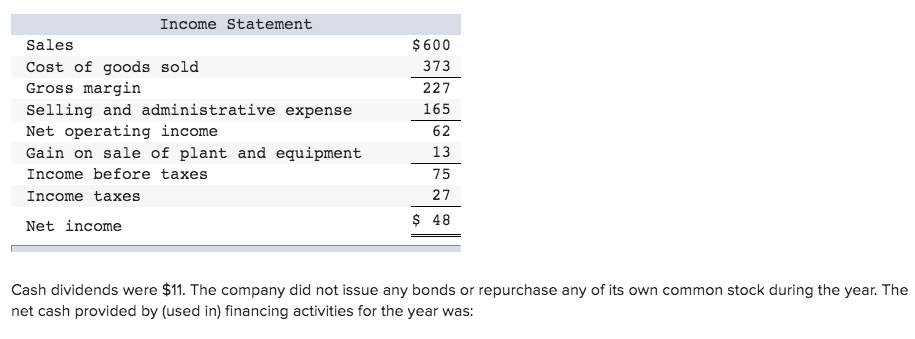

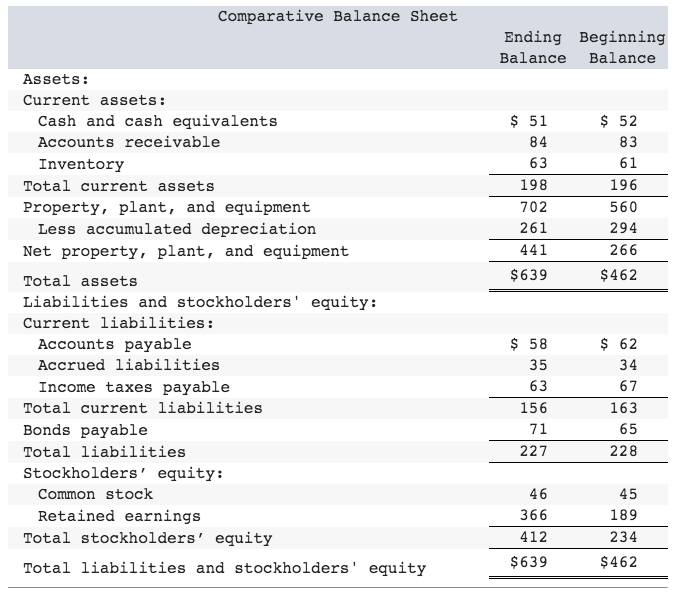

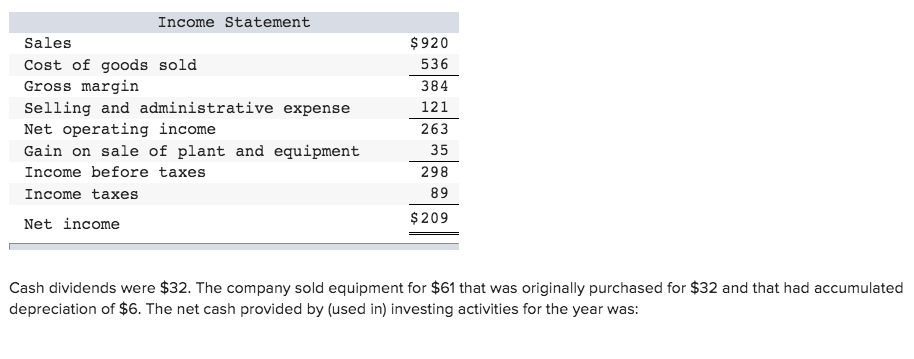

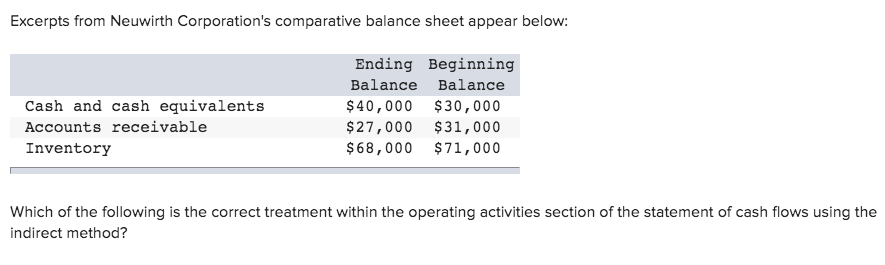

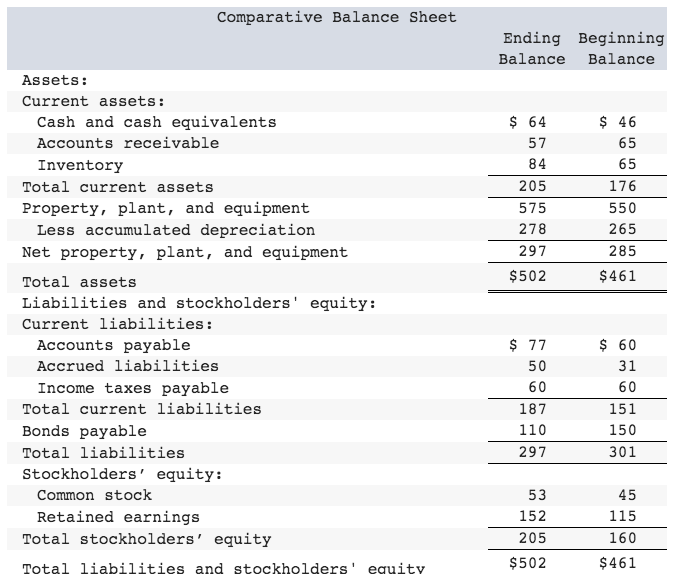

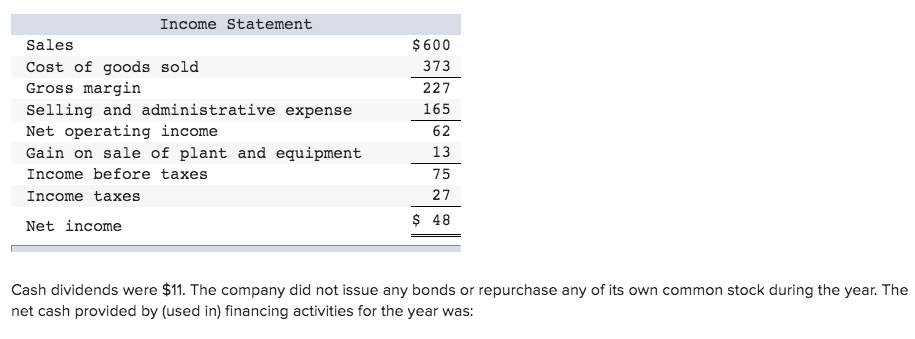

Comparative Balance Sheet Ending Beginning Balance Balance Assets Current assets: $ 52 $ 51 Cash and cash equivalents Accounts receivable 84 83 63 61 Inventory 198 196 Total current assets Property, plant, and equipment 702 560 261 294 Less accumulated depreciation 266 441 Net property, plant, and equipment $639 $462 Total assets Liabilities and stockholders' equity: Current liabilities: $ 58 Accounts payable $62 Accrued liabilities 35 34 Income taxes payable 63 67 163 Total current liabilities 156 71 65 Bonds payable 227 228 Total liabilities Stockholders' equity: Common stock 46 45 Retained earnings 366 189 Total stockholders' equity 412 234 $639 $462 Total liabilities and stockholders' equity Income Statement Sales $920 536 Cost of goods sold Gross margin 384 121 Selling and administrative expense Net operating income Gain on sale of plant and equipment 263 35 298 Income before taxes 89 Income taxes $209 Net income Cash dividends were $32. The company sold equipment for $61 that was originally purchased for $32 and that had accumulated depreciation of $6. The net cash provided by (used in) investing activities for the year was: Excerpts from Neuwirth Corporation's comparative balance sheet appear below: Ending Beginning Balance Balance Cash and cash equivalents $40,000 $30,000 Accounts receivable $27,000 $31,000 $68,000 $71,000 Inventory Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method? Comparative Balance Sheet Ending Beginning Balance Balance Assets: Current assets: $ 46 Cash and cash equivalents 64 65 Accounts receivable 57 84 65 Inventory 205 176 Total current assets Property, plant, and equipment Less accumulated depreciation 550 575 265 278 297 285 Net property, plant, and equipment $502 $461 Total assets Liabilities and stockholders' equity Current liabilities Accounts payable $ 77 $60 Accrued liabilities 50 31 60 Income taxes payable 60 Total current liabilities 187 151 Bonds payable 110 150 301 297 Total liabilities Stockholders' equity: Common stock 53 45 Retained earnings Total stockholders' equity 152 115 205 160 $502 $461 Total liabilities and stockholders' eauitv 1 Income Statement Sales $600 373 Cost of goods sold Gross margin 227 165 Selling and administrative expense Net operating income Gain on sale of plant and equipment 62 13 Income before taxes 75 27 Income taxes $ 48 Net income Cash dividends were $11. The company did not issue any bonds or repurchase any of its own common stock during the year. The net cash provided by (used in) financing activities for the year was