Question

COMPARATIVE BALANCE SHEETS AS AT 30 JUNE Current Assets 2021 2020 Cash at Bank 31 000 7 200 Accounts Receivable (net) 32 800 41 000

COMPARATIVE BALANCE SHEETS

AS AT 30 JUNE

|

Current Assets | 2021 | 2020 | ||

| Cash at Bank | 31 000 |

| 7 200 |

|

| Accounts Receivable (net) | 32 800 |

| 41 000 |

|

| Inventory | 18 000 |

| 21 000 |

|

| Prepaid Expenses | 8 000 | $89 800 | 12 000 | $81 200 |

| Non-Current Assets |

|

|

|

|

| Computer | 450 000 |

| 410 000 |

|

| Less:Accum. Depreciation | (28 200) | 421 800 | (21 000) | 389 000 |

| Total Assets |

| 511 600 |

| 470 200 |

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

| Accounts Payable | 18 000 |

| 20 000 |

|

| Expenses Payable | 2 000 |

| 3 000 |

|

| Tax Payable | 16 400 | 36 400 | 22 000 | 45 000 |

| Non-Current Liabilities |

|

|

|

|

| Bank Loan |

| 25 000 |

| 25 000 |

| Total Liabilities |

| 61 400 |

| 70 000 |

| Net Assets |

| $450 200 |

| $400 200 |

|

|

|

|

|

|

| Equity |

|

|

|

|

| Capital Mr. Light |

| 450 200 |

| 400 200 |

|

|

| $450 200 |

| $400 200 |

INCOME STATEMENT

FOR THE YEAR ENDED 30 JUNE 2021

|

|

|

|

| Net Sales |

| $207 000 |

| Cost of Sales |

| 99 000 |

| Gross Profit: |

| 108 000 |

| Other Revenue: |

|

|

| Discount Received | $4 500 |

|

| Interest Revenue | 11 000 | 15 500 |

|

|

| 123 500 |

| Expenses: |

|

|

| Selling & Admin Expense | 24 000 |

|

| Doubtful Debts Expense | 3 500 |

|

| Depreciation Expense | 7 200 |

|

| Interest Expense | 2 800 | 37 500 |

| Profit before tax |

| 86 000 |

| Income Tax Expense |

| 26 000 |

| Profit |

| $60 000 |

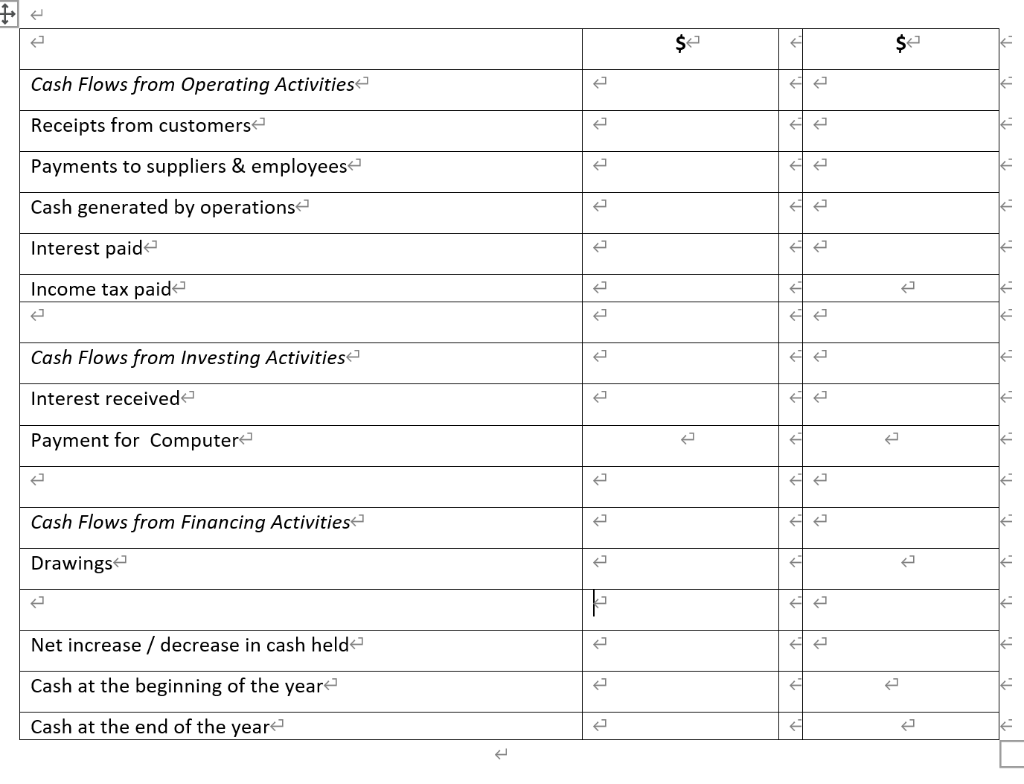

a. Prepare a Statement of Cash Flows in the pro forma provided on the following page. You must show all calculations (an answer without supporting calculations will receive zero marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started