Answered step by step

Verified Expert Solution

Question

1 Approved Answer

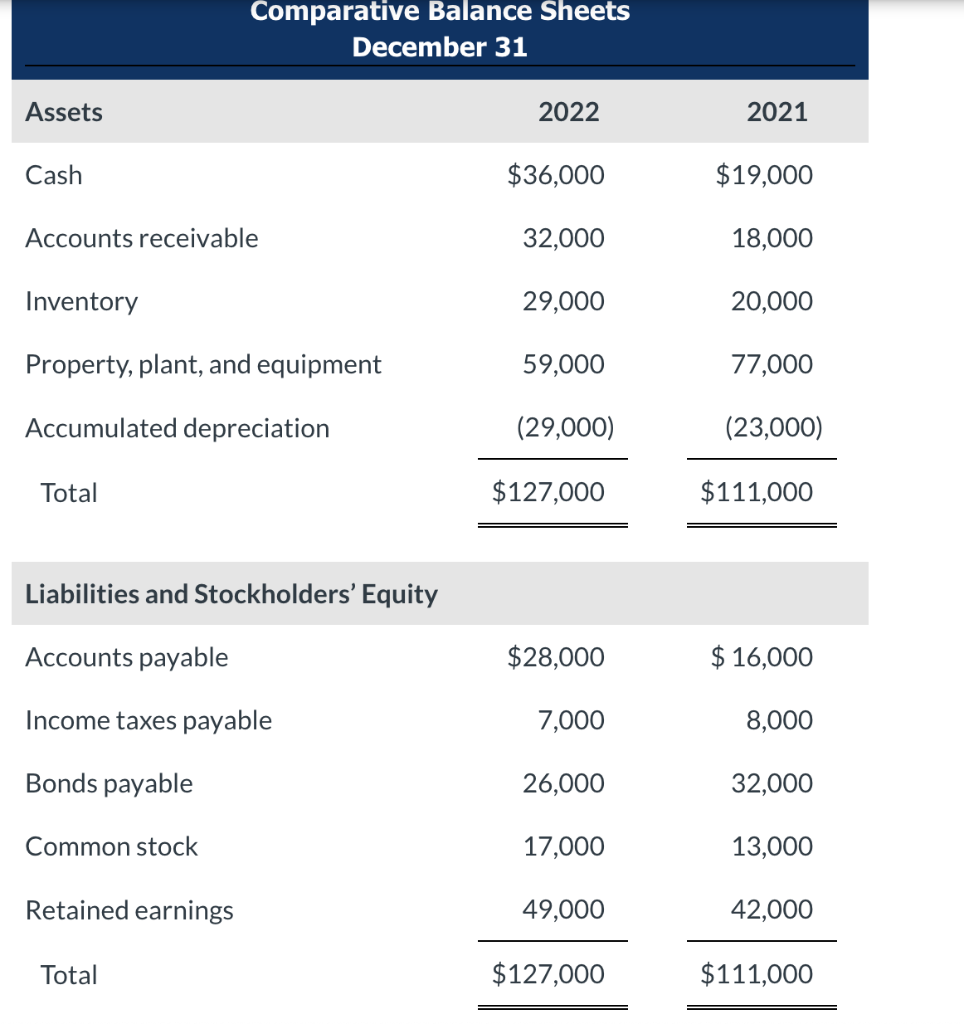

Comparative Balance Sheets December 31 2022 $36,000 32,000 29,000 59,000 (29,000) $127,000 $28,000 7,000 26,000 17,000 49,000 $127,000 Assets Cash Accounts receivable Inventory Property,

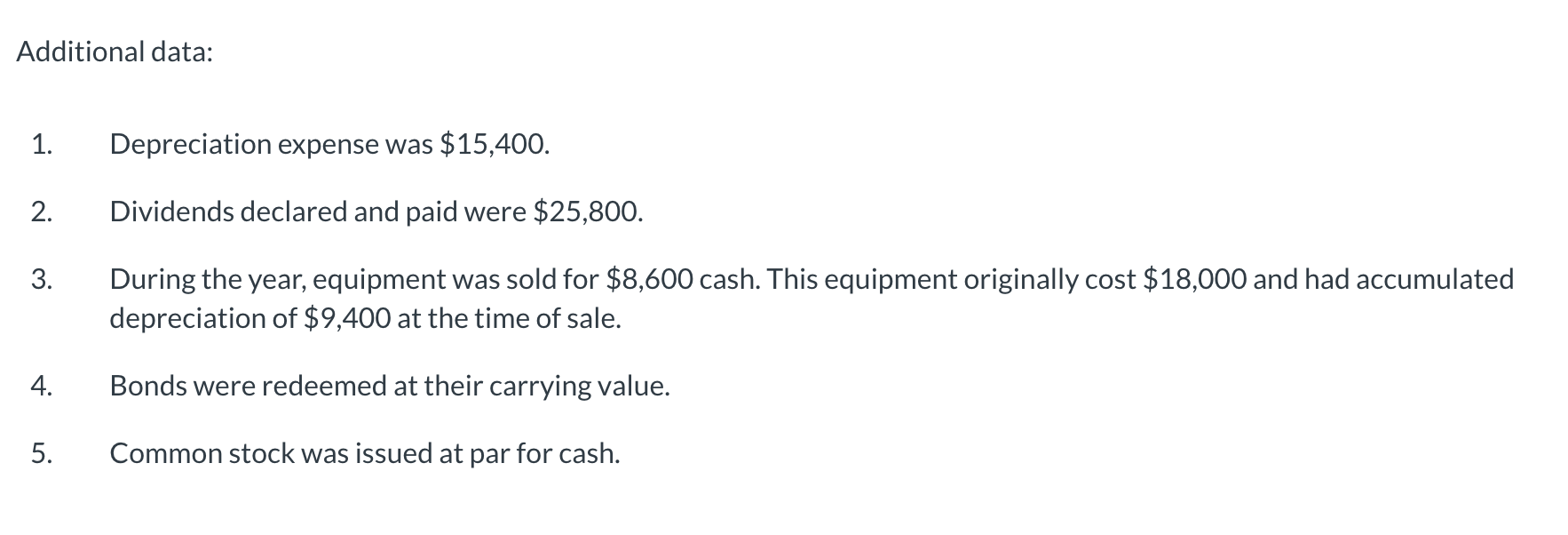

Comparative Balance Sheets December 31 2022 $36,000 32,000 29,000 59,000 (29,000) $127,000 $28,000 7,000 26,000 17,000 49,000 $127,000 Assets Cash Accounts receivable Inventory Property, plant, and equipment Accumulated depreciation Total Liabilities and Stockholders' Equity Accounts payable Income taxes payable Bonds payable Common stock Retained earnings Total 2021 $19,000 18,000 20,000 77,000 (23,000) $111,000 $ 16,000 8,000 32,000 13,000 42,000 $111,000 CRANE COMPANY Income Statement For the Year Ended December 31, 2022 $17,250 5,750 Sales revenue Cost of goods sold Gross profit Selling expenses Administrative expenses Income from operations Interest expense Income before income taxes Income tax expense Net income $241,000 175,000 66,000 23,000 43,000 2,000 41,000 8,200 $32,800 Additional data: 1. Depreciation expense was $15,400. 2. Dividends declared and paid were $25,800. 3. During the year, equipment was sold for $8,600 cash. This equipment originally cost $18,000 and had accumulated depreciation of $9,400 at the time of sale. 4. Bonds were redeemed at their carrying value. 5. Common stock was issued at par for cash. CRANE COMPANY Statement of Cash Flows Adjustments to reconcile net income to $ $ (b). Compute free cash flow. (Enter negative amount using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Free Cash Flow $

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Cash flows from operating activities Net income 32800 Adjustmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started