Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Incorporated, are

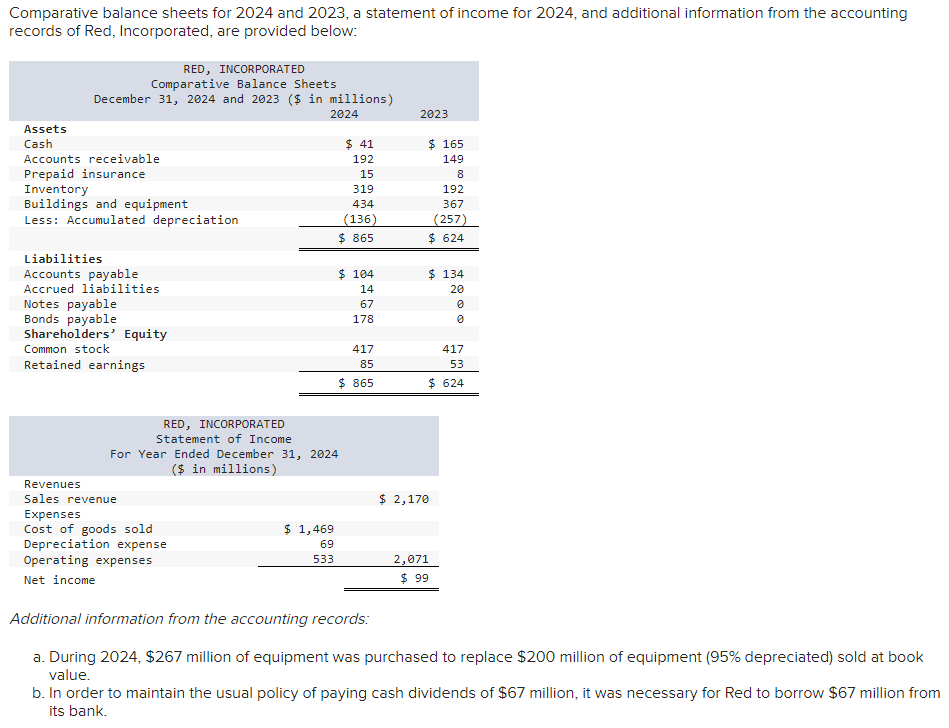

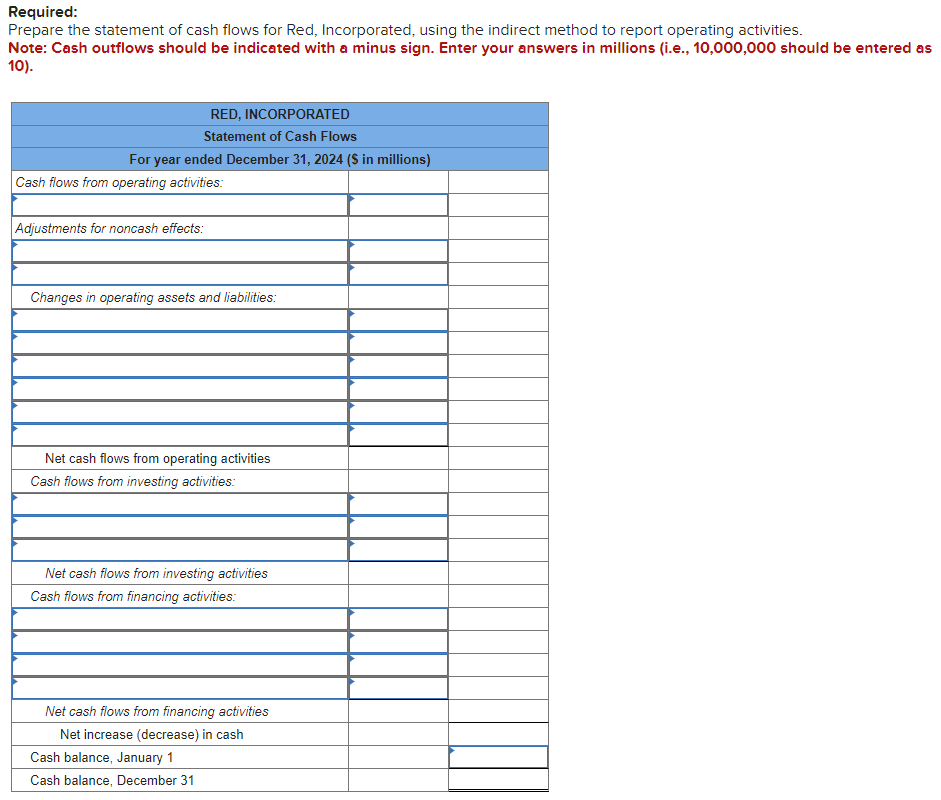

Comparative balance sheets for 2024 and 2023, a statement of income for 2024, and additional information from the accounting records of Red, Incorporated, are provided below: RED, INCORPORATED Comparative Balance Sheets December 31, 2024 and 2023 ($ in millions) 2024 2023 Assets Cash Accounts receivable $ 41 192 $ 165 149 Prepaid insurance 15 8 Inventory 319 192 Buildings and equipment 434 367 Less: Accumulated depreciation (136) (257) $ 865 $ 624 Liabilities Accounts payable Notes payable Accrued liabilities Bonds payable Shareholders' Equity Common stock Retained earnings $ 104 14 67 178 $ 134 20 0 0 417 417 85 53 $ 865 $ 624 Revenues RED, INCORPORATED Statement of Income For Year Ended December 31, 2024 ($ in millions) Sales revenue Expenses Cost of goods sold Depreciation expense Operating expenses Net income $ 2,170 $ 1,469 69 533 2,071 $ 99 Additional information from the accounting records: a. During 2024, $267 million of equipment was purchased to replace $200 million of equipment (95% depreciated) sold at book value. b. In order to maintain the usual policy of paying cash dividends of $67 million, it was necessary for Red to borrow $67 million from its bank. Required: Prepare the statement of cash flows for Red, Incorporated, using the indirect method to report operating activities. Note: Cash outflows should be indicated with a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10). RED, INCORPORATED Statement of Cash Flows For year ended December 31, 2024 ($ in millions) Cash flows from operating activities: Adjustments for noncash effects: Changes in operating assets and liabilities: Net cash flows from operating activities Cash flows from investing activities: Net cash flows from investing activities Cash flows from financing activities: Net cash flows from financing activities Net increase (decrease) in cash Cash balance, January 1 Cash balance, December 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started