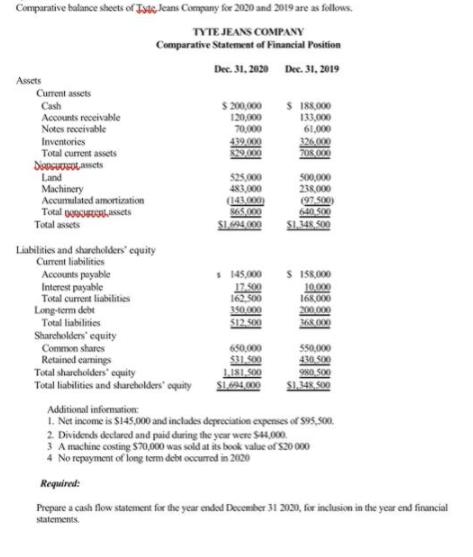

Comparative balance sheets of Iste leans Company for 2020 and 2019 are as follows. TYTE JEANS COMPANY Comparative Statement of Financial Position Dec. 31,

Comparative balance sheets of Iste leans Company for 2020 and 2019 are as follows. TYTE JEANS COMPANY Comparative Statement of Financial Position Dec. 31, 2020 Dec. 31, 2019 Assets Current assets Cash Accounts receivable Notes receivable Inventories Total current assets $ 200,000 120,000 70,000 439.000 329.000 S 188,000 133,000 61,000 326.000 208.000 Land Machinery 525,000 483,000 500,000 238,000 (97.500) Accumulated amortization Total UANsets Total assets (143.000 865.000 S1.400 S1.348.500 Liabilities and sharcholders' equity Current liabilities s 1 45,000 17.500 162,500 350.000 S12.500 S IS8,000 10.000 168,000 200.000 368.000 Accounts payable Interest payable Total current liabilities Long-term debt Total liabilities Sharcholders' equity Common shares Retained earnings Total sharcholders equity Total liabilities and sharcholders' oquity 650,000 $31.500 LISI,S00 550,000 430 500 980 S00 Additional information: I. Net income is $145,000 and inclades depreciation expenses of S95,S00. 2 Dividends declared and paid dring the year were S44,000. 3 Amachine costing S70,000 was sold at its book value of S20000 4 No repayment of long term debt occurred in 2020 Required: Prepare a cash flow statement for the year endod Decenber 31 300, koer inclusion in the year end financial statements.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Cash Flows For the Year ended A Cash Flows from Operating Activity Net Income 145000 Ad...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started