Answered step by step

Verified Expert Solution

Question

1 Approved Answer

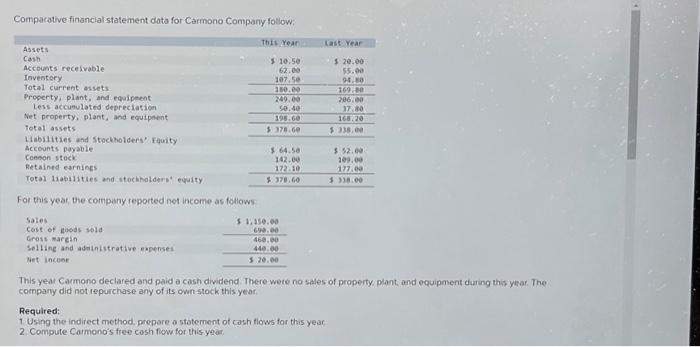

Comparative financial statement data for Carmono Company follow: Assets Cash Accounts receivable. Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property,

Comparative financial statement data for Carmono Company follow: Assets Cash Accounts receivable. Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity For this year, the company reported net income as follows: Sales. Cost of goods sold Gross margin Selling and administrative expenses Net income This Year. $10.50 62.00 107.50 180.00 249.00 50.40 198.60 $378.60 $ 64.50 142.00 172.10 $ 378.60 $ 1,150.00 690.00 460.00 440.00 $20.00 Last Year. $ 20.00 55.00 94.80 Required: 1. Using the indirect method, prepare a statement of cash flows for this year. 2. Compute Carmono's free cash flow for this year. 169.80 206.00 37.80 168.20 $ 338.00 $ 52.00 109.00 177.00 $ 338.00 This year Carmono declared and paid a cash dividend. There were no sales of property, plant, and equipment during this year. The company did not repurchase any of its own stock this year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started