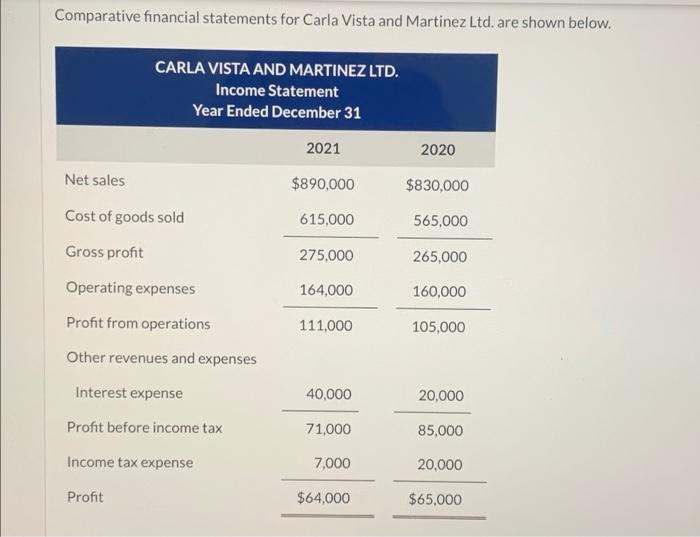

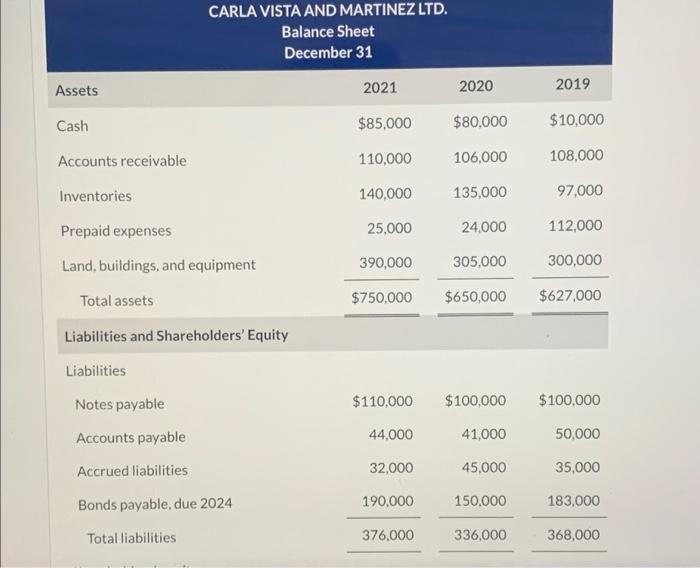

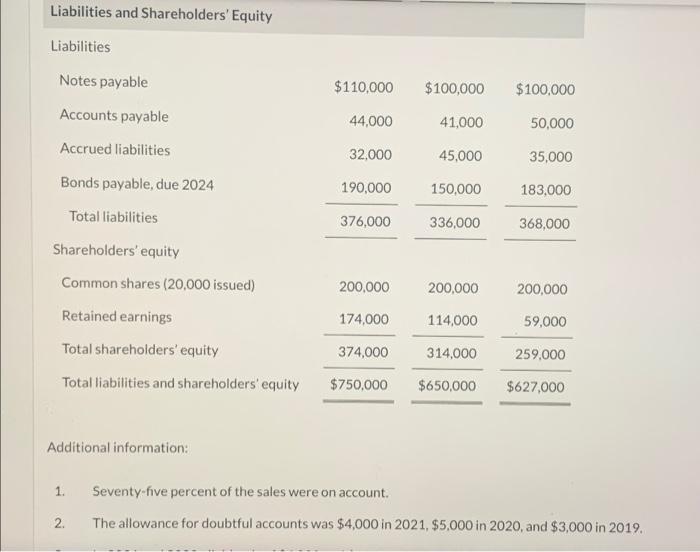

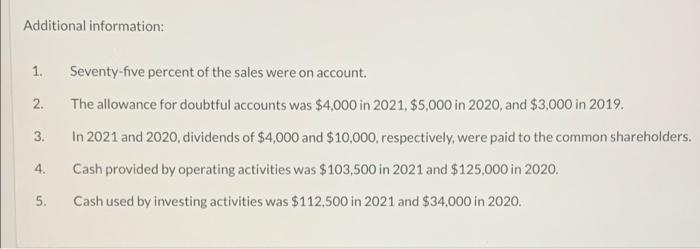

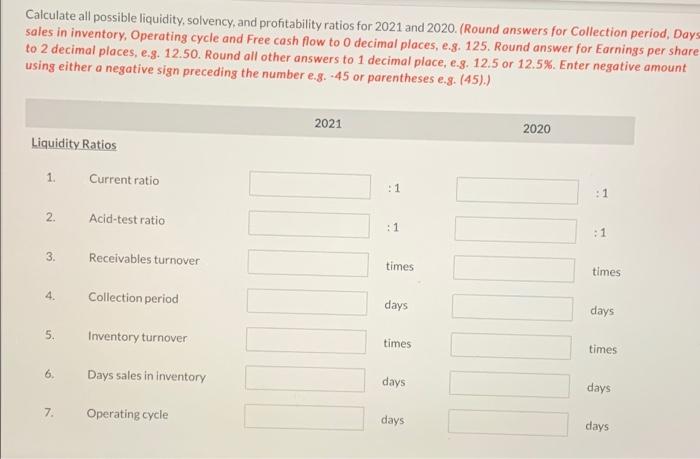

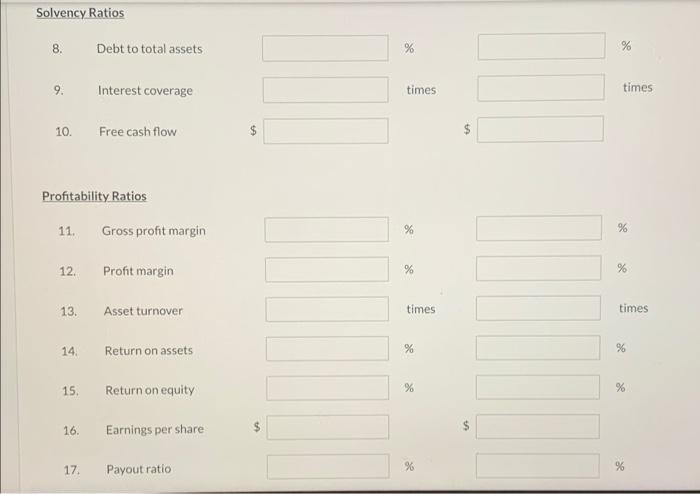

Comparative financial statements for Carla Vista and Martinez Ltd. are shown below. CARLA VISTA AND MARTINEZ LTD. Income Statement Year Ended December 31 2021 2020 Net sales $890,000 $830,000 Cost of goods sold 615,000 565,000 Gross profit 275.000 265,000 Operating expenses 164,000 160,000 111,000 105,000 Profit from operations Other revenues and expenses 40,000 20,000 Interest expense Profit before income tax 71,000 85,000 Income tax expense 7,000 20,000 Profit $64,000 $65,000 CARLA VISTA AND MARTINEZ LTD. Balance Sheet December 31 Assets 2021 2020 2019 Cash $85,000 $80,000 $10,000 Accounts receivable 110,000 106,000 108,000 Inventories 140,000 135,000 97,000 Prepaid expenses 25,000 24,000 112,000 390,000 305,000 300,000 Land, buildings, and equipment Total assets Liabilities and Shareholders' Equity $750,000 $650,000 $627,000 Liabilities Notes payable Accounts payable $110,000 $100,000 $100,000 44,000 41,000 50,000 Accrued liabilities 32,000 45,000 35,000 Bonds payable, due 2024 190,000 150,000 183,000 Total liabilities 376,000 336,000 368,000 Liabilities and Shareholders' Equity Liabilities $110,000 $100,000 $100,000 44,000 41,000 50,000 32.000 45,000 35,000 190,000 150,000 183,000 376,000 336,000 Notes payable Accounts payable Accrued liabilities Bonds payable, due 2024 Total liabilities Shareholders' equity Common shares (20,000 issued) Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 368,000 200,000 200,000 200,000 174,000 114,000 374,000 314,000 59,000 259.000 $627,000 $750,000 $650,000 Additional information: 1. Seventy-five percent of the sales were on account. 2. The allowance for doubtful accounts was $4,000 in 2021, $5,000 in 2020, and $3,000 in 2019. Additional information: 1. 2. 3. Seventy-five percent of the sales were on account. The allowance for doubtful accounts was $4,000 in 2021, $5,000 in 2020, and $3,000 in 2019. In 2021 and 2020, dividends of $4,000 and $10,000, respectively, were paid to the common shareholders. Cash provided by operating activities was $103,500 in 2021 and $125,000 in 2020. Cash used by investing activities was $112,500 in 2021 and $34,000 in 2020. 4. 5. Calculate all possible liquidity, solvency, and profitability ratios for 2021 and 2020. (Round answers for Collection period, Days sales in inventory, Operating cycle and Free cash flow to 0 decimal places, e.g. 125. Round answer for Earnings per share to 2 decimal places, e.g. 12.50. Round all other answers to 1 decimal place, e.g. 12.5 or 12.5%. Enter negative amount using either a negative sign preceding the number e.g. -45 or parentheses e,8. (45).) 2021 2020 Liquidity Ratios 1 Current ratio :1 :1 2. Acid-test ratio :1 1 1 1 3 Receivables turnover times times 4. Collection period days days 5. Inventory turnover times times 6. Days sales in inventory days days 7. Operating cycle days days Solvency Ratios 8. Debt to total assets % % 9. Interest coverage times times 10. Free cash flow $ Profitability Ratios 11. Gross profit margin % %6 12. Proht margin % % 13. Asset turnover times times 14 Return on assets % % 15. Return on equity % de 16. $ Earnings per share 17 Payout ratio % %