Answered step by step

Verified Expert Solution

Question

1 Approved Answer

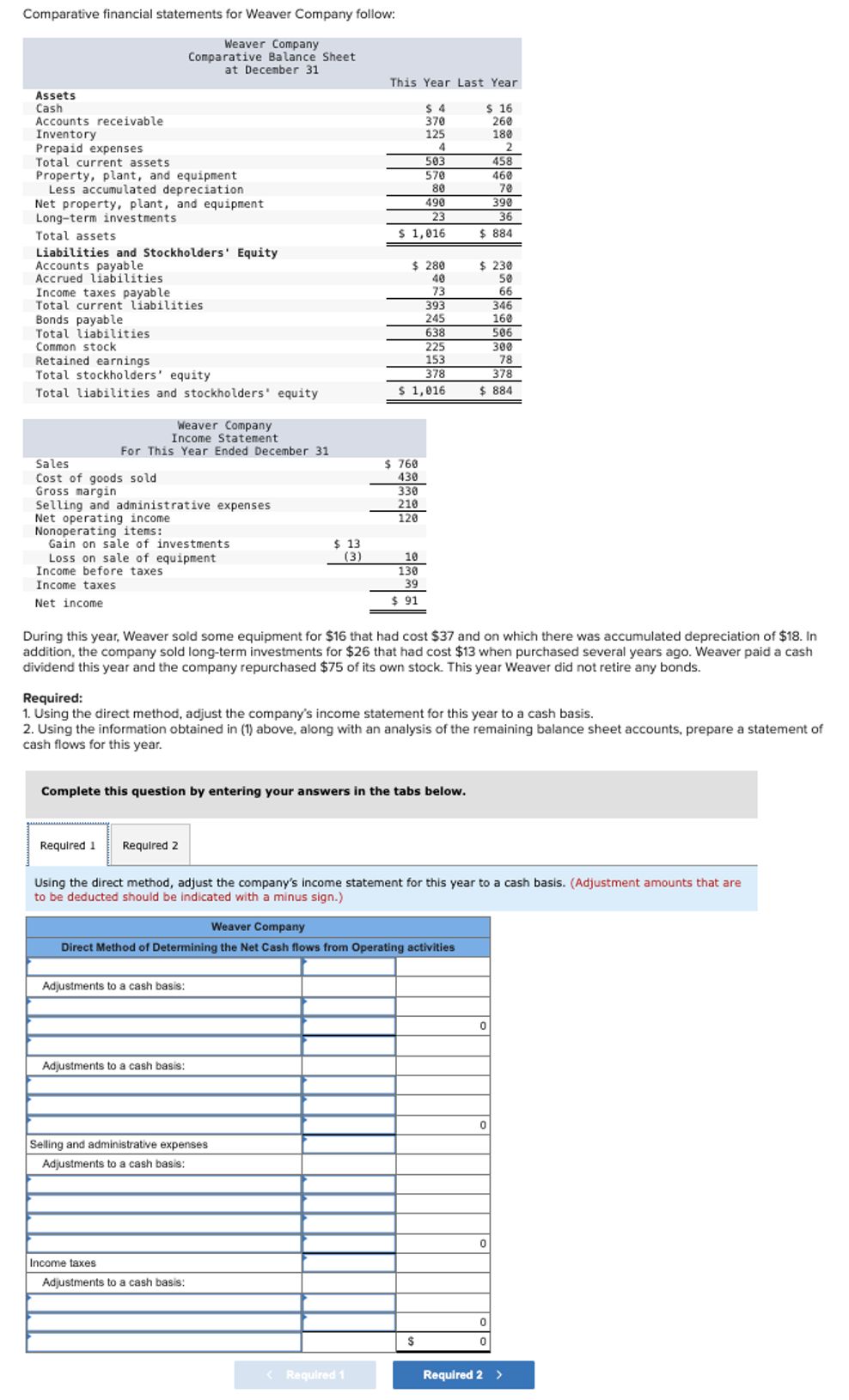

Comparative financial statements for Weaver Company follow: Weaver Company Comparative Balance Sheet at December 31 This Year Last Year Accrued liabilities Assets Cash Accounts

Comparative financial statements for Weaver Company follow: Weaver Company Comparative Balance Sheet at December 31 This Year Last Year Accrued liabilities Assets Cash Accounts receivable Inventory Prepaid expenses Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Long-term investments Total assets Liabilities and Stockholders' Equity Accounts payable Income taxes payable Total current liabilities $ 4 $ 16 370 260 125 180 4 2 503 458 570 460 80 70 490 390 23 36 $ 1,016 $ 884 $ 280 $ 230 40 50 73 66 393 346 Bonds payable 245 160 Total liabilities 638 506 Common stock 225 300 Retained earnings 153 78 Total stockholders' equity 378 378 Total liabilities and stockholders' equity $ 1,016 $ 884 Weaver Company Income Statement For This Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Nonoperating items: Gain on sale of investments Loss on sale of equipment Income before taxes Income taxes Net income $ 760 430 330 210 120 $ 13 (3) 10 130 39 $ 91 During this year, Weaver sold some equipment for $16 that had cost $37 and on which there was accumulated depreciation of $18. In addition, the company sold long-term investments for $26 that had cost $13 when purchased several years ago. Weaver paid a cash dividend this year and the company repurchased $75 of its own stock. This year Weaver did not retire any bonds. Required: 1. Using the direct method, adjust the company's income statement for this year to a cash basis. 2. Using the information obtained in (1) above, along with an analysis of the remaining balance sheet accounts, prepare a statement of cash flows for this year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Using the direct method, adjust the company's income statement for this year to a cash basis. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) Weaver Company Direct Method of Determining the Net Cash flows from Operating activities Adjustments to a cash basis: Adjustments to a cash basis: Selling and administrative expenses Adjustments to a cash basis: Income taxes Adjustments to a cash basis: 0 0 0 0 $ < Required 1 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required 1 Using the direct method adjust the companys income statement for this year to a cash basi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started