Answered step by step

Verified Expert Solution

Question

1 Approved Answer

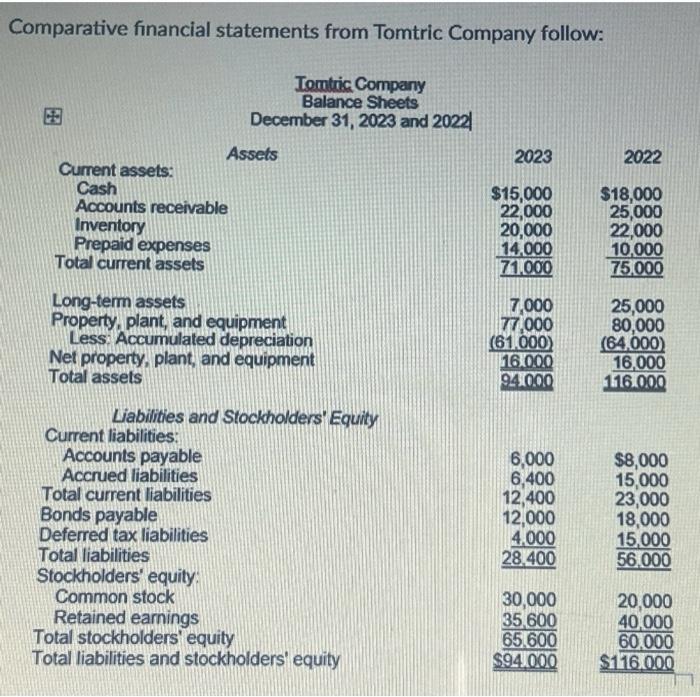

Comparative financial statements from Tomtric Company follow: Tomtric Company Balance Sheets December 31, 2023 and 2022 Current assets: Cash Accounts receivable Inventory Prepaid expenses Total

Comparative financial statements from Tomtric Company follow: Tomtric Company Balance Sheets December 31, 2023 and 2022 Current assets: Cash Accounts receivable Inventory Prepaid expenses Total current assets Long-term assets Property, plant, and equipment Less: Accumulated depreciation Net property, plant, and equipment Total assets Assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Accrued liabilities Total current liabilities Bonds payable Deferred tax liabilities Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders equity Total liabilities and stockholders' equity 2023 $15,000 22,000 20,000 14.000 71.000 7,000 77,000 (61.000) 16.000 94.000 6,000 6,400 12,400 12,000 4,000 28,400 30,000 35,600 65.600 $94.000 2022 $18,000 25,000 22,000 10,000 75,000 25,000 80,000 (64.000) 16,000 116.000 $8,000 15,000 23,000 18,000 15,000 56,000 20,000 40,000 60.000 $116.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started