Answered step by step

Verified Expert Solution

Question

1 Approved Answer

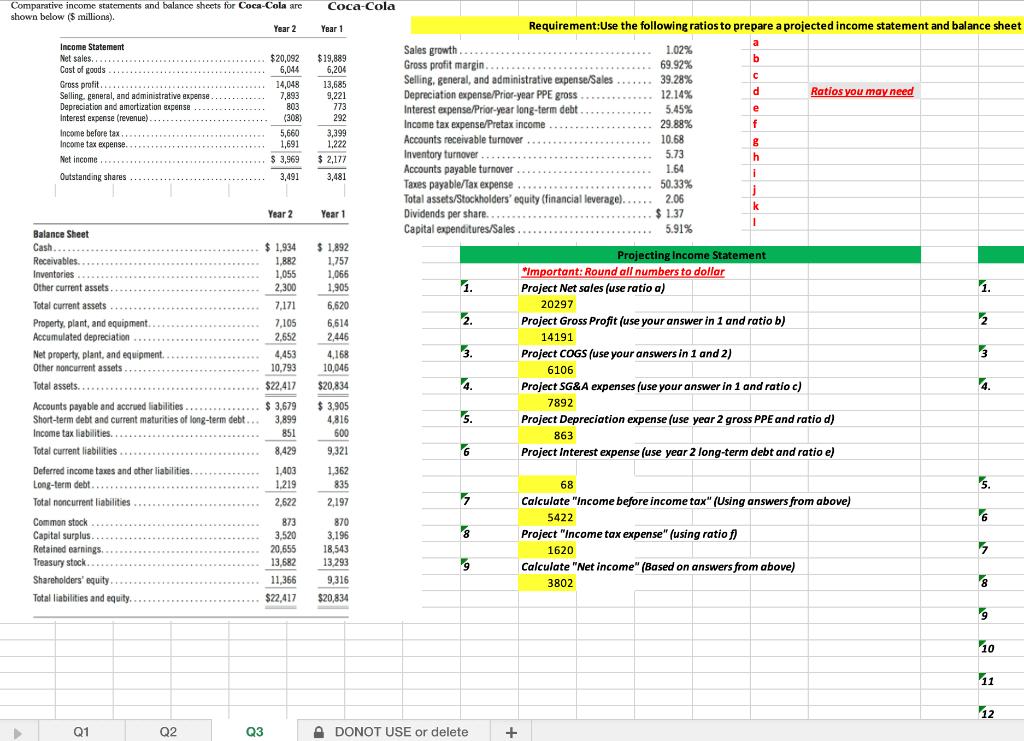

Comparative income statements and balance sheets for Coca-Cola are shown below ($ millions). Coca-Cola Year 2 Year 1 Requirement:Use the following ratios to prepare

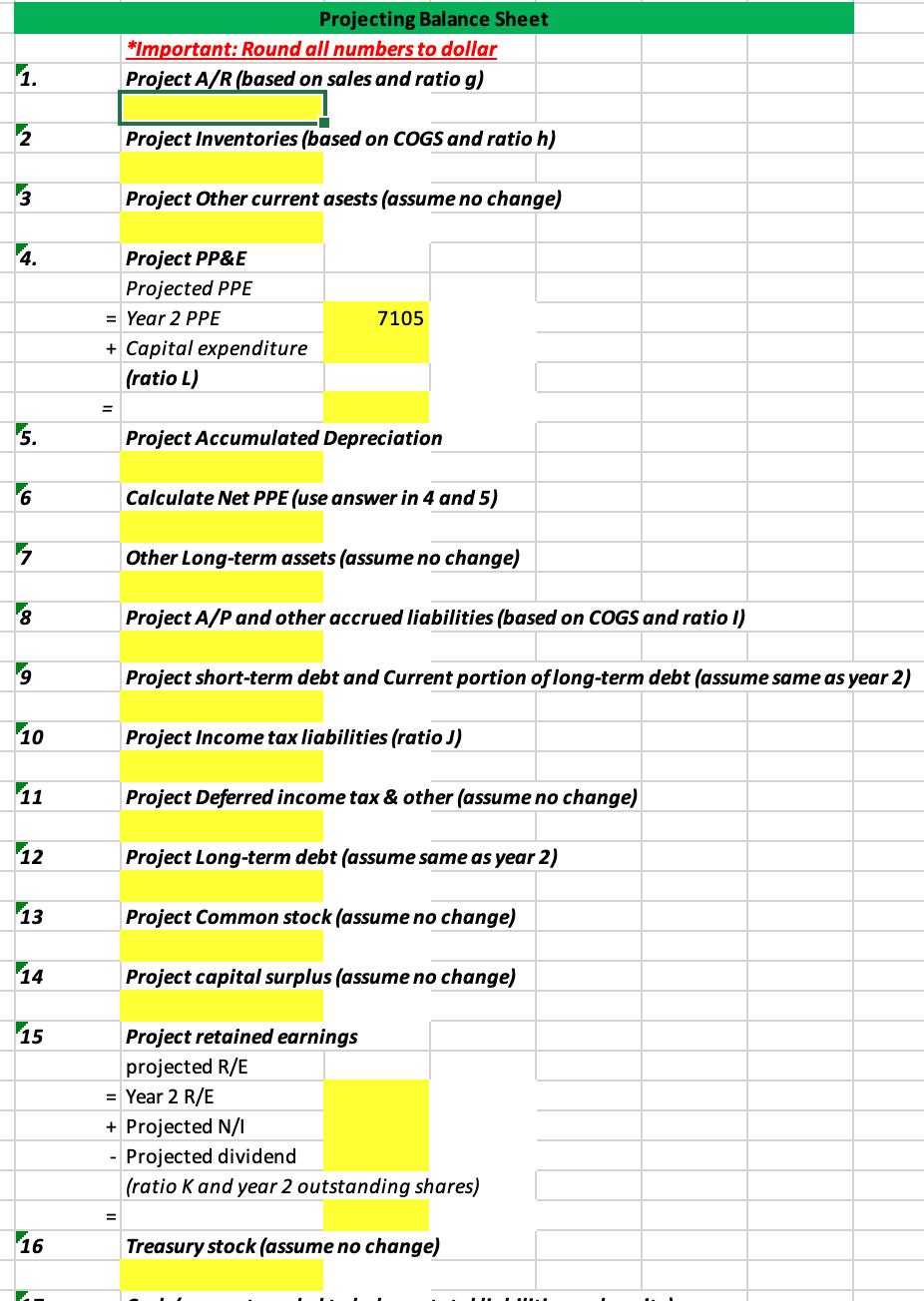

Comparative income statements and balance sheets for Coca-Cola are shown below ($ millions). Coca-Cola Year 2 Year 1 Requirement:Use the following ratios to prepare a projected income statement and balance sheet a Income Statement Sales growth. Net sales... $20,092 $19,889 Cast of goods 6,044 Gross profit margin. 1.02% 69.92% b 6,204 Gross profit... 14,048 13,685 Selling, general, and administrative expense/Sales 39.28% Selling, general, and administrative expense 7,893 9,221 Depreciation expense/Prior-year PPE gross. 12.14% d Ratios you may need Depreciation and amortization expense 803 773 Interest expense/Prior-year long-term debt.. 5.45% e Interest expense (revenue). (308) 292 Income tax expense/Pretax income 29.88% f Income before tax... 5,660 3,399 Income tax expense... 1,691 1,222 Accounts receivable turnover 10.68 g Net income. $ 3,969 $ 2,177 Inventory turnover.. 5.73 h Accounts payable turnover 1.64 Outstanding shares 3,491 3,481 Year 2 Year 1 Taxes payable/Tax expense Dividends per share.... 50.33% Total assets/Stockholders' equity (financial leverage)... 2.06 $ 1.37 Balance Sheet Cash... Capital expenditures/Sales.. 5.91% $ 1,934 $ 1,892 Receivables... 1,882 1,757 Projecting Income Statement Inventories 1,055 1,066 *Important: Round all numbers to dollar Other current assets. 2,300 1,905 1. Project Net sales (use ratio a) 1. Total current assets 7,171 6,620 20297 Property, plant, and equipment.. Accumulated depreciation Net property, plant, and equipment.. Other noncurrent assets.. 7,105 6,614 2. Project Gross Profit (use your answer in 1 and ratio b) 2 2,652 2,446 14191 4,453 4,168 3. Project COGS (use your answers in 1 and 2) 3 10,793 10,046 6106 Total assets..... $22,417 $20,834 4. Project SG&A expenses (use your answer in 1 and ratio c) 4. Accounts payable and accrued liabilities... $ 3,679 $ 3,905 7892 Short-term debt and current maturities of long-term debt... 3,899 4,816 5. Project Depreciation expense (use year 2 gross PPE and ratio d) Income tax liabilities... 851 600 863 Total current liabilities... 8,429 9,321 6 Project Interest expense (use year 2 long-term debt and ratio e) Deferred income taxes and other liabilities.. 1,403 1,362 Long-term debt.... 1,219 835 68 5. Total noncurrent liabilities. 2,622 2,197 7 Calculate "Income before income tax" (Using answers from above) 5422 6 Common stock 873 870 Capital surplus. 3,520 3,196 8 Project "Income tax expense" (using ratio f) Retained earnings.. 20,655 18,543 1620 Treasury stock.. 13,682 13,293 9 Calculate "Net income" (Based on answers from above) Shareholders' equity.. 11,366 9,316 3802 Total liabilities and equity. $22,417 $20,834 Q1 Q2 Q3 DONOT USE or delete + 7 8 9 10 11 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started