Answered step by step

Verified Expert Solution

Question

1 Approved Answer

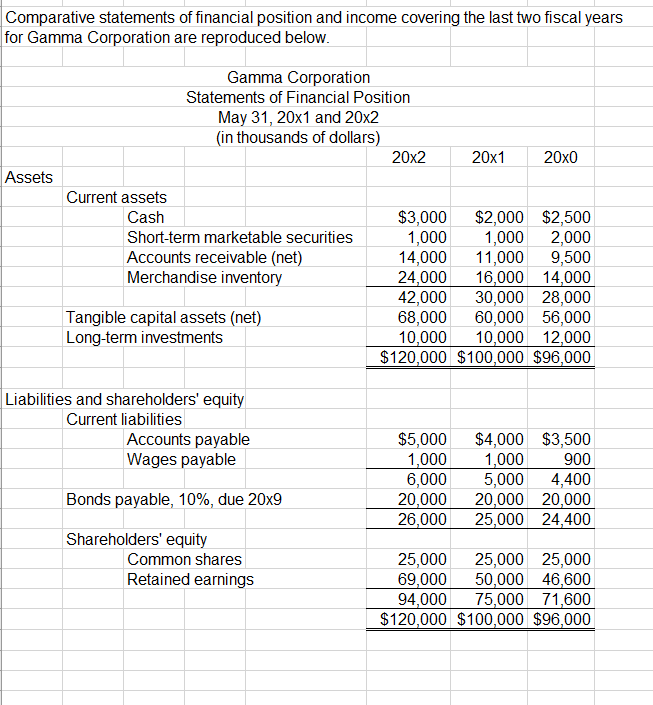

Comparative statements of financial position and income covering the last two fiscal years for Gamma Corporation are reproduced below. Gamma Corporation Statements of Financial

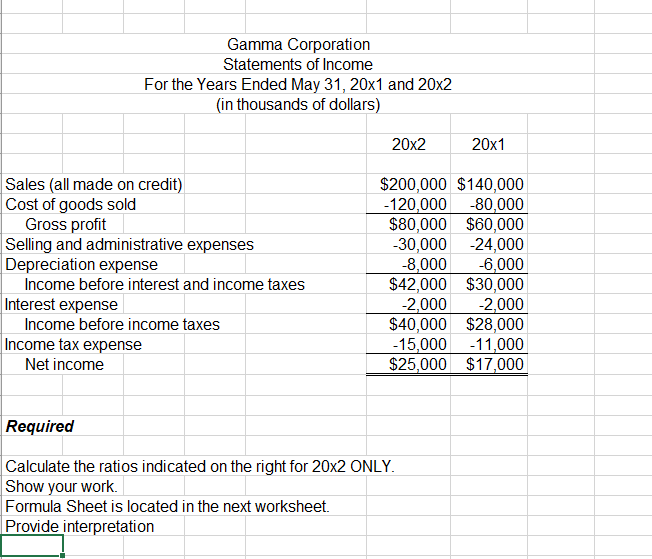

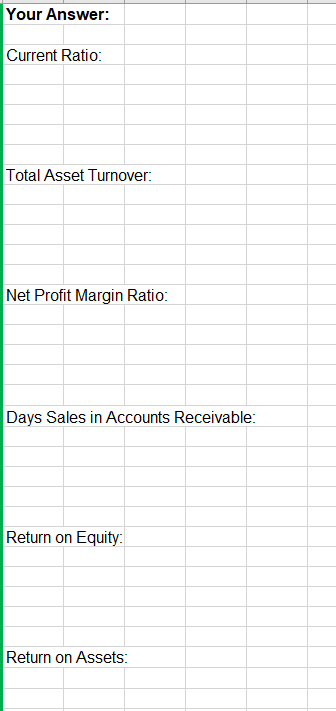

Comparative statements of financial position and income covering the last two fiscal years for Gamma Corporation are reproduced below. Gamma Corporation Statements of Financial Position May 31, 20x1 and 20x2 (in thousands of dollars) 20x2 20x1 20x0 Assets Current assets Cash $3,000 $2,000 $2,500 Short-term marketable securities 1,000 1,000 2,000 Accounts receivable (net) 14,000 11,000 9,500 Merchandise inventory 24,000 16,000 14,000 42,000 30,000 28,000 Tangible capital assets (net) Long-term investments 68,000 60,000 56,000 10,000 10,000 12,000 $120,000 $100,000 $96,000 Liabilities and shareholders' equity Current liabilities Accounts payable $5,000 $4,000 $3,500 Wages payable 1,000 1,000 900 6,000 5,000 4,400 Bonds payable, 10%, due 20x9 20,000 20,000 20,000 26,000 25,000 24,400 Shareholders' equity Common shares 25,000 25,000 25,000 Retained earnings 69,000 50,000 46,600 94,000 75,000 71,600 $120,000 $100,000 $96,000 Gamma Corporation Statements of Income For the Years Ended May 31, 20x1 and 20x2 (in thousands of dollars) 20x2 20x1 Sales (all made on credit) $200,000 $140,000 Cost of goods sold -120,000 -80,000 Gross profit $80,000 $60,000 Selling and administrative expenses -30,000 -24,000 Depreciation expense -8,000 -6,000 Income before interest and income taxes $42,000 $30,000 Interest expense -2,000 -2,000 Income before income taxes $40,000 $28,000 Income tax expense -15,000 -11,000 Net income $25,000 $17,000 Required Calculate the ratios indicated on the right for 20x2 ONLY. Show your work. Formula Sheet is located in the next worksheet. Provide interpretation Your Answer: Current Ratio: Total Asset Turnover: Net Profit Margin Ratio: Days Sales in Accounts Receivable: Return on Equity: Return on Assets:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started