Answered step by step

Verified Expert Solution

Question

1 Approved Answer

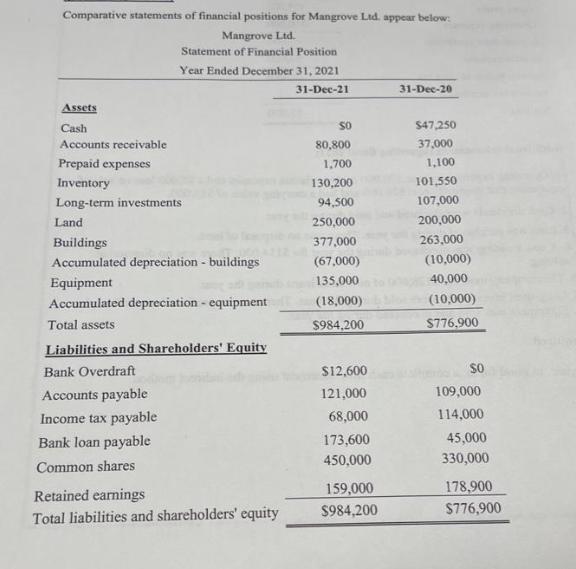

Comparative statements of financial positions for Mangrove Ltd. appear below: Mangrove Ltd. Statement of Financial Position Year Ended December 31, 2021 31-Dec-21 Assets Cash

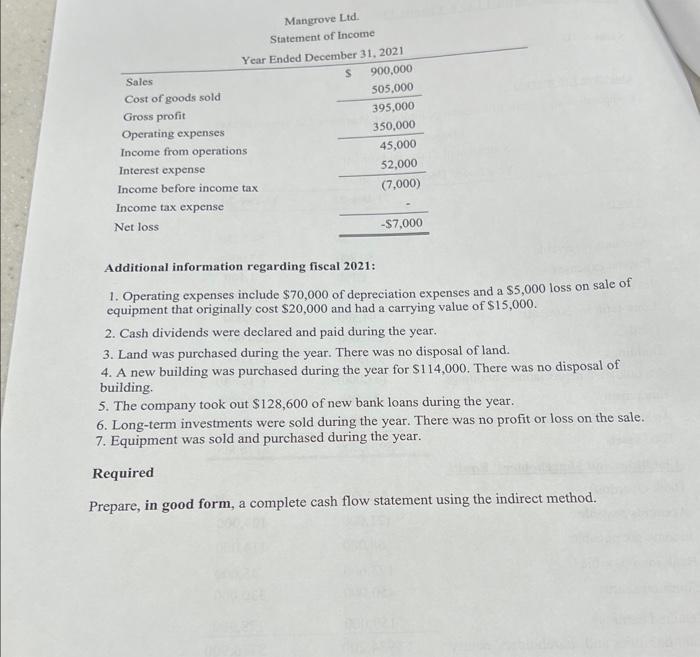

Comparative statements of financial positions for Mangrove Ltd. appear below: Mangrove Ltd. Statement of Financial Position Year Ended December 31, 2021 31-Dec-21 Assets Cash Accounts receivable Prepaid expenses Inventory Long-term investments Land Buildings Accumulated depreciation - buildings Equipment Accumulated depreciation - equipment Total assets Liabilities and Shareholders' Equity Bank Overdraft Accounts payable Income tax payable Bank loan payable Common shares Retained earnings Total liabilities and shareholders' equity SO 80,800 1,700 130,200 94,500 250,000 377,000 (67,000) 135,000 (18,000) $984,200 $12,600 121,000 68,000 173,600 450,000 159,000 $984,200 31-Dec-20 $47,250 37,000 1,100 101,550 107,000 200,000 263,000 (10,000) 40,000 (10,000) $776,900 SO 109,000 114,000 45,000 330,000 178,900 $776,900 Mangrove Ltd. Statement of Income Year Ended December 31, 2021 S 900,000 Sales Cost of goods sold Gross profit Operating expenses Income from operations Interest expense Income before income tax Income tax expense Net loss 505,000 395,000 350,000 45,000 52,000 (7,000) -$7,000 Additional information regarding fiscal 2021: 1. Operating expenses include $70,000 of depreciation expenses and a $5,000 loss on sale of equipment that originally cost $20,000 and had a carrying value of $15,000. 2. Cash dividends were declared and paid during the year. 3. Land was purchased during the year. There was no disposal of land. 4. A new building was purchased during the year for $114,000. There was no disposal of building. 5. The company took out $128,600 of new bank loans during the year. 6. Long-term investments were sold during the year. There was no profit or loss on the sale. 7. Equipment was sold and purchased during the year. Required Prepare, in good form, a complete cash flow statement using the indirect method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the cash flow statement using the indirect method we need to analyze the changes in the b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started