Answered step by step

Verified Expert Solution

Question

1 Approved Answer

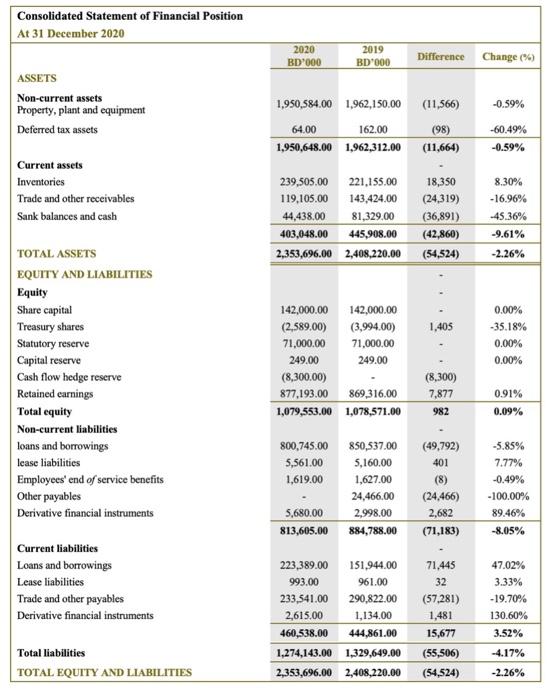

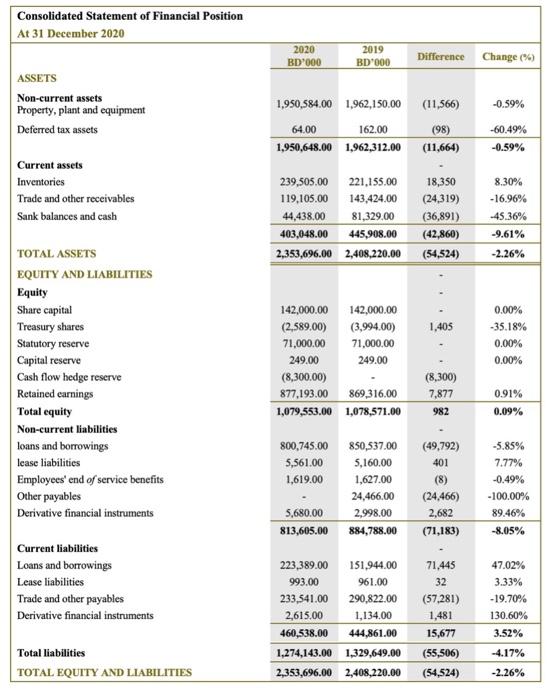

Compare and analyze (in detail) the balance sheet for company x of 2019 and 2020. Consolidated Statement of Financial Position At 31 December 2020 ASSETS

Compare and analyze (in detail) the balance sheet for company x of 2019 and 2020.

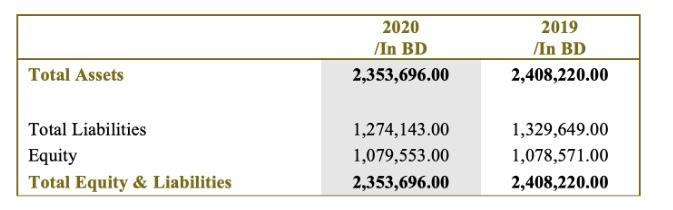

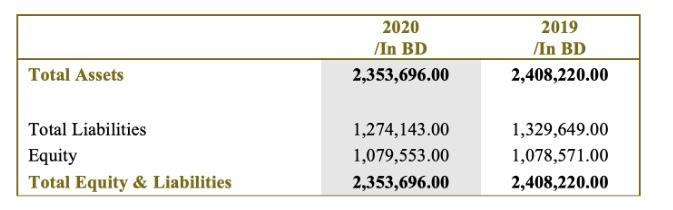

Consolidated Statement of Financial Position At 31 December 2020 ASSETS Non-current assets Property, plant and equipment Deferred tax assets Current assets Inventories Trade and other receivables Sank balances and cash TOTAL ASSETS EQUITY AND LIABILITIES Equity Share capital Treasury shares Statutory reserve Capital reserve Cash flow hedge reserve Retained earnings Total equity Non-current liabilities loans and borrowings lease liabilities Employees' end of service benefits Other payables Derivative financial instruments Current liabilities Loans and borrowings Lease liabilities Trade and other payables Derivative financial instruments Total liabilities TOTAL EQUITY AND LIABILITIES 2020 BD'000 2019 BD'000 1,950,584.00 1,962,150.00 64.00 162.00 1,950,648.00 1,962,312.00 142,000.00 142,000.00 (2,589.00) (3,994.00) 71,000.00 71,000.00 249.00 249.00 (8,300.00) 877,193.00 869,316.00 1,079,553.00 1,078,571.00 239,505.00 221,155.00 18,350 119,105.00 143,424.00 (24,319) 44,438.00 81,329.00 (36,891) 403,048.00 445,908.00 (42,860) 2,353,696.00 2,408,220.00 (54,524) 800,745.00 850,537.00 5,561.00 5,160.00 1,619.00 1,627.00 24,466.00 5,680.00 2,998.00 813,605.00 884,788.00 223,389.00 993.00 Difference 151,944.00 961.00 290,822.00 1,134.00 (11,566) (98) (11,664) 1,405 (8,300) 7,877 982 (49,792) 401 (8) (24,466) 2,682 (71,183) 71,445 32 233,541.00 (57,281) 2,615.00 1,481 460,538.00 444,861.00 15,677 1,274,143.00 1,329,649.00 (55,506) 2,353,696.00 2,408,220.00 (54,524) Change (%) -0.59% -60.49% -0.59% 8.30% -16.96% -45.36% -9.61% -2.26% 0.00% -35.18% 0.00% 0.00% 0.91% 0.09% -5.85% 7.77% -0.49% -100.00% 89.46% -8.05% 47.02% 3.33% -19.70% 130.60% 3.52% -4.17% -2.26%

Step by Step Solution

★★★★★

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Compare and analyze in detail the balance sheet for company x of 2019 and 2020 The companys total assets have increased from 2019 to 2020 This can be attributed to an increase in property plant and eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started