Answered step by step

Verified Expert Solution

Question

1 Approved Answer

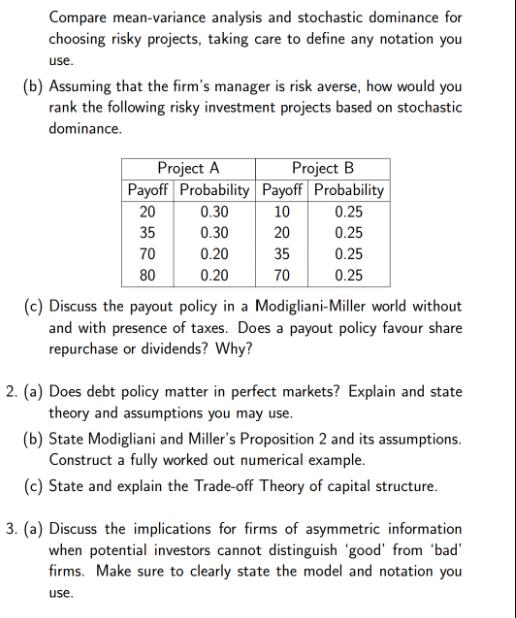

Compare mean-variance analysis and stochastic dominance for choosing risky projects, taking care to define any notation you use. (b) Assuming that the firm's manager

Compare mean-variance analysis and stochastic dominance for choosing risky projects, taking care to define any notation you use. (b) Assuming that the firm's manager is risk averse, how would you rank the following risky investment projects based on stochastic dominance. Project A Project B Payoff Probability Payoff Probability 20 0.30 10 0.25 0.30 20 0.25 0.20 35 0.25 0.20 70 0.25 35 70 80 (c) Discuss the payout policy in a Modigliani-Miller world without and with presence of taxes. Does a payout policy favour share repurchase or dividends? Why? 2. (a) Does debt policy matter in perfect markets? Explain and state theory and assumptions you may use. (b) State Modigliani and Miller's Proposition 2 and its assumptions. Construct a fully worked out numerical example. (c) State and explain the Trade-off Theory of capital structure. 3. (a) Discuss the implications for firms of asymmetric information when potential investors cannot distinguish 'good' from 'bad' firms. Make sure to clearly state the model and notation you use.

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for each question a In a perfect capital market without taxes t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started