Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compare the accounting income with economic income and what difference both can have in appraising the production project with reference to the attached case Sorenzyme

Compare the accounting income with economic income and what difference both can have in appraising the production project with reference to the attached case

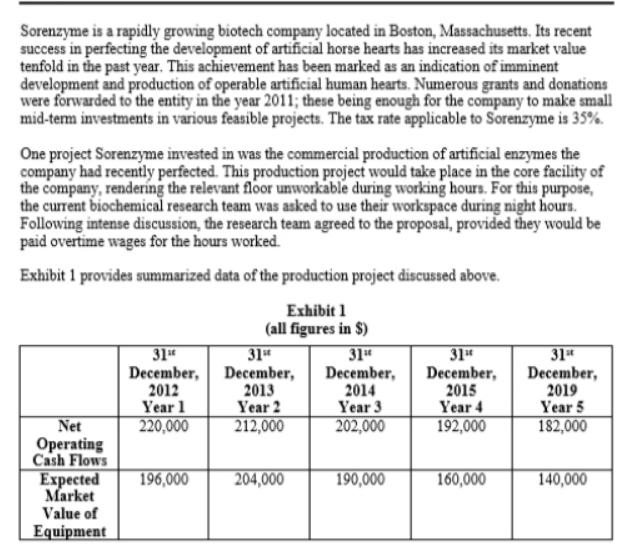

Sorenzyme is a rapidly growing biotech company located in Boston, Massachusetts. Its recent success in perfecting the development of artificial horse hearts has increased its market value tenfold in the past year. This achievement has been marked as an indication of imminent development and production of operable artificial human hearts. Numerous grants and donations were forwarded to the entity in the year 2011; these being enough for the company to make small mid-term investments in various feasible projects. The tax rate applicable to Sorenzyme is 35%. One project Sorenzyme invested in was the commercial production of artificial enzymes the company had recently perfected. This production project would take place in the core facility of the company, rendering the relevant floor unworkable during working hours. For this purpose, the current biochemical research team was asked to use their workspace during night hours. Following intense discussion, the research team agreed to the proposal, provided they would be paid overtime wages for the hours worked. Exhibit 1 provides summarized data of the production project discussed above. Exhibit 1 (all figures in $) Net Operating Cash Flows Expected Market Value of Equipment 311 December, 2012 Year 1 220,000 196,000 31st December, 2013 Year 2 212,000 204,000 31 December, 2014 Year 3 202,000 190,000 31 December, 2015 Year 4 192,000 160,000 31st December, 2019 Year 5 182,000 140,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Accounting income refers to the income reported in the financial statements of a company based on ge...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started