Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Compare the alternative transactions described on the last page of the case. Which one would you choose if you were David Jacobs? Which one would

Compare the alternative transactions described on the last page of the case. Which one would you choose if you were David Jacobs? Which one would you choose if you were a general partner in CHB Partners? Who else is affected by this choice and how?

I will thumbs up, please be as detailed as you can, thank you

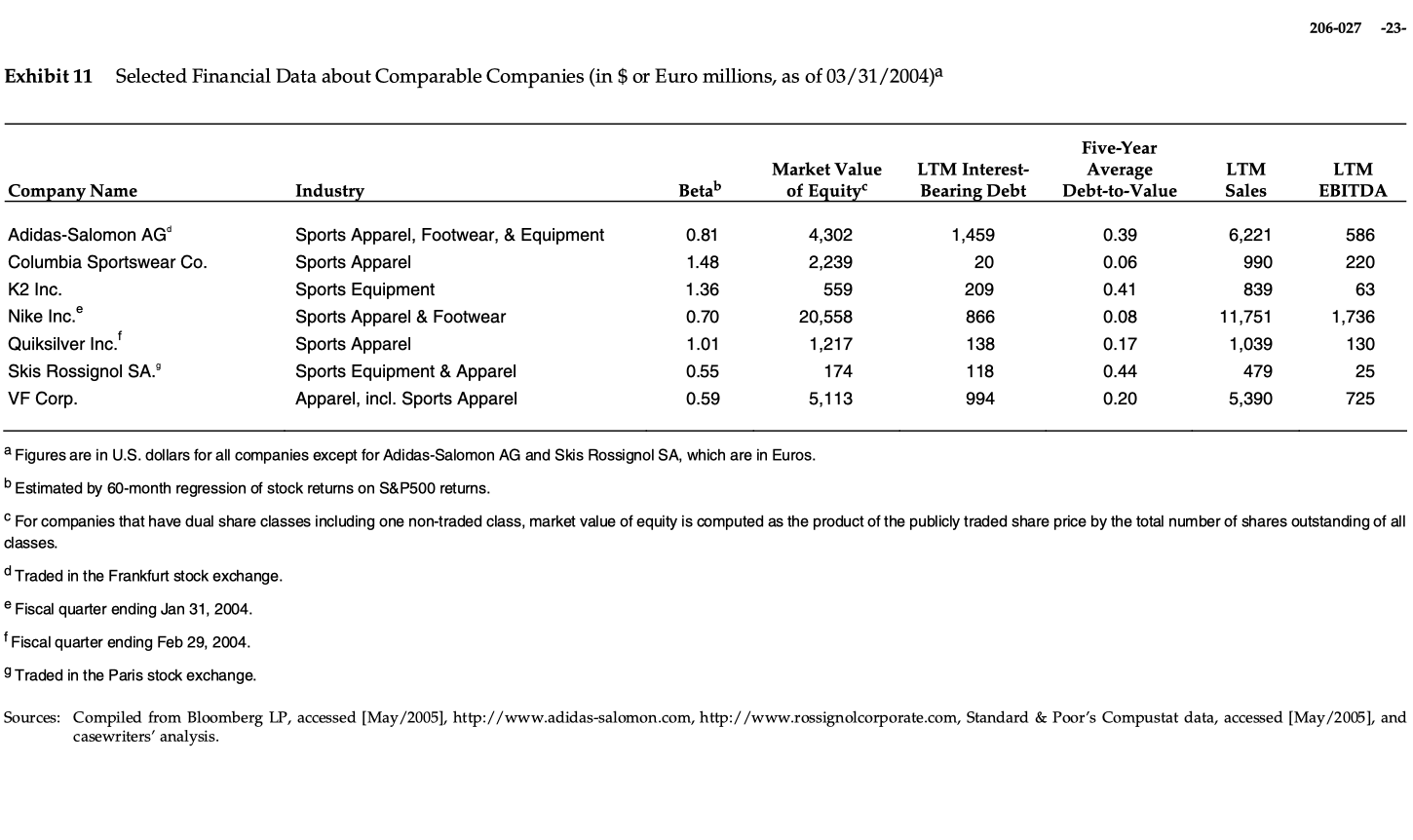

206-027 -23- Exhibit 11 Selected Financial Data about Comparable Companies (in $ or Euro millions, as of 03/31/2004)a Market Value of Equity Five-Year Average Debt-to-Value LTM Sales LTM Interest- Bearing Debt LTM EBITDA Company Name Industry Betab 0.39 6,221 0.81 1.48 586 220 990 839 Adidas-Salomon AG Columbia Sportswear Co. K2 Inc. Nike Inc. Quiksilver Inc. Skis Rossignol SA." VF Corp. Sports Apparel, Footwear, & Equipment Sports Apparel Sports Equipment Sports Apparel & Footwear Sports Apparel Sports Equipment & Apparel Apparel, incl. Sports Apparel 1.36 0.70 4,302 2,239 559 20,558 1,217 174 5,113 1,459 20 209 866 138 118 994 0.06 0.41 0.08 0.17 0.44 63 1,736 130 1.01 0.55 11,751 1,039 479 5,390 25 0.59 0.20 725 a Figures are in U.S. dollars for all companies except for Adidas-Salomon AG and Skis Rossignol SA, which are in Euros. b Estimated by 60-month regression of stock returns on S&P500 returns. For companies that have dual share classes including one non-traded class, market value of equity is computed as the product of the publicly traded share price by the total number of shares outstanding of all classes. d Traded in the Frankfurt stock exchange. e Fiscal quarter ending Jan 31, 2004. Fiscal quarter ending Feb 29, 2004. 9 Traded in the Paris stock exchange. Sources: Compiled from Bloomberg LP, accessed [May/2005), http://www.adidas-salomon.com, http://www.rossignolcorporate.com, Standard & Poor's Compustat data, accessed [May/2005), and casewriters' analysis. 206-027 -23- Exhibit 11 Selected Financial Data about Comparable Companies (in $ or Euro millions, as of 03/31/2004)a Market Value of Equity Five-Year Average Debt-to-Value LTM Sales LTM Interest- Bearing Debt LTM EBITDA Company Name Industry Betab 0.39 6,221 0.81 1.48 586 220 990 839 Adidas-Salomon AG Columbia Sportswear Co. K2 Inc. Nike Inc. Quiksilver Inc. Skis Rossignol SA." VF Corp. Sports Apparel, Footwear, & Equipment Sports Apparel Sports Equipment Sports Apparel & Footwear Sports Apparel Sports Equipment & Apparel Apparel, incl. Sports Apparel 1.36 0.70 4,302 2,239 559 20,558 1,217 174 5,113 1,459 20 209 866 138 118 994 0.06 0.41 0.08 0.17 0.44 63 1,736 130 1.01 0.55 11,751 1,039 479 5,390 25 0.59 0.20 725 a Figures are in U.S. dollars for all companies except for Adidas-Salomon AG and Skis Rossignol SA, which are in Euros. b Estimated by 60-month regression of stock returns on S&P500 returns. For companies that have dual share classes including one non-traded class, market value of equity is computed as the product of the publicly traded share price by the total number of shares outstanding of all classes. d Traded in the Frankfurt stock exchange. e Fiscal quarter ending Jan 31, 2004. Fiscal quarter ending Feb 29, 2004. 9 Traded in the Paris stock exchange. Sources: Compiled from Bloomberg LP, accessed [May/2005), http://www.adidas-salomon.com, http://www.rossignolcorporate.com, Standard & Poor's Compustat data, accessed [May/2005), and casewriters' analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started