Question

Compare the current value of Armin Industries with and without leverage, given the data in Table. Assume that the risk-free rate is 5%, the new

Compare the current value of Armin Industries with and without leverage, given the data in Table. Assume that the risk-free rate is 5%, the new product is equally likely to succeed or fail, and the risk is diversifiable.

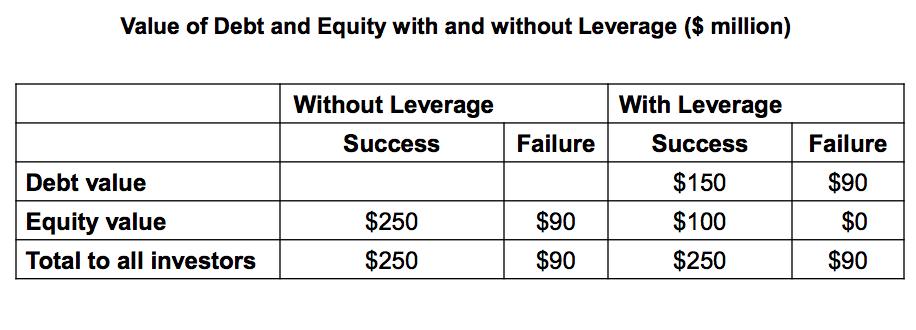

ii) Extending assume now that the costs of financial distress are $15 million.

Compute the value of Moon's securities at the beginning of the year with and without leverage given that financial distress is costly.

iii) Honeywell International Inc. (HON) has a market debt−equity ratio of 0.5. - Assume its current debt cost of capital is 6.5%, and its equity cost of capital is 14%. - If HON issues equity and uses the proceeds to repay its debt and reduce its debt−equity ratio to 0.4, it will lower its debt cost of capital to 5.75%. - With perfect capital markets, what effect will this transaction have on HON's equity cost of capital and WACC?

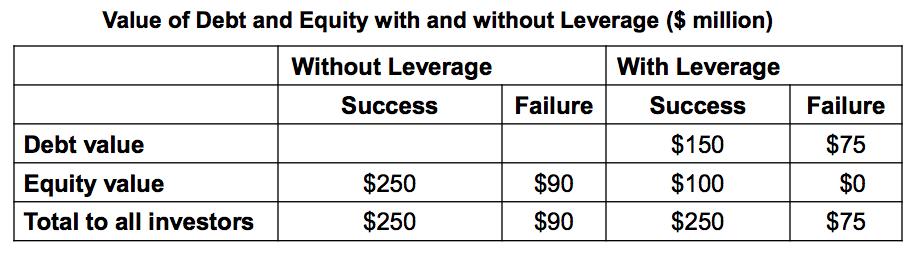

Value of Debt and Equity with and without Leverage ($ million) Without Leverage With Leverage Debt value Equity value Total to all investors Success $250 $250 Failure $90 $90 Success $150 $100 $250 Failure $75 $0 $75

Step by Step Solution

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

i Armin Industries Comparing Value with and Without Leverage Given data Without Leverage Success Debt value 150 million Equity value 250 million Failure Debt value 75 million Equity value 90 million T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started