Question

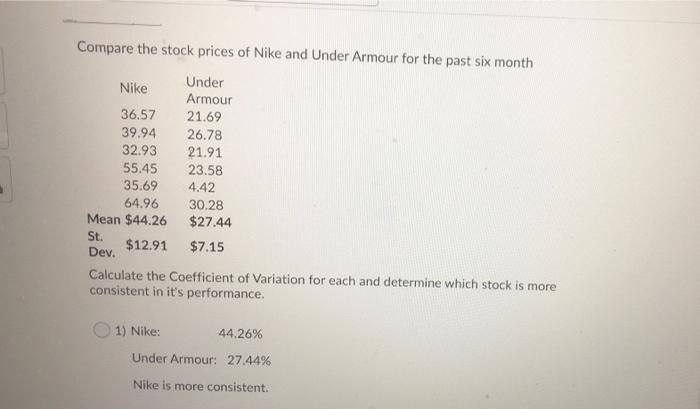

Compare the stock prices of Nike and Under Armour for the past six month Under Nike Armour 36.57 21.69 39.94 26.78 32.93 21.91 St.

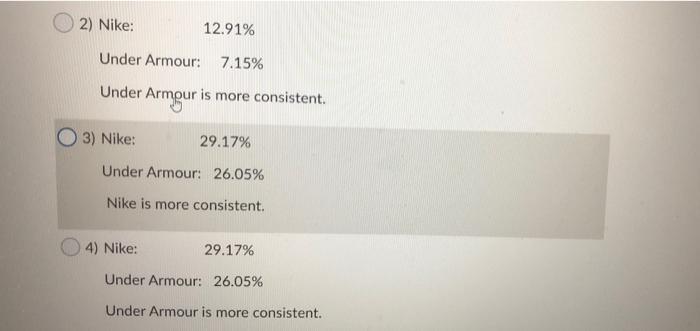

Compare the stock prices of Nike and Under Armour for the past six month Under Nike Armour 36.57 21.69 39.94 26.78 32.93 21.91 St. Dev. 55.45 23.58 35.69 4.42 64.96 Mean $44.26 30.28 $27.44 $12.91 $7.15 Calculate the Coefficient of Variation for each and determine which stock is more consistent in it's performance. 1) Nike: 44.26% Under Armour: 27.44% Nike is more consistent. 2) Nike: 12.91% Under Armour: 7.15% Under Armour is more consistent. (3) Nike: 29.17% Under Armour: 26.05% Nike is more consistent. 29.17% Under Armour: 26.05% Under Armour is more consistent. 4) Nike:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the coefficient of variation CV we u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Statistical Methods And Data Analysis

Authors: R. Lyman Ott, Micheal T. Longnecker

7th Edition

1305269470, 978-1305465527, 1305465520, 978-1305269477

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App