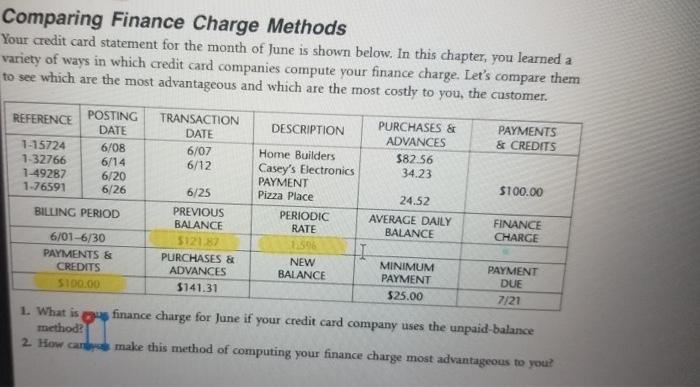

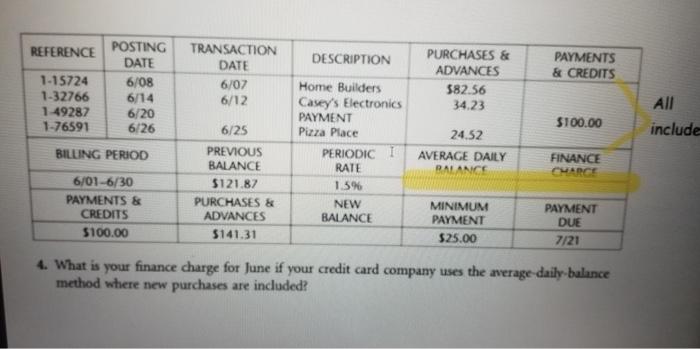

Comparing Finance Charge Methods Your credit card statement for the month of June is shown below. In this chapter, you learned a variety of ways in which credit card companies compute your finance charge. Let's compare them to see which are the most advantageous and which are the most costly to you, the customer. REFERENCE PAYMENTS & CREDITS 1-15724 1-32766 1-49287 1-76591 POSTING DATE 6/08 6/14 6/20 6/26 TRANSACTION DATE 6/07 6/12 $100.00 BILLING PERIOD DESCRIPTION PURCHASES & ADVANCES Home Builders $82.56 Casey's Electronics 34.23 PAYMENT Pizza Place 24.52 PERIODIC AVERAGE DAILY RATE BALANCE SO 1 NEW MINIMUM BALANCE PAYMENT $25.00 6/25 PREVIOUS BALANCE 512187 PURCHASES & ADVANCES $141.31 FINANCE CHARGE 6/01-6/30 PAYMENTS & CREDITS S100.00 PAYMENT DUE 7/21 1. What is us finance charge for June if your credit card company uses the unpaid-balance method? 2. How can make this method of computing your finance charge most advantageous to you? REFERENCE DESCRIPTION 1-15724 1-32766 1-49287 1-76591 POSTING DATE 6/08 6/14 6/20 6/26 TRANSACTION DATE 6/07 6/12 PAYMENTS & CREDITS PURCHASES & ADVANCES 582.56 34.23 $100.00 All include BILLING PERIOD Home Builders Casey's Electronics PAYMENT Pizza Place PERIODICI RATE 1.5% NEW BALANCE 24.52 AVERAGE DAILY BALANCE FINANCE CHARGE 6/25 PREVIOUS BALANCE $121.87 PURCHASES & ADVANCES 5141.31 6/01-6/30 PAYMENTS & CREDITS $100.00 MINIMUM PAYMENT $25.00 PAYMENT DUE 7/21 4. What is your finance charge for June if your credit card company uses the average daily balance method where new purchases are included? Comparing Finance Charge Methods Your credit card statement for the month of June is shown below. In this chapter, you learned a variety of ways in which credit card companies compute your finance charge. Let's compare them to see which are the most advantageous and which are the most costly to you, the customer. REFERENCE PAYMENTS & CREDITS 1-15724 1-32766 1-49287 1-76591 POSTING DATE 6/08 6/14 6/20 6/26 TRANSACTION DATE 6/07 6/12 $100.00 BILLING PERIOD DESCRIPTION PURCHASES & ADVANCES Home Builders $82.56 Casey's Electronics 34.23 PAYMENT Pizza Place 24.52 PERIODIC AVERAGE DAILY RATE BALANCE SO 1 NEW MINIMUM BALANCE PAYMENT $25.00 6/25 PREVIOUS BALANCE 512187 PURCHASES & ADVANCES $141.31 FINANCE CHARGE 6/01-6/30 PAYMENTS & CREDITS S100.00 PAYMENT DUE 7/21 1. What is us finance charge for June if your credit card company uses the unpaid-balance method? 2. How can make this method of computing your finance charge most advantageous to you? REFERENCE DESCRIPTION 1-15724 1-32766 1-49287 1-76591 POSTING DATE 6/08 6/14 6/20 6/26 TRANSACTION DATE 6/07 6/12 PAYMENTS & CREDITS PURCHASES & ADVANCES 582.56 34.23 $100.00 All include BILLING PERIOD Home Builders Casey's Electronics PAYMENT Pizza Place PERIODICI RATE 1.5% NEW BALANCE 24.52 AVERAGE DAILY BALANCE FINANCE CHARGE 6/25 PREVIOUS BALANCE $121.87 PURCHASES & ADVANCES 5141.31 6/01-6/30 PAYMENTS & CREDITS $100.00 MINIMUM PAYMENT $25.00 PAYMENT DUE 7/21 4. What is your finance charge for June if your credit card company uses the average daily balance method where new purchases are included