Answered step by step

Verified Expert Solution

Question

1 Approved Answer

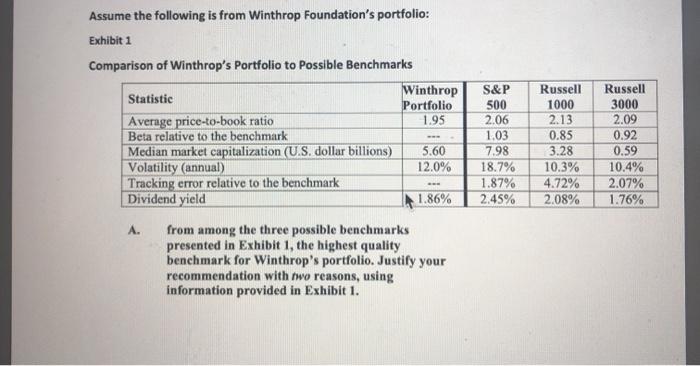

Comparison of Winthrops Portfolio to Possible Benchmarks Statistic Winthrop Portfolio S&P 500 Russell 1000 Russell 3000 Average price-to-book ratio 1.95 2.06 2.13 2.09 Beta relative

Comparison of Winthrops Portfolio to Possible Benchmarks

| Statistic | Winthrop Portfolio | S&P 500 | Russell 1000 | Russell 3000 |

| Average price-to-book ratio | 1.95 | 2.06 | 2.13 | 2.09 |

| Beta relative to the benchmark | --- | 1.03 | 0.85 | 0.92 |

| Median market capitalization (U.S. dollar billions) | 5.60 | 7.98 | 3.28 | 0.59 |

| Volatility (annual) | 12.0% | 18.7% | 10.3% | 10.4% |

| Tracking error relative to the benchmark | --- | 1.87% | 4.72% | 2.07% |

| Dividend yield | 1.86% | 2.45% | 2.08% | 1.76% |

- from among the three possible benchmarks presented in Exhibit 1, the highest quality benchmark for Winthrops portfolio. Justify your recommendation with two reasons, using information provided in Exhibit 1.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started