Question

Competency In this project, you will demonstrate your mastery of the following competency: Analyze cost data to inform business operations and strategic decisions Communicate cost

Competency

In this project, you will demonstrate your mastery of the following competency:

- Analyze cost data to inform business operations and strategic decisions

- Communicate cost data and analysis information to internal stakeholders

Overview

Cost accounting is focused on assisting the organization in making better operational decisions. One important decision revolves around exploring options to allow the organization to achieve desired sales and profit levels. In this project, you will take the role of a cost accountant assisting a client with evaluation options to achieve a target profit. You will also help the client with various strategies to achieve that target profit, as well as help the client determine whether or not to accept a special order.

Directions

Your completed project will consist of the following three deliverables:

Project One Workbook Complete the Project One Workbook Template found in the What to Submit section. It includes all calculations to be completed for the proposed scenarios for the client, which can be found in Project One Case Study linked in the Supporting Materials section. The template will aid you in preparing the financial report for the stakeholders represented in the case study.

Stakeholder Presentation Template and Recorded Narration Once you have completed all necessary research for the client, you will need to prepare a presentation for the stakeholders represented in the case study using the Project One Presentation Template found in the What to Submit section. Review the Speaker Notes for each slide, they contain guiding information on what should be included on each slide. It will need to be organized and formatted based on the needs of the stakeholders. This should be a polished presentation with all key information including basic visualizations. You may include speaker notes; however, this is optional.

High-Level Takeaway Document Prepare a one-page document that is a high-level overview of the presentation geared towards the stakeholders. This is common practice to have a document for stakeholders to review once a presentation is complete. It will allow them to reference key points and critical information from the presentation to make their decision.

Specifically, you must address the following rubric criteria:

Project One Workbook

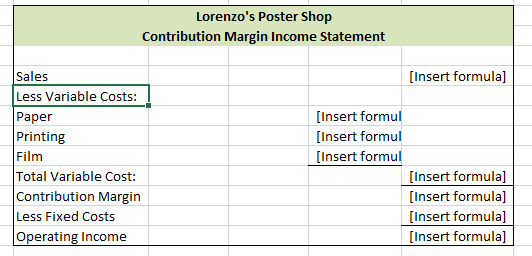

- Prepare an accurate contribution margin income statement based on breakeven using correct Excel formulas.

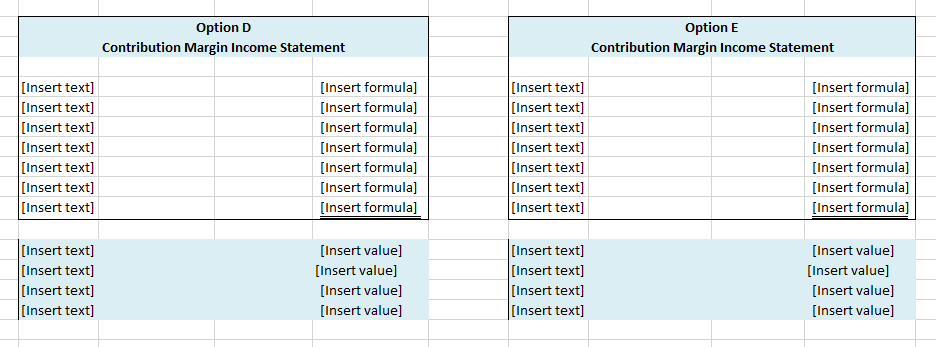

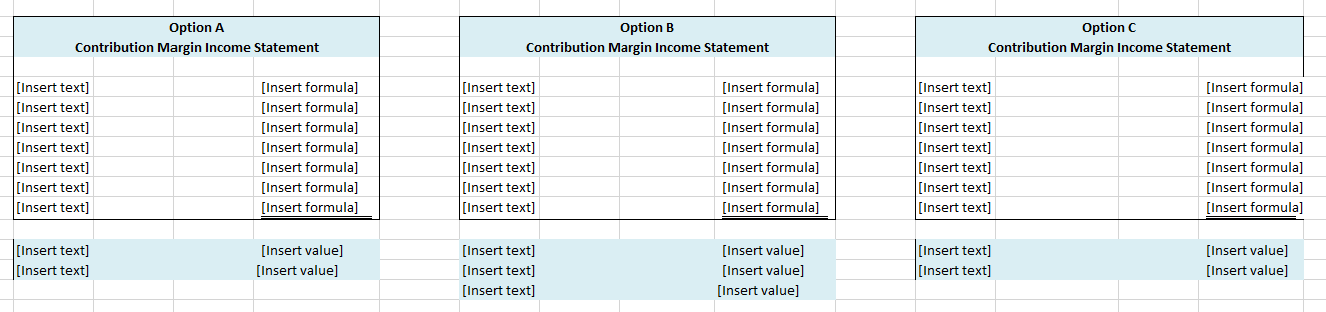

- Perform a cost volume profit analysis for all scenarios using correct Excel formulas. There are five scenarios. Include the following details in your response:

- Calculate the effects on costs and sales volume for each scenario.

- Prepare an accurate contribution margin income statement for each scenario.

- Calculate the after-tax effect of each proposed scenario.

- Determine the effect of the price increase based on the market for all scenarios using correct Excel formulas. Include the following details in your response:

- Calculate the after-tax effect on sales for each scenario.

- Prepare a contribution margin income statement for each scenario.

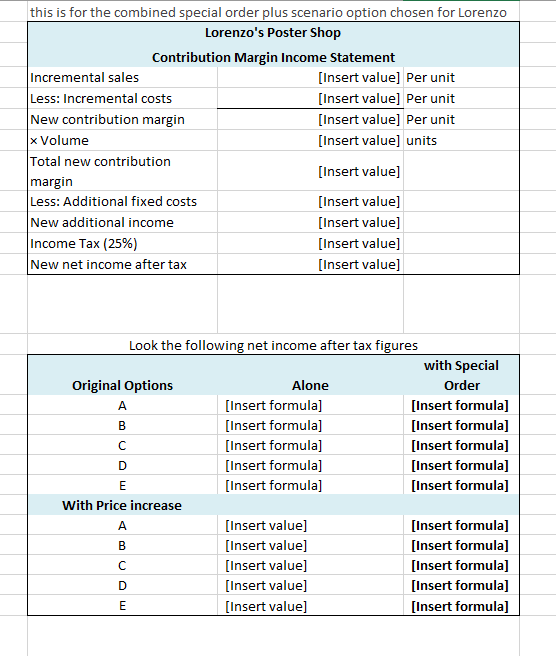

- Evaluate a special-order option using correct Excel formulas. Include the following details in your response:

- Calculate accurately the after-tax profitability of the special order.

- Prepare an accurate contribution margin income statement for the company if the special order is accepted.

Stakeholder Presentation

- Explain the key points to communicate to the stakeholders. Include the following details in your response:

- Summarize the companys request.

- Explain the benefits and advantages to the company for each scenario.

- Explain the disadvantages to the company for each scenario.

- Present the best possible recommendation(s) for the company moving forward based on cost data analysis. Include the following details in your response:

- Determine which scenario is the best for Lorenzo's company.

- Determine if Lorenzo should accept the special order.

- Provide your rationale.

- Explain the potential impact of decisions on business and workforce relationships. Include the following details in your response:

- Explain the potential effects of going from a salary to commission-based salesforce.

- Explain the potential effects of downgrading the quality of supplies for customers orders in the short and long term.

- Explain how a potential price increase might affect customers short and long term.

- Utilize effective basic visualizations that support your rationale.

- Create a simple, neat, and clearly articulated presentation with narration for the needs of the stakeholders.

ACC 311 Project One Scenario

Lorenzo, the owner of a local poster shop, comes to you for help. While his shop has been breaking even for the past two years, it has not been able to generate a profit. For him to keep the shop open, he needs to earn at least $12,000 in operating income next year.

You agree to help Lorenzo and ask him for some current information about his products selling price and costs. You tell him you will work through some possible scenarios that might involve changing his sales price to generate the number of units sold needed to reach his target profit.

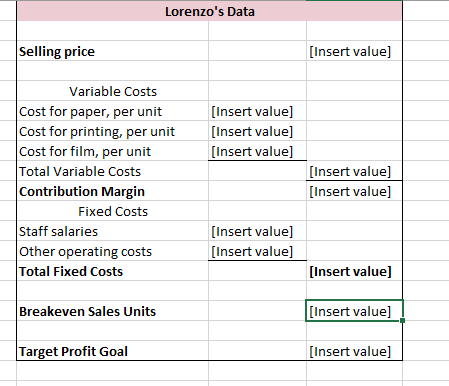

Lorenzo shares the following information with you as you ponder different scenarios to help your client.

| Selling price | $7.50 |

| Cost for paper, per unit | $0.70 |

| Cost for printing, per unit | $1.10 |

| Cost for film, per unit | $0.60 |

| Staff salaries | $48,000.00 |

| Other operating costs | $12,120.00 |

Using Lorenzos data and proper Excel formulas, first, plan to get an understanding of Lorenzos financial situation based on breakeven. Then look at the following five pricing scenarios:

- Lower the selling price by 10% to increase sales volume by 5%.

- Advertise on radio and social media for a combined cost of $1,000 to increase volume by 10%.

- Use a more affordable paper on which to print the posters (available for $0.60 per unit), in combination with a less-expensive film to coat the surface of the poster (available for $0.40 per unit).

- Instead of paying the salespeople a fixed salary, move to a commission-based compensation plan (save $20,000 in salary; incur $1.50 per unit sold commission), which should increase sales volume by 20%.

- Advertise on radio and social media for a combined cost of $1,000 and, instead of paying salespeople a fixed salary, move to a commission-based compensation plan (save $20,000 in salary; incur $1.50 per unit sold commission), which could increase sales volume by 25%.

A few days later, Lorenzo calls back and says he realizes he didnt take into account any tax consequences. He lets you know that he estimates his tax rate to be about 25% and asks if you could please factor that into the various options. He is open to raising the price of his posters if you think that is a viable option.

He also lets you know that hes been approached by a potential client inquiring about a special order, and he wants you to advise him on whether to accept the order. The client wants 500 custom posters for $7 per poster. The posters will require a different type of paper that will cost $0.10 more per poster. The order will also require Lorenzo to pay an extra $1000 in employee costs.

Per Lorenzos request, you also decide to see what effect a price increase might have on Lorenzos position. You have noticed that Lorenzos is one of the only poster shops in the area, and customers may be willing to pay more, and a higher price may even signal higher quality. Though, there are no guarantees that the market will accept the price increase. Lorenzo is looking at increasing the sales price to $9.25.

You let Lorenzo know that you will do an analysis of all options and present your recommendations when you are done.

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{LorenzosPosterShopContributionMarginIncomeStatement} \\ \hline Sales & & [Insert formula] \\ \hline Less Variable Costs: & & \\ \hline Paper & \multicolumn{2}{|l|}{ [Insert formul } \\ \hline Printing & \multicolumn{2}{|l|}{ [Insert formul } \\ \hline Film & \multicolumn{2}{|l|}{ [Insert formul } \\ \hline Total Variable Cost: & & [Insert formula] \\ \hline Contribution Margin & & [Insert formula] \\ \hline Less Fixed Costs & & [Insert formula] \\ \hline Operating Income & & [Insert formula] \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Lorenzo's Data } \\ \hline Selling price & & [Insert value] \\ \hline \multicolumn{3}{|l|}{ Variable Costs } \\ \hline Cost for paper, per unit & [Insert value] & \\ \hline Cost for printing, per unit & [Insert value] & \\ \hline Cost for film, per unit & [Insert value] & \\ \hline Total Variable Costs & & [Insert value] \\ \hline Contribution Margin & & [Insert value] \\ \hline \multicolumn{3}{|l|}{ Fixed Costs } \\ \hline Staff salaries & [Insert value] & \\ \hline Other operating costs & [Insert value] & \\ \hline Total Fixed Costs & & [Insert value] \\ \hline Breakeven Sales Units & & [Insert value] \\ \hline Target Profit Goal & & [Insert value] \\ \hline \end{tabular} this is for the combined special order plus scenario option chosen for Lorenzo \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{LorenzosPosterShopContributionMarginIncomeStatement} \\ \hline Incremental sales & [Insert value] & Per unit \\ \hline Less: Incremental costs & [Insert value] & Per unit \\ \hline New contribution margin & [Insert value] & Per unit \\ \hline Volume & [Insert value] & units \\ \hline Totalnewcontributionmargin & [Insert value] & \\ \hline Less: Additional fixed costs & [Insert value] & \\ \hline New additional income & [Insert value] & \\ \hline Income Tax (25\%) & [Insert value] & \\ \hline New net income after tax & [Insert value] & \\ \hline \end{tabular} Look the following net income after tax figures \begin{tabular}{|c|c|c|} \hline Original Options & Alone & withSpecialOrder \\ \hline A & [Insert formula] & [Insert formula] \\ \hline B & [Insert formula] & [Insert formula] \\ \hline C & [Insert formula] & [Insert formula] \\ \hline D & [Insert formula] & [Insert formula] \\ \hline E & [Insert formula] & [Insert formula] \\ \hline \multicolumn{3}{|l|}{ With Price increase } \\ \hline A & [Insert value] & [Insert formula] \\ \hline B & [Insert value] & [Insert formula] \\ \hline C & [Insert value] & [Insert formula] \\ \hline D & [Insert value] & [Insert formula] \\ \hline E & [Insert value] & [Insert formula] \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{2}{|c|}{OptionAContributionMarginIncomeStatement} & \multicolumn{2}{|c|}{OptionBContributionMarginIncomeStatement} & \multicolumn{2}{|c|}{OptionCContributionMarginIncomeStatement} \\ \hline [Insert text] & [Insert formula] & [Insert text] & [Insert formula] & [Insert text] & [Insert formula] \\ \hline [Insert text] & [Insert formula] & [Insert text] & [Insert formula] & [Insert text] & [Insert formula] \\ \hline [Insert text] & [Insert formula] & [Insert text] & [Insert formula] & [Insert text] & [Insert formula] \\ \hline [Insert text] & [Insert formula] & [Insert text] & [Insert formula] & [Insert text] & [Insert formula] \\ \hline [Insert text] & [Insert formula] & [Insert text] & [Insert formula] & [Insert text] & [Insert formula] \\ \hline [Insert text] & [Insert formula] & [Insert text] & [Insert formula] & [Insert text] & [Insert formula] \\ \hline [Insert text] & [Insert formula] & [Insert text] & [Insert formula] & [Insert text] & [Insert formula] \\ \hline \multirow[t]{2}{*}{\begin{tabular}{|l} {[ Insert text ]} \\ [Insert text ] \end{tabular}} & \multirow[t]{2}{*}{[Insertvalue][Insertvalue]} & \multirow{2}{*}{[Inserttext][Inserttext][Inserttext]} & \multirow{2}{*}{[Insertvalue][Insertvalue][Insertvalue]} & [Inserttext][Inserttext] & [Insertvalue][Insertvalue] \\ \hline & & & & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started