Competitor company is Lowes

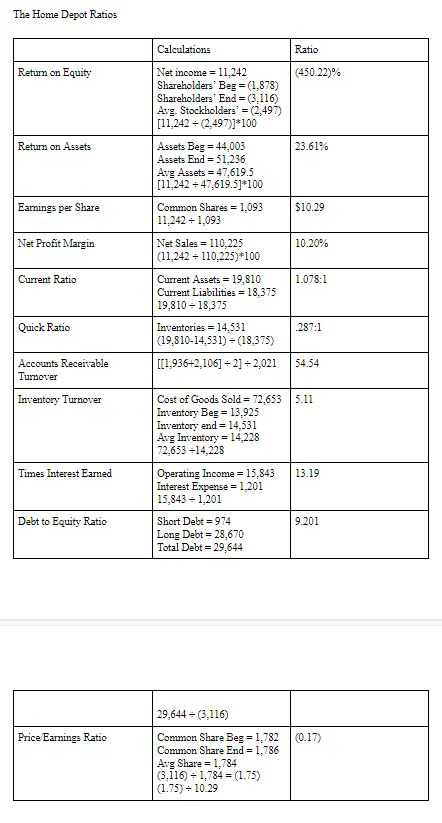

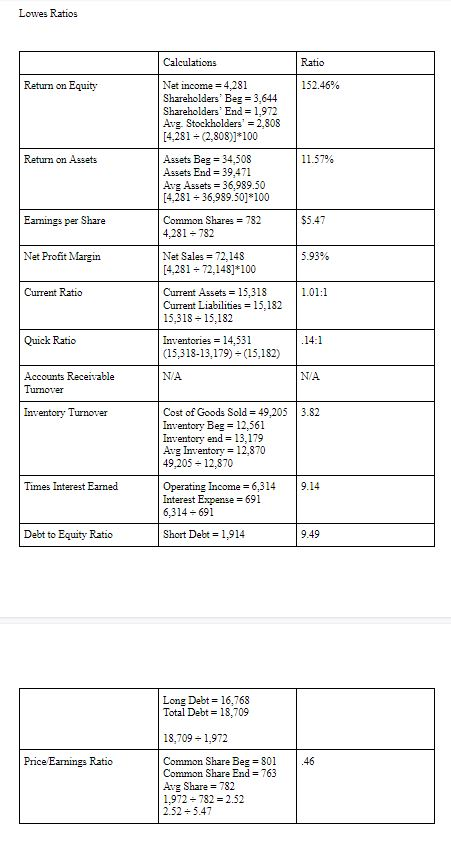

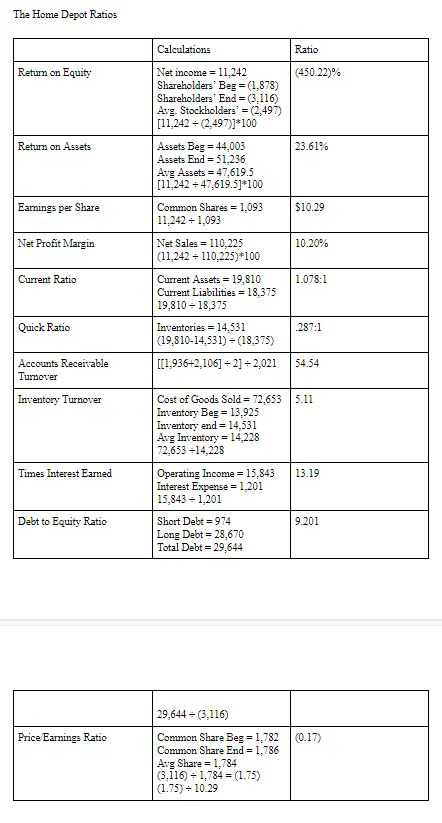

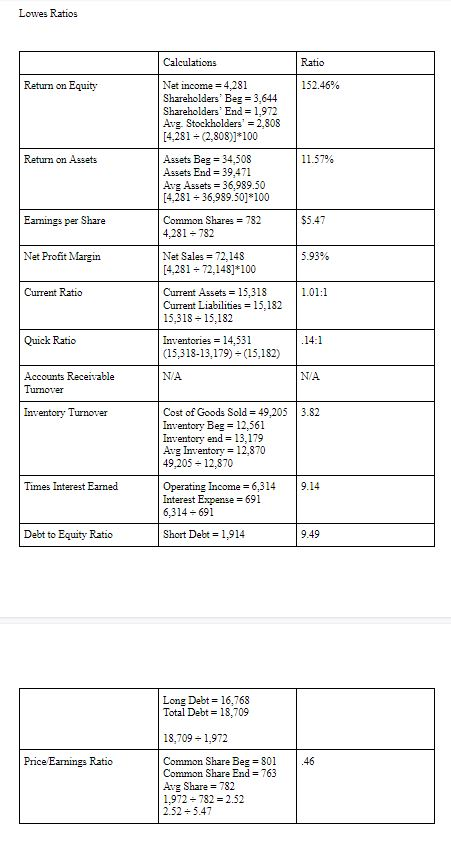

Profitability: 1. What is your assessment of the profitability of your firm in the most recent year? How does your firm's profitability compare with that of the competitor? 2. Compare the cash flows from operating activities for your firm with the net income for the most recent year. What factors have contributed to the difference between these two numbers? Liquidity and Capital Structure: 1. Will the company be able to meet its obligations as they become due? How does your firm's liquidity compare with that of the competitor? 2. What is the capital structure of your company (i.e., what percentage of the total assets of the company are financed through liabilities and what percentage through stockholders' equity)? 3. Is the capital structure of the competitor significantly different from that of your company? Briefly explain your answer. The Home Depot Ratios Calculations Ratio Return on Equity (450.22% Return on Assets 23.61% Eamings per Share $10.29 Net income = 11.242 Shareholders' Beg = (1,878) Shareholders' End=(3,116) Avg Stockholders' = (2,497) [11,242 - (2.497)]*100 Assets Beg = 44,003 Assets End = 51,236 Avg Assets = 47,619.3 [11.242 -47,619.5]*100 Common Shares = 1,093 11,242 +1,093 Net Sales = 110,225 (11,242 - 110.225)*100 Current Assets - 19,810 Current Liabilities = 18,375 19.810-18,375 Inventories = 14,331 (19,810-14,531) - (18,375) [[1,936+2,106] =2] =2,021 Net Profit Margin 10.20% Current Ratio 1.078:1 Quick Ratio .287:1 54.54 Accounts Receivable Turnover Inventory Turnover Cost of Goods Sold = 72,653 5.11 Inventory Beg = 13,925 Inventory end = 14,531 Avg Inventory = 14,228 72,653 -14,228 Times Interest Earned 13.19 Operating Income = 15,843 Interest Expense = 1,201 15.843-1,201 Short Debt = 974 Long Debt - 28,670 Total Debt = 29,644 Debt to Equity Ratio 9.201 Price Earnings Ratio (0.17) 29,644 - (3,116) Common Share Beg = 1,782 Common Share End = 1,786 Avg Share = 1,784 (3.116) - 1,784 = (1.75) (1.75) - 10.29 Lowes Ratios Calculations Ratio Return on Equity 152.46% Return on Assets Net income = 4,281 Shareholders' Beg -3,644 Shareholders End = 1,972 Avg. Stockholders' = 2,808 [4,281 = (2,808)]*100 Assets Beg = 34,508 Assets End = 39,471 Avg Assets = 36,989.50 [4,281 - 36,989.50]*100 Common Shares = 782 4,281 - 782 11.57% Earnings per Share $5.47 Net Profit Margin 5.93% Current Ratio 1.01:1 Net Sales = 72,148 [4,281 - 72,148]*100 Current Assets = 15,318 Current Liabilities = 15,182 15,318 = 15,182 Inventories = 14,531 (15,318-13,179) = (15,182) Quick Ratio .14:1 Accounts Receivable Turnover NA NA Inventory Turnover Cost of Goods Sold = 49,205 3.82 Inventory Beg = 12,561 Inventory end = 13,179 Arg Inventory = 12,870 49,205 12,870 Operating Income = 6,314 9.14 Interest Expense = 691 6,314 = 691 Short Debt = 1,914 9.49 Times Interest Earned Debt to Equity Ratio Long Debt = 16,768 Total Debt = 18,709 18,709 = 1,972 Price Earnings Ratio .46 Common Share Beg = 801 Common Share End = 763 Avg Share = 782 1,972 = 782 = 2.52 2.52 = 5.47 Profitability: 1. What is your assessment of the profitability of your firm in the most recent year? How does your firm's profitability compare with that of the competitor? 2. Compare the cash flows from operating activities for your firm with the net income for the most recent year. What factors have contributed to the difference between these two numbers? Liquidity and Capital Structure: 1. Will the company be able to meet its obligations as they become due? How does your firm's liquidity compare with that of the competitor? 2. What is the capital structure of your company (i.e., what percentage of the total assets of the company are financed through liabilities and what percentage through stockholders' equity)? 3. Is the capital structure of the competitor significantly different from that of your company? Briefly explain your answer. The Home Depot Ratios Calculations Ratio Return on Equity (450.22% Return on Assets 23.61% Eamings per Share $10.29 Net income = 11.242 Shareholders' Beg = (1,878) Shareholders' End=(3,116) Avg Stockholders' = (2,497) [11,242 - (2.497)]*100 Assets Beg = 44,003 Assets End = 51,236 Avg Assets = 47,619.3 [11.242 -47,619.5]*100 Common Shares = 1,093 11,242 +1,093 Net Sales = 110,225 (11,242 - 110.225)*100 Current Assets - 19,810 Current Liabilities = 18,375 19.810-18,375 Inventories = 14,331 (19,810-14,531) - (18,375) [[1,936+2,106] =2] =2,021 Net Profit Margin 10.20% Current Ratio 1.078:1 Quick Ratio .287:1 54.54 Accounts Receivable Turnover Inventory Turnover Cost of Goods Sold = 72,653 5.11 Inventory Beg = 13,925 Inventory end = 14,531 Avg Inventory = 14,228 72,653 -14,228 Times Interest Earned 13.19 Operating Income = 15,843 Interest Expense = 1,201 15.843-1,201 Short Debt = 974 Long Debt - 28,670 Total Debt = 29,644 Debt to Equity Ratio 9.201 Price Earnings Ratio (0.17) 29,644 - (3,116) Common Share Beg = 1,782 Common Share End = 1,786 Avg Share = 1,784 (3.116) - 1,784 = (1.75) (1.75) - 10.29 Lowes Ratios Calculations Ratio Return on Equity 152.46% Return on Assets Net income = 4,281 Shareholders' Beg -3,644 Shareholders End = 1,972 Avg. Stockholders' = 2,808 [4,281 = (2,808)]*100 Assets Beg = 34,508 Assets End = 39,471 Avg Assets = 36,989.50 [4,281 - 36,989.50]*100 Common Shares = 782 4,281 - 782 11.57% Earnings per Share $5.47 Net Profit Margin 5.93% Current Ratio 1.01:1 Net Sales = 72,148 [4,281 - 72,148]*100 Current Assets = 15,318 Current Liabilities = 15,182 15,318 = 15,182 Inventories = 14,531 (15,318-13,179) = (15,182) Quick Ratio .14:1 Accounts Receivable Turnover NA NA Inventory Turnover Cost of Goods Sold = 49,205 3.82 Inventory Beg = 12,561 Inventory end = 13,179 Arg Inventory = 12,870 49,205 12,870 Operating Income = 6,314 9.14 Interest Expense = 691 6,314 = 691 Short Debt = 1,914 9.49 Times Interest Earned Debt to Equity Ratio Long Debt = 16,768 Total Debt = 18,709 18,709 = 1,972 Price Earnings Ratio .46 Common Share Beg = 801 Common Share End = 763 Avg Share = 782 1,972 = 782 = 2.52 2.52 = 5.47