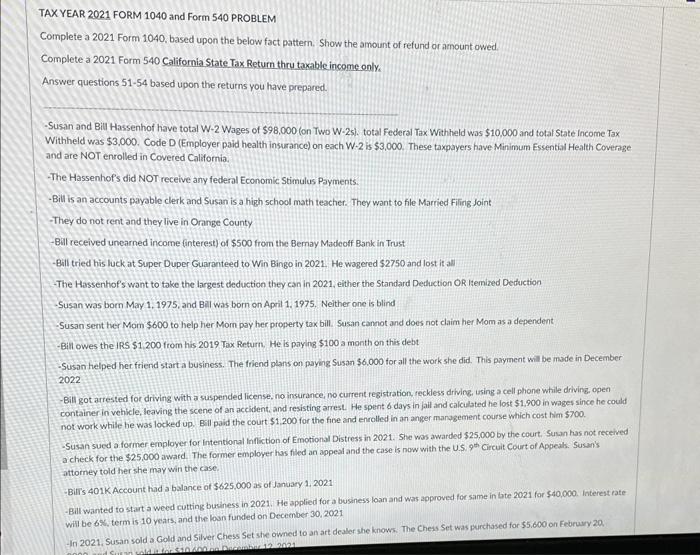

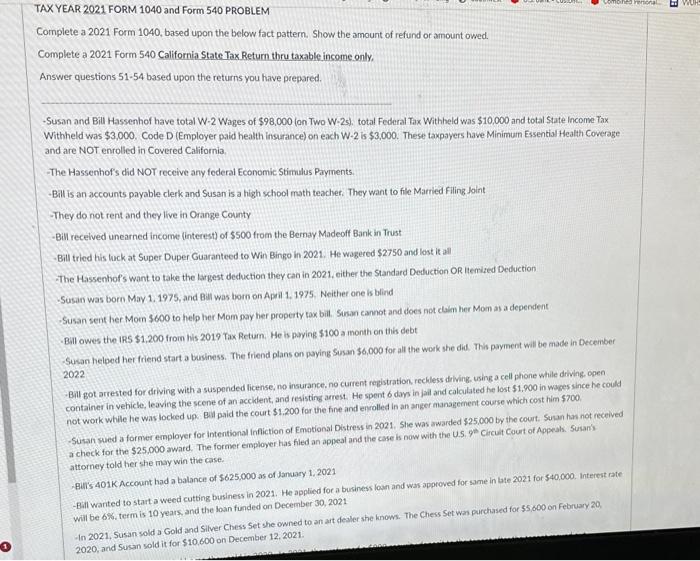

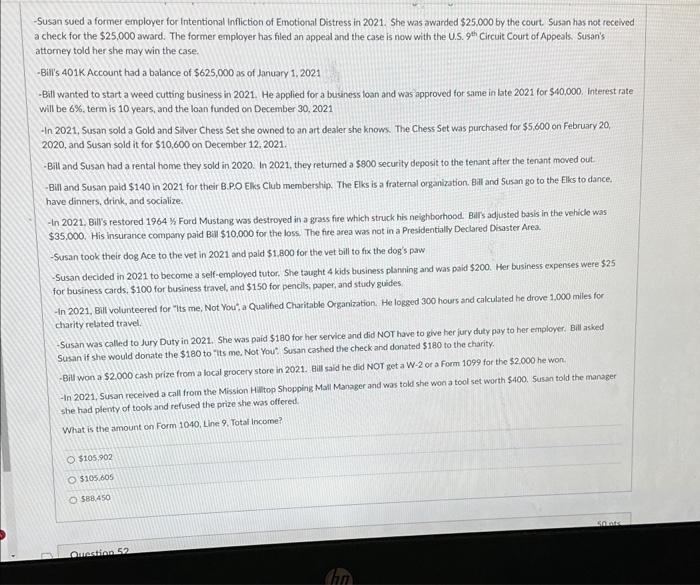

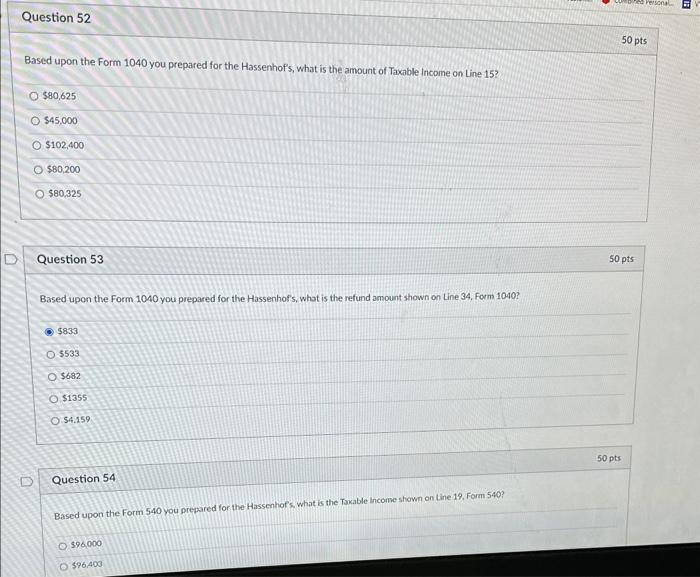

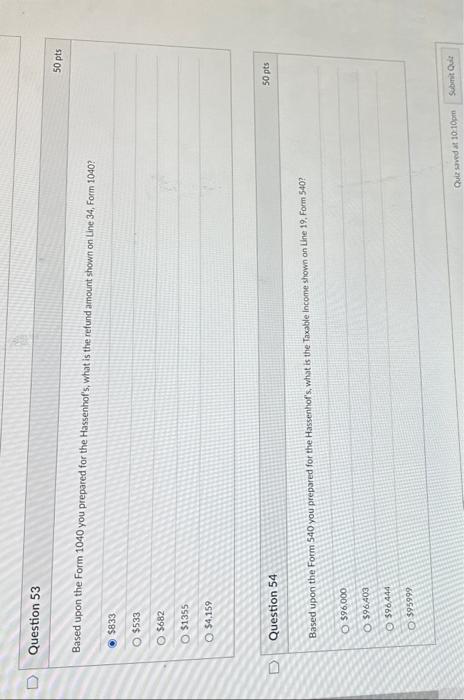

Complete a 2021 Form 1040, based upon the below fact pattern. Show the amount of refund or amount owed. Complete a 2021 Form 540 California State Tax Retum thru taxable income only, Answer questions 51-54 based upon the returns you have prepared. -Susan and Bill Hassenhof have total W-2 Wages of $98,000 (on Two W-2s). total Federal Tax Withheld was $10,000 and total State income Tax Withheld was $3,000. Code D (Emplayer paid health insurance) on each W2 is $3,000. These taxpayers have Minimum Essential Health Covernge and are NOT enrolled in Covered Calfornia. -The Hassenhof's did NOT receive any federal Economic Stimulus Payments. -Bill is an accounts payable clerk and Susan is a high school math teacher. They want to file Married Filing Joint. -They do not rent and they live in Orange County - Bill received uncarned income finterest) of $500 from the Bemay Madeoff Bank in Trust - Bill tried his luck at Super Duper Guaranteed to Win Bingo in 2021 . He wagered $2750 and lost it all -The Hassentiof's want to take the largest deduction they can in 2021, either the Standard Deduction OR Itemired Deduction - Susan was bom May 1,1975, and Bel was born on April 1. 1975. Neither one is blind - Susan sent tuer Mom $600 to help her Mom pay her property tax bill. Susan cannot and does not claim her Mom as a dependent. - Bill owes the IRS $1.200 from his 2019 Tax Return, He is paying $100a month on this debt - Susson helped her friend start a business. The friend plans on payng Susan $6.000 for all the work she did. This payment will be made in December 2022 -Bill got arrested for driving with a suspended license, no insurance, no current registration, reckless driving, using a cell phone while driving open container in vehicle, leaving thie scene of an accident, and resisting arrest. He spent 6 days in jail and calculated he lost $1,900 in wages since he could not work while he was locked up. Bail paid the court $1.200 for the fine and encolled in an anger maragement course which cost him $700. - Susan sued a former employer for intentional linfiction of Emotional Distress in 2021 . She was awarded $25,000 by the court, Suban has not recelved a check for the $25,000 award. The former employer has filed an appeal and the case is now with the U.5.9t Circuit Court of Appeats. Susan's attomey told her she may win the case. -Bili's 401K Account had a balance of $625,000 as of January 1, 2021 -Bil wanted to start a weed cutting buciness in 2021. He applied for a business loan and was approved for same in bate 2021 for $40,000. Interest rate will be 6%, term is 10 yeats, and the loun funded on Deceenber 30,2021 -In 2021, Susan sold a Gold and Silver Chess Set she owned to an art dealer she knows. The Chess Set was purchased for 55.600 on Fobruwry 20. TAX YEAR 2021 FORM 1040 and Form 540 PROBLEM Complete a 2021 Form 1040, based upon the below fact pattern. Show the amount of refund or amount owed. Complete a 2021 Form 540 California State Tax Return thru taxable income only, Answer questions 5154 based upon the returns you have prepared. - Susan and Bill Hassenhof have total W-2 Wages of $98,000( on Two W-2s). total Federal Tax Withheld was $10,000 and total State income Tax Withheld was $3,000. Code D (Employer paid health insurance) on each W2 is $3,000. These taxpayers have Minimum Essential Health Coverage and are NOT enrolied in Covered California. -The Hassenhof's did NOT receive any federal Economic Stimulus Payments: - Bill is an accounts payable clerk and Susan is a high school math teacher. They want to file Married Filing Joint -They do not rent and they live in Orange County - Bill recelved unearned income (interest) of $500 from the Bernay Madeoff Bank in Trust -Bill tried his luck at Super Duper Guaranteed to Win Bingo in 2021. He wogered $2750 and lost it all The Hassenhofs want to take the largest deduction they can in 2021, either the Standard Defluction OR ltemized Deduction - Susain was born May 1. 1975, and Bull was bom on April 1. 1975, Neither one is blind -Susan sent her Moen $600 to help her Mom gay her property tax bill. Stown cannot and does not daim her Mom as a dependent - Bill owes the IRS $1,200 from his 2019 Tax Return. He is paying $100 a month on thik debt -Sucan helped her friend start a business. The friend plans on paying susan$6,000 for all the woak she did. This payment will be made in December 2022 -Bail got arrested for driving with a suspended license, no insurance. no current repistration, rechless deliving using a cell phone while diving, apen container in vehicle, leaving the scene of an accident, and resisting arrest. He spent 6 days in jal and calcilated he lost $1,900 in wages since he could not work while he was locked ups. Bal paid the court $1,200 for the fine and envolled in an anger managenent course which cost him $700. - Suxan wued a former employer for interitional infiction of Emational Distress in 2021. She was awarded $25,000 by the court. Suma has not recelived a check for the $25.000 ward. The former employer has filed an appeal and the case is now with the U.S. 9 e Circuit Court of Appeak. Susar's attorney told her she may win the case. Bitis 401K Accoment had a balance of 5625,000 as of January 1,2021 - Bill wanted to start a weed cutting business in 2021 . He applied foc a business loan and was approved for same in the 2021 for 540,000 . Interest rate will be 6%, term is 10 years, and the loan funded on December 30,2021 ln2021, Susan sold a Gold and Silver Chess Set she owned to an art dealer she knows. The Chess Set wan parchased for 55,600 on february 20 . - 2020. and Susan sold it for $10,600 on December 12, 2021. Susan sued a former employer for Intentional infliction of Emotional Distress in 2021. She was awarded $25.000 by the court. 5 usan has not received check for the $25,000 award. The former employer has filed an appeal and the case is now with the U.S. 9 th Circuit Court of Appeals. Susan's attomey told her she may win the case. -Bili's 401K Account had a balance of $625,000 as of January 1,2021 -Bill wanted to start a weed cutting business in 2021 . He applied for a business loan and was approved for same in late 2021 for $40,000. Interest rate will be 6%, term is 10 years, and the loan funded on December 30,2021 -In 2021, Susan sold a Gold and Silver Chess Set she owned to an art dealer she knows. The Chess Set was purchased for $5,600 on February 20 , 2020 , and Susan sold it for $10,600 on December 12, 2021. - Bill and Susan had a rental home they sold in 2020. In 2021, they retumed a $900 security deposit to the tenant after the tenant moved out -Bill and Susan paid $140 in 2021 for their B.P.O Eliss Club membership. The Elks is a fraternal organization. Bill and Susan go to the Elks to dance. have dinners, drink, and socialize. -In 2021. Bill's restored 1964 \% Ford Mustang was destroyed in a grass fire which struck his neighborhood. Bilirs ad justed basis in the vehiclo was $35,000. His insurance company paid Bill $10.000 for the loss. The fire area was not in a Presidentially Declared Disaster Area. - Susan took their dog Ace to the vet in 2021 and pald $1.800 for the vet bill to fix the dog's paw - Susan decided in 2021 to become a self-emploved tutor. She taught 4 kids business planing and was paid $200. Her business expenses were $25 for business cards. $100 for business travel, and $150 for pencils, poper, and study guides: -In 2021, Bill voluntecred for "Its me, Not You:; Qualified Charitable Organization. He logged 300 hours and calculated he drove 1,000 miles for charity related travel. - Susan was called to Jury Duty in 2021 . She was paid $180 for her service and did NOT have to give her jury duty pay to her employer. Bill asked Susan if she would donate the $180 to "its me. Not You: Susan cashed the check and donated $180 to the charity. -Bilt won a $2,000 cash prize from a lacal grocery store in 2021 . Bill said he did NOT get a W-2 or a form 1099 for the $2.000 he won. -In 2021, Susan received a call from the Mission Hillop Shopping Mall Manager and was told she won a tool set worth $400, susan told the manager she had plenty of tools and refused the prize stie was olfered. What is the amount on Form 1040, Line 9. Totai income? $105,902 5105,605 588,450 Based upon the Form 1040 you prepared for the Hassenhof's, what is the amount of Taxable Income on Line 15 ? $80,625$45,000$102,400$80,200$80,325 Question 53 Based upon the Form 1040 you prepared for the Hassenhof's, whot is the refund amount shown on Line 34 , Form 1040 ? $833$533$682$1355$4.159 Question 54 Based upon the Form 540 you prepared for the Hassenhof s. what is the Taxable income shown on tine 19. Form 540? $96000 $96,400 Based upon the Form 1040 you prepared for the Hassenhof's, what is the refund amount shown on Line 34, Form 1040? $833$533$682$1355$4,159 Question 54 Based upon the Form 540 you prepared for the Hassenhof's, what is the Taxable income shown an Line 19. Form 540? $96.000$96.403 $96.444 $95999 Complete a 2021 Form 1040, based upon the below fact pattern. Show the amount of refund or amount owed. Complete a 2021 Form 540 California State Tax Retum thru taxable income only, Answer questions 51-54 based upon the returns you have prepared. -Susan and Bill Hassenhof have total W-2 Wages of $98,000 (on Two W-2s). total Federal Tax Withheld was $10,000 and total State income Tax Withheld was $3,000. Code D (Emplayer paid health insurance) on each W2 is $3,000. These taxpayers have Minimum Essential Health Covernge and are NOT enrolled in Covered Calfornia. -The Hassenhof's did NOT receive any federal Economic Stimulus Payments. -Bill is an accounts payable clerk and Susan is a high school math teacher. They want to file Married Filing Joint. -They do not rent and they live in Orange County - Bill received uncarned income finterest) of $500 from the Bemay Madeoff Bank in Trust - Bill tried his luck at Super Duper Guaranteed to Win Bingo in 2021 . He wagered $2750 and lost it all -The Hassentiof's want to take the largest deduction they can in 2021, either the Standard Deduction OR Itemired Deduction - Susan was bom May 1,1975, and Bel was born on April 1. 1975. Neither one is blind - Susan sent tuer Mom $600 to help her Mom pay her property tax bill. Susan cannot and does not claim her Mom as a dependent. - Bill owes the IRS $1.200 from his 2019 Tax Return, He is paying $100a month on this debt - Susson helped her friend start a business. The friend plans on payng Susan $6.000 for all the work she did. This payment will be made in December 2022 -Bill got arrested for driving with a suspended license, no insurance, no current registration, reckless driving, using a cell phone while driving open container in vehicle, leaving thie scene of an accident, and resisting arrest. He spent 6 days in jail and calculated he lost $1,900 in wages since he could not work while he was locked up. Bail paid the court $1.200 for the fine and encolled in an anger maragement course which cost him $700. - Susan sued a former employer for intentional linfiction of Emotional Distress in 2021 . She was awarded $25,000 by the court, Suban has not recelved a check for the $25,000 award. The former employer has filed an appeal and the case is now with the U.5.9t Circuit Court of Appeats. Susan's attomey told her she may win the case. -Bili's 401K Account had a balance of $625,000 as of January 1, 2021 -Bil wanted to start a weed cutting buciness in 2021. He applied for a business loan and was approved for same in bate 2021 for $40,000. Interest rate will be 6%, term is 10 yeats, and the loun funded on Deceenber 30,2021 -In 2021, Susan sold a Gold and Silver Chess Set she owned to an art dealer she knows. The Chess Set was purchased for 55.600 on Fobruwry 20. TAX YEAR 2021 FORM 1040 and Form 540 PROBLEM Complete a 2021 Form 1040, based upon the below fact pattern. Show the amount of refund or amount owed. Complete a 2021 Form 540 California State Tax Return thru taxable income only, Answer questions 5154 based upon the returns you have prepared. - Susan and Bill Hassenhof have total W-2 Wages of $98,000( on Two W-2s). total Federal Tax Withheld was $10,000 and total State income Tax Withheld was $3,000. Code D (Employer paid health insurance) on each W2 is $3,000. These taxpayers have Minimum Essential Health Coverage and are NOT enrolied in Covered California. -The Hassenhof's did NOT receive any federal Economic Stimulus Payments: - Bill is an accounts payable clerk and Susan is a high school math teacher. They want to file Married Filing Joint -They do not rent and they live in Orange County - Bill recelved unearned income (interest) of $500 from the Bernay Madeoff Bank in Trust -Bill tried his luck at Super Duper Guaranteed to Win Bingo in 2021. He wogered $2750 and lost it all The Hassenhofs want to take the largest deduction they can in 2021, either the Standard Defluction OR ltemized Deduction - Susain was born May 1. 1975, and Bull was bom on April 1. 1975, Neither one is blind -Susan sent her Moen $600 to help her Mom gay her property tax bill. Stown cannot and does not daim her Mom as a dependent - Bill owes the IRS $1,200 from his 2019 Tax Return. He is paying $100 a month on thik debt -Sucan helped her friend start a business. The friend plans on paying susan$6,000 for all the woak she did. This payment will be made in December 2022 -Bail got arrested for driving with a suspended license, no insurance. no current repistration, rechless deliving using a cell phone while diving, apen container in vehicle, leaving the scene of an accident, and resisting arrest. He spent 6 days in jal and calcilated he lost $1,900 in wages since he could not work while he was locked ups. Bal paid the court $1,200 for the fine and envolled in an anger managenent course which cost him $700. - Suxan wued a former employer for interitional infiction of Emational Distress in 2021. She was awarded $25,000 by the court. Suma has not recelived a check for the $25.000 ward. The former employer has filed an appeal and the case is now with the U.S. 9 e Circuit Court of Appeak. Susar's attorney told her she may win the case. Bitis 401K Accoment had a balance of 5625,000 as of January 1,2021 - Bill wanted to start a weed cutting business in 2021 . He applied foc a business loan and was approved for same in the 2021 for 540,000 . Interest rate will be 6%, term is 10 years, and the loan funded on December 30,2021 ln2021, Susan sold a Gold and Silver Chess Set she owned to an art dealer she knows. The Chess Set wan parchased for 55,600 on february 20 . - 2020. and Susan sold it for $10,600 on December 12, 2021. Susan sued a former employer for Intentional infliction of Emotional Distress in 2021. She was awarded $25.000 by the court. 5 usan has not received check for the $25,000 award. The former employer has filed an appeal and the case is now with the U.S. 9 th Circuit Court of Appeals. Susan's attomey told her she may win the case. -Bili's 401K Account had a balance of $625,000 as of January 1,2021 -Bill wanted to start a weed cutting business in 2021 . He applied for a business loan and was approved for same in late 2021 for $40,000. Interest rate will be 6%, term is 10 years, and the loan funded on December 30,2021 -In 2021, Susan sold a Gold and Silver Chess Set she owned to an art dealer she knows. The Chess Set was purchased for $5,600 on February 20 , 2020 , and Susan sold it for $10,600 on December 12, 2021. - Bill and Susan had a rental home they sold in 2020. In 2021, they retumed a $900 security deposit to the tenant after the tenant moved out -Bill and Susan paid $140 in 2021 for their B.P.O Eliss Club membership. The Elks is a fraternal organization. Bill and Susan go to the Elks to dance. have dinners, drink, and socialize. -In 2021. Bill's restored 1964 \% Ford Mustang was destroyed in a grass fire which struck his neighborhood. Bilirs ad justed basis in the vehiclo was $35,000. His insurance company paid Bill $10.000 for the loss. The fire area was not in a Presidentially Declared Disaster Area. - Susan took their dog Ace to the vet in 2021 and pald $1.800 for the vet bill to fix the dog's paw - Susan decided in 2021 to become a self-emploved tutor. She taught 4 kids business planing and was paid $200. Her business expenses were $25 for business cards. $100 for business travel, and $150 for pencils, poper, and study guides: -In 2021, Bill voluntecred for "Its me, Not You:; Qualified Charitable Organization. He logged 300 hours and calculated he drove 1,000 miles for charity related travel. - Susan was called to Jury Duty in 2021 . She was paid $180 for her service and did NOT have to give her jury duty pay to her employer. Bill asked Susan if she would donate the $180 to "its me. Not You: Susan cashed the check and donated $180 to the charity. -Bilt won a $2,000 cash prize from a lacal grocery store in 2021 . Bill said he did NOT get a W-2 or a form 1099 for the $2.000 he won. -In 2021, Susan received a call from the Mission Hillop Shopping Mall Manager and was told she won a tool set worth $400, susan told the manager she had plenty of tools and refused the prize stie was olfered. What is the amount on Form 1040, Line 9. Totai income? $105,902 5105,605 588,450 Based upon the Form 1040 you prepared for the Hassenhof's, what is the amount of Taxable Income on Line 15 ? $80,625$45,000$102,400$80,200$80,325 Question 53 Based upon the Form 1040 you prepared for the Hassenhof's, whot is the refund amount shown on Line 34 , Form 1040 ? $833$533$682$1355$4.159 Question 54 Based upon the Form 540 you prepared for the Hassenhof s. what is the Taxable income shown on tine 19. Form 540? $96000 $96,400 Based upon the Form 1040 you prepared for the Hassenhof's, what is the refund amount shown on Line 34, Form 1040? $833$533$682$1355$4,159 Question 54 Based upon the Form 540 you prepared for the Hassenhof's, what is the Taxable income shown an Line 19. Form 540? $96.000$96.403 $96.444 $95999