Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete a form 1065 for Hansen Food Storage and a K-1 for each partner. Scan the 1065 and K-1s together A few notes: Each partner

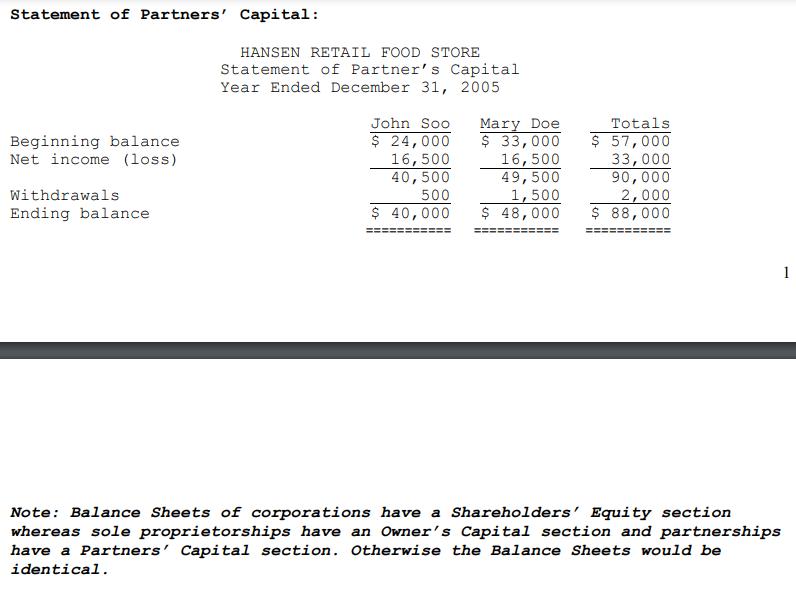

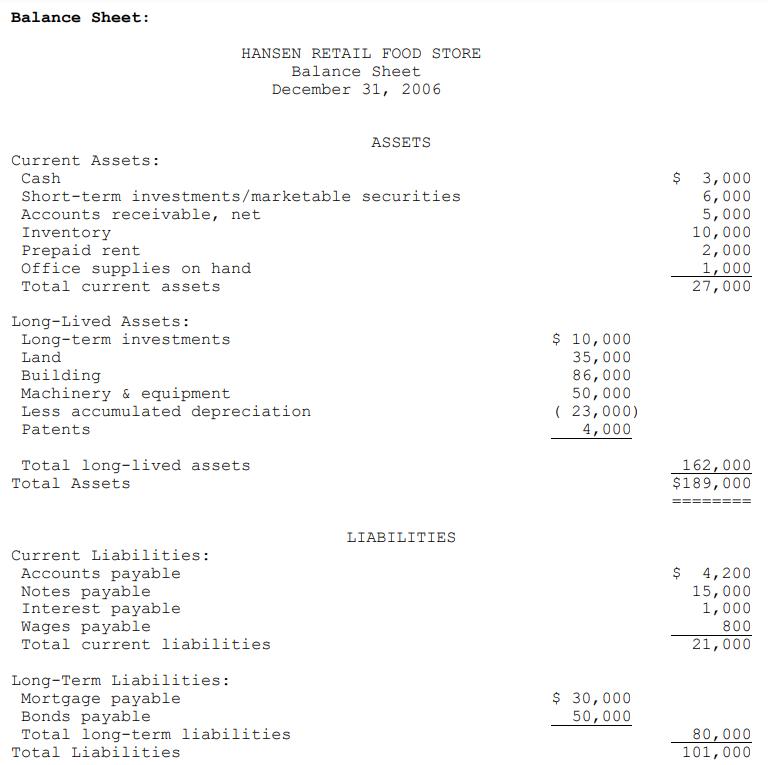

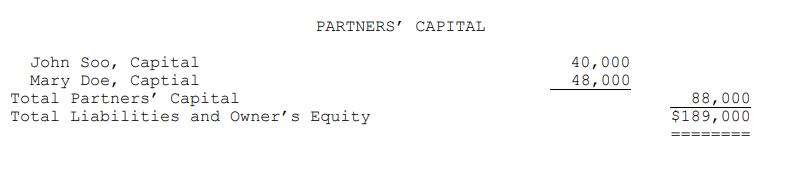

Complete a form 1065 for Hansen Food Storage and a K-1 for each partner. Scan the 1065 and K-1s together A few notes: Each partner will need a K-1. Partner Capital is the same formula as equity Beginning Equity +Contributions +Net Income (Partner Share) -Withdraws = Ending Equity You share income based on your equity percentage. All items on Schedule K on Form 1065 will transfer to Form K-1 in each partner's individual percentage. Your Balance Sheet on the last page of Form 1065 should Balance.

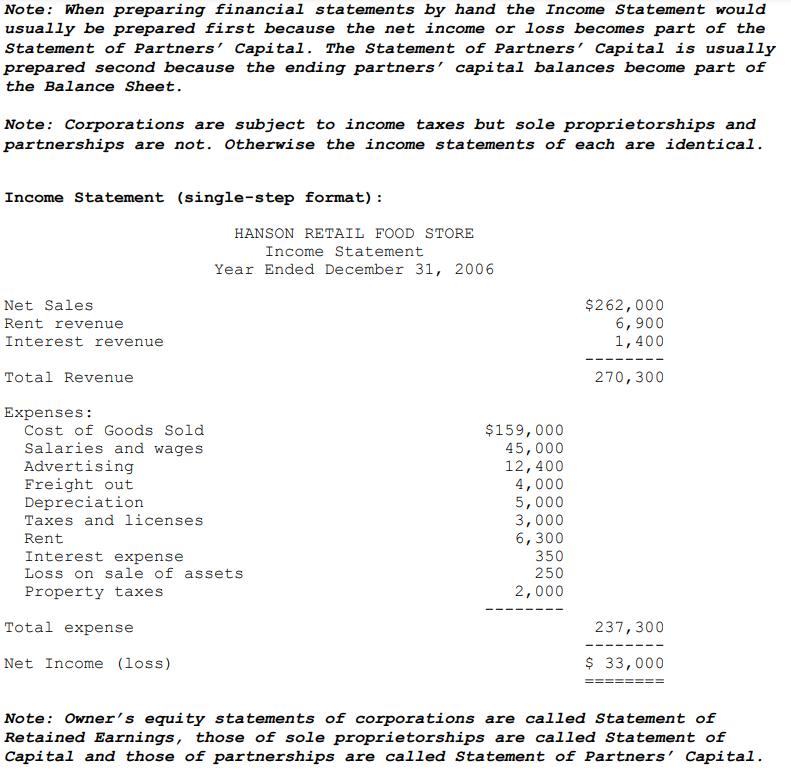

Note: When preparing financial statements by hand the Income Statement would usually be prepared first because the net income or loss becomes part of the Statement of Partners' Capital. The Statement of Partners' Capital is usually prepared second because the ending partners' capital balances become part of the Balance Sheet. Note: Corporations are subject to income taxes but sole proprietorships and partnerships are not. Otherwise the income statements of each are identical. Income Statement (single-step format): Net Sales. Rent revenue Interest revenue Total Revenue Expenses: Cost of Goods Sold Salaries and wages. Advertising Freight out Depreciation Taxes and licenses Rent HANSON RETAIL FOOD STORE Income Statement Year Ended December 31, 2006 Interest expense Loss on sale of assets Property taxes Total expense Net Income (loss). $159,000 45,000 12,400 4,000 5,000 3,000 6,300 350 250 2,000 $262,000 6,900 1,400 270,300 237,300 $ 33,000 Note: Owner's equity statements of corporations are called Statement of Retained Earnings, those of sole proprietorships are called Statement of Capital and those of partnerships are called Statement of Partners' Capital.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started