complete a trial balance

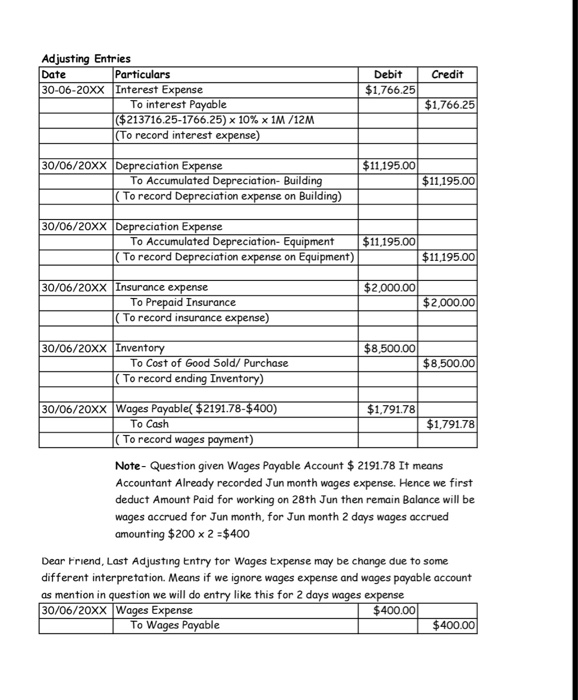

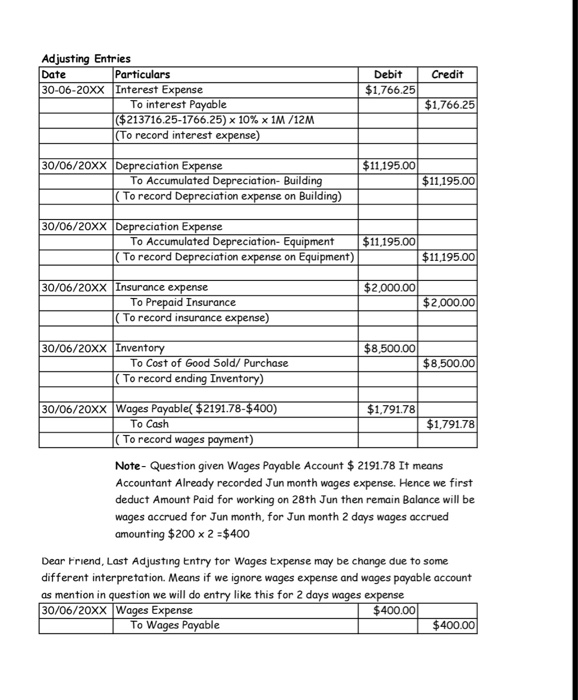

Credit Debit $1,766.25 Adjusting Entries Date Particulars 30-06-20XX Interest Expense To interest Payable ($213716.25-1766.25) 10% x 1M /12M I(To record interest expense) $1,766,25 $11.195.00 30/06/20XX Depreciation Expense To Accumulated Depreciation- Building To record Depreciation expense on Building) $11,195.00 30/06/20XX Depreciation Expense To Accumulated Depreciation Equipment (To record Depreciation expense on Equipment) $11,195,00 $11,195.00 $2,000.00 30/06/20XX Insurance expense To Prepaid Insurance (To record insurance expense) $2,000.00 $8.500.00 30/06/20XX Inventory To Cost of Good Sold/ Purchase (To record ending Inventory) $8,500.00 $1.791.78 30/06/20XX Wages Payable( $2191.78-$400) To Cash (To record wages payment) $1,791.78 Note - Question given Wages Payable Account $ 2191.78 It means Accountant Already recorded Jun month wages expense. Hence we first deduct Amount Paid for working on 28th Jun then remain Balance will be wages accrued for Jun month, for Jun month 2 days wages accrued amounting $200 x 2 = $400 Dear Friend, Last Adjusting entry for Wages Expense may be change due to some different interpretation. Means if we ignore wages expense and wages payable account as mention in question we will do entry like this for 2 days wages expense 30/06/20XX Wages Expense $400.00 To Wages Payable $400.00 Credit Debit $1,766.25 Adjusting Entries Date Particulars 30-06-20XX Interest Expense To interest Payable ($213716.25-1766.25) 10% x 1M /12M I(To record interest expense) $1,766,25 $11.195.00 30/06/20XX Depreciation Expense To Accumulated Depreciation- Building To record Depreciation expense on Building) $11,195.00 30/06/20XX Depreciation Expense To Accumulated Depreciation Equipment (To record Depreciation expense on Equipment) $11,195,00 $11,195.00 $2,000.00 30/06/20XX Insurance expense To Prepaid Insurance (To record insurance expense) $2,000.00 $8.500.00 30/06/20XX Inventory To Cost of Good Sold/ Purchase (To record ending Inventory) $8,500.00 $1.791.78 30/06/20XX Wages Payable( $2191.78-$400) To Cash (To record wages payment) $1,791.78 Note - Question given Wages Payable Account $ 2191.78 It means Accountant Already recorded Jun month wages expense. Hence we first deduct Amount Paid for working on 28th Jun then remain Balance will be wages accrued for Jun month, for Jun month 2 days wages accrued amounting $200 x 2 = $400 Dear Friend, Last Adjusting entry for Wages Expense may be change due to some different interpretation. Means if we ignore wages expense and wages payable account as mention in question we will do entry like this for 2 days wages expense 30/06/20XX Wages Expense $400.00 To Wages Payable $400.00

complete a trial balance

complete a trial balance