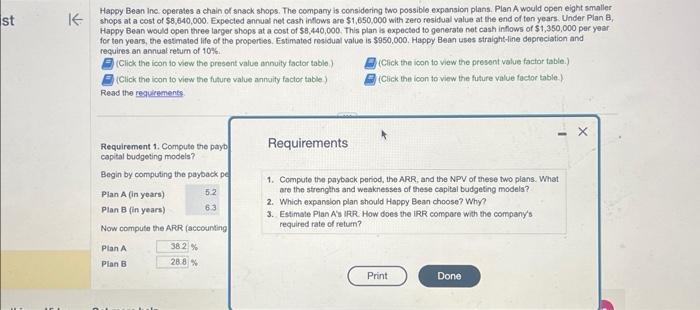

complete all questions within the requirements listed in image (1) thannk you!

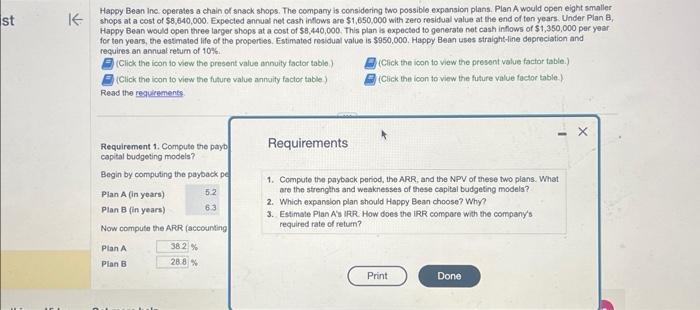

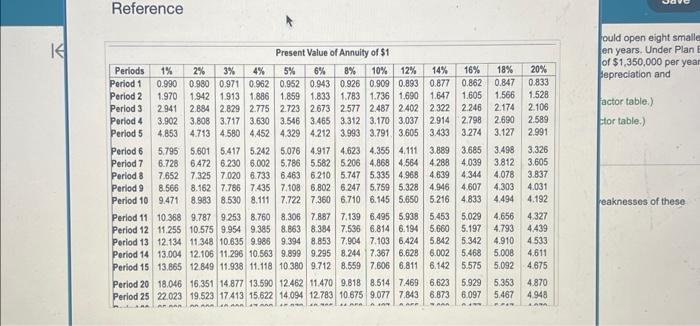

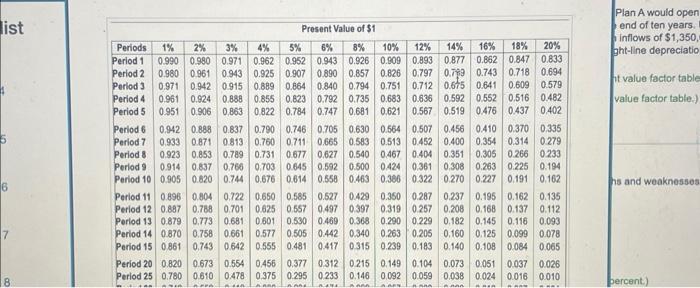

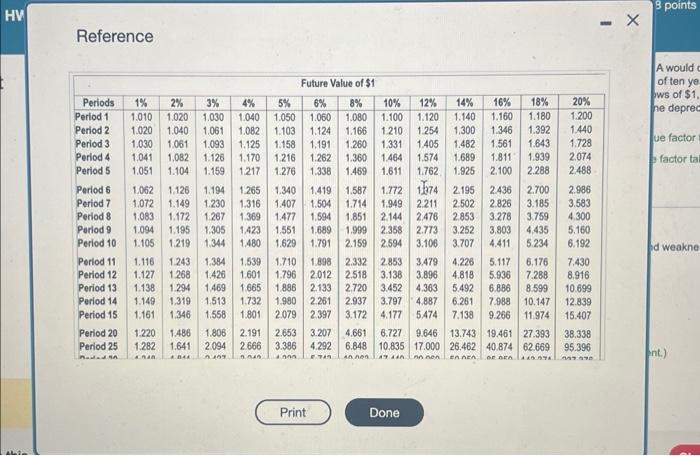

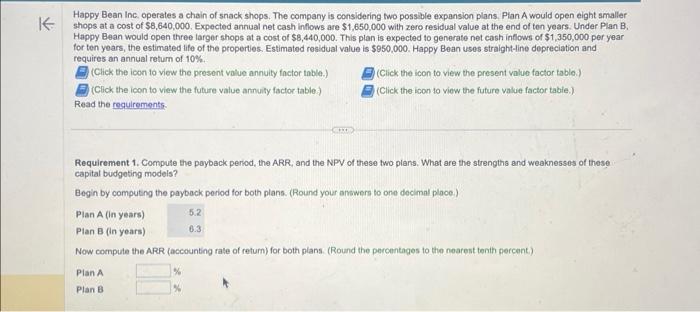

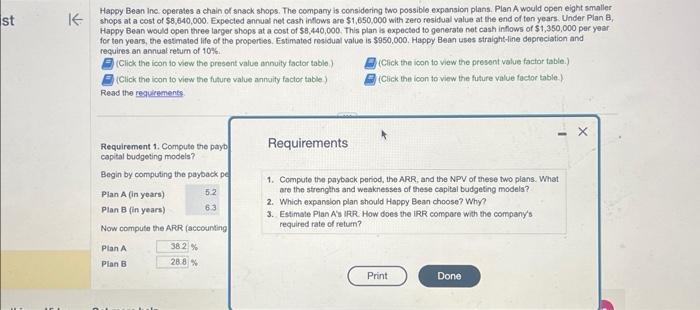

Hapoy Bean inc operates a chain of snack shops. The company is considering two possible expansion plans. Plan A would open eight smaller shops at a cost of $8,640,000. Expected annua net cash inflows are $1,650,000 with zero residual value at the end of ton years. Under Plan 8 , Happy Bean would open three larger shops at a cost of $8,440,000. This plan is expected to generate not cash inflows of $1,350,000 per year for ten years, the estimated life of the propertes. Estimated residual value is $950,000. Happy Bean uses straight-line depreciation and requires an annual resum of 10%. (Click the icon to view the present value annuity factor table.) (Click the icon to view the presont value factor tabie.) (Click the icon to view the fulure value annoity faclor table) (Cick the icon to view the future value factior table.) Read the regulements. Requirement 1. Computo the payt capital budgeting models? Begin by computing the payback pe Plan A (in years) Plan B (in years) Now compute the AFR (accounting Requirements 1. Compute the payback poriod, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgeting models? 2. Which expansion plan should Happy Bean choose? Why? 3. Estimale Plan A 's IRR. How does the IRR compore with the company's required rate of retum? Reference ould open eight smalle en years. Under Plan of $1,350,000 per yea lepreciation and actor tabie.) ftor table.) on list Plan A would open end of ten years. inflows of $1,350. ght-line depreciatio it value factor table value factor table.) Reference Happy Bean inc, operates a chain of snack shops. The company is considering wo possible expansion plans. Plan A would open eight smaller shops at a cost of $8,640,000. Expected annual net cash intlows are $1,650,000 with zere residual value at the end of ton years. Under Plan B. Happy Bean would open three larger shops at a cost of $8,440,000. This plan is expected to generate net cash inflows of $1,350,000 per year for ten years, the estimated life of the properties. Estimated residual value is $950,000. Happy Bean uses straight-line depreciation and requires an annual return of 10%. (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) (Click the icon to view the future value annuily factor table-) (Click the icon to view the future value factor tabie.) Read the reguiremonts: Requirement 1. Compute the payback period, the ARR, and the NPV of these two plans. What are the strengths and weaknesses of these capital budgoting models? Begin by computing the paybock poriod for both plans. (Round your answers to one decimal place) Now compute the ARR (accounting rale of return) for both plans. (Round the percontages to the nearest tenth percent) Pian A Plan B