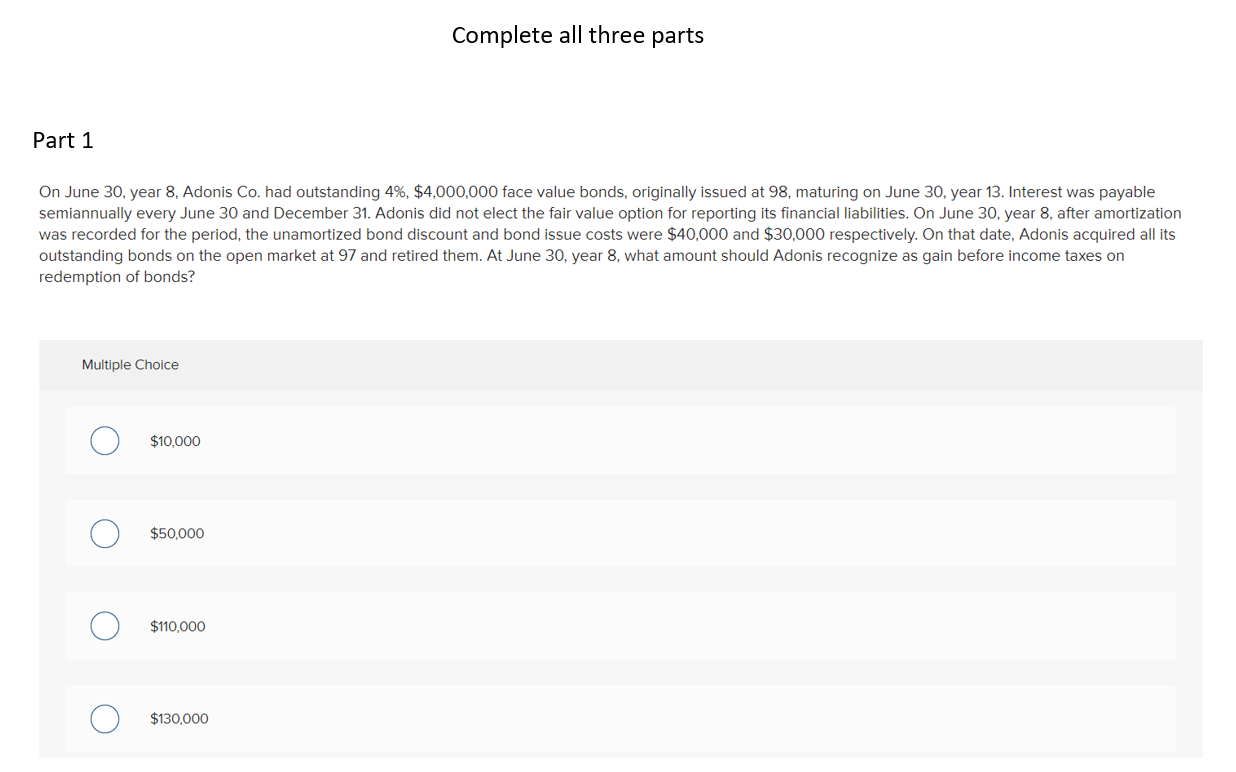

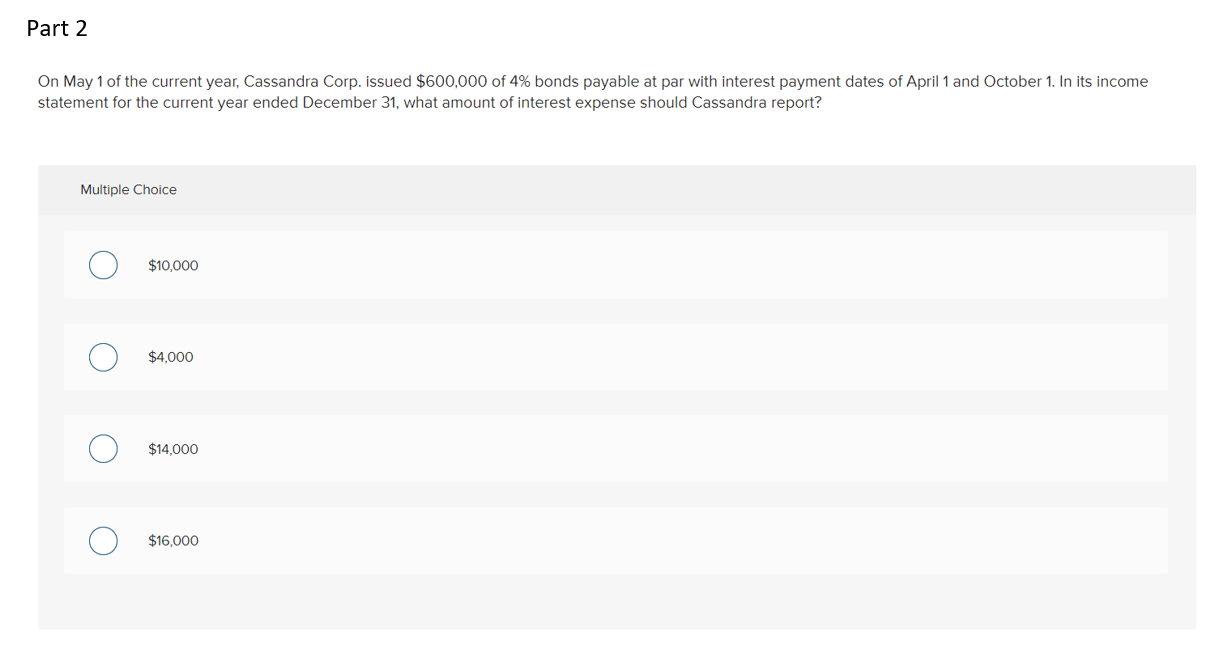

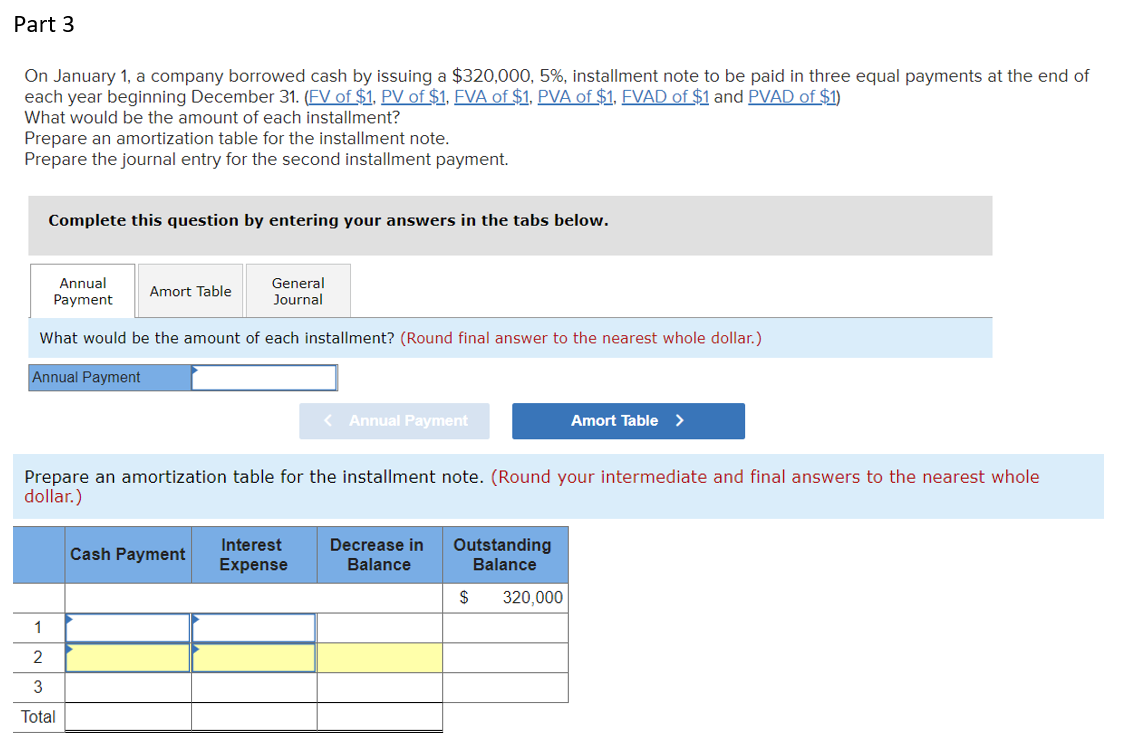

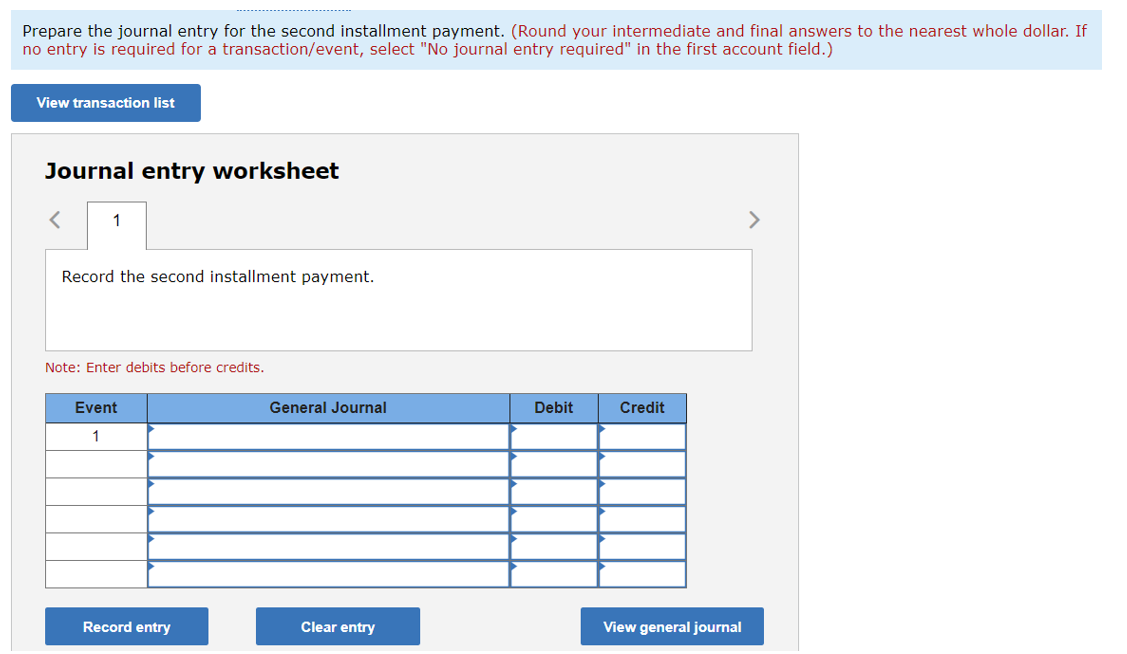

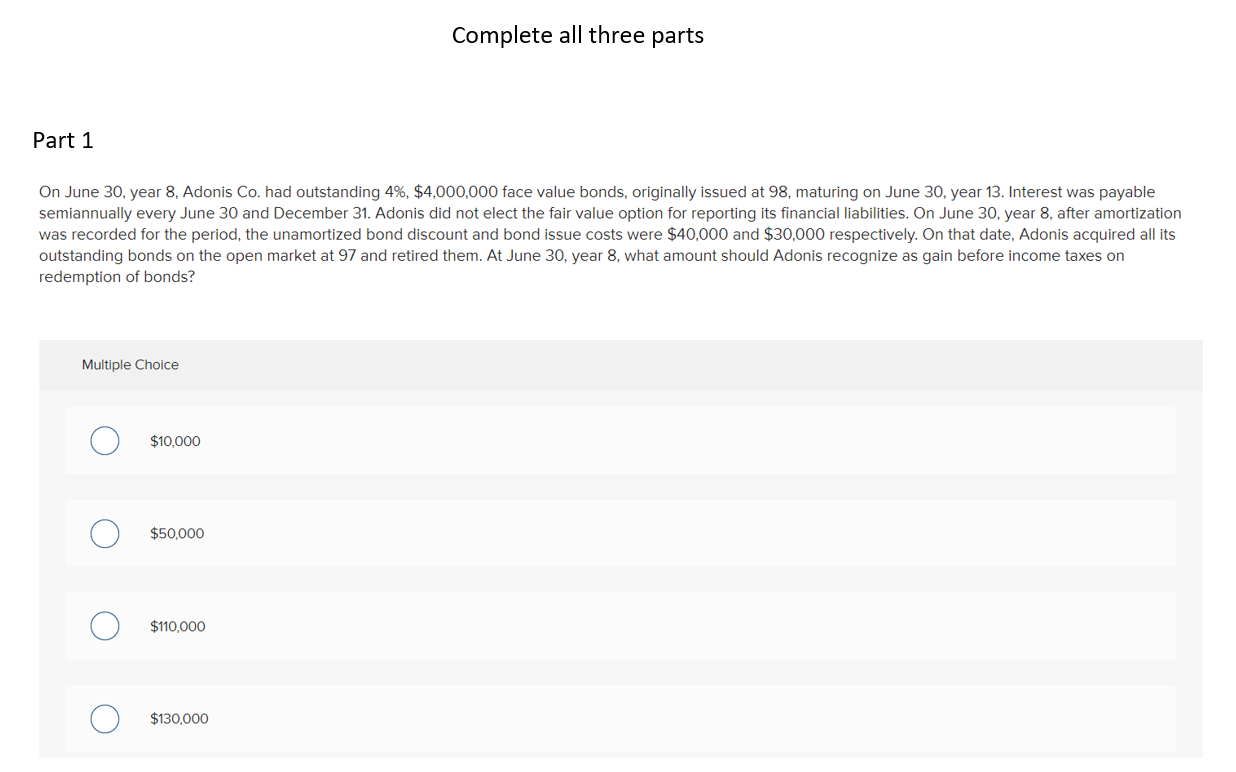

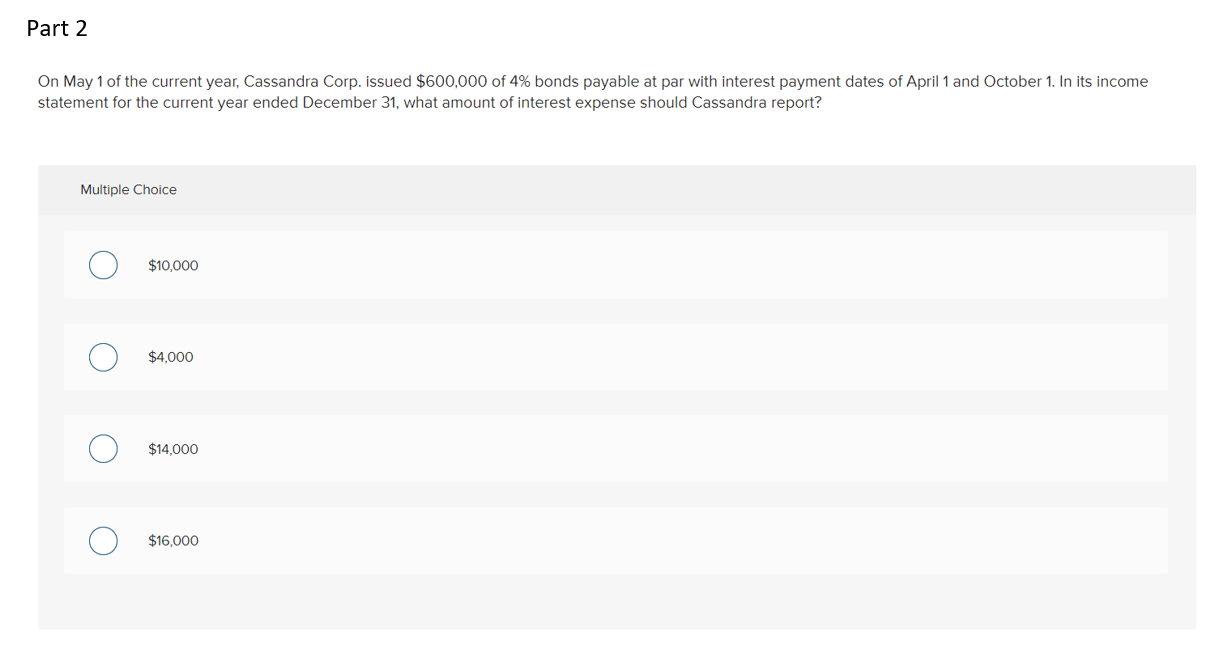

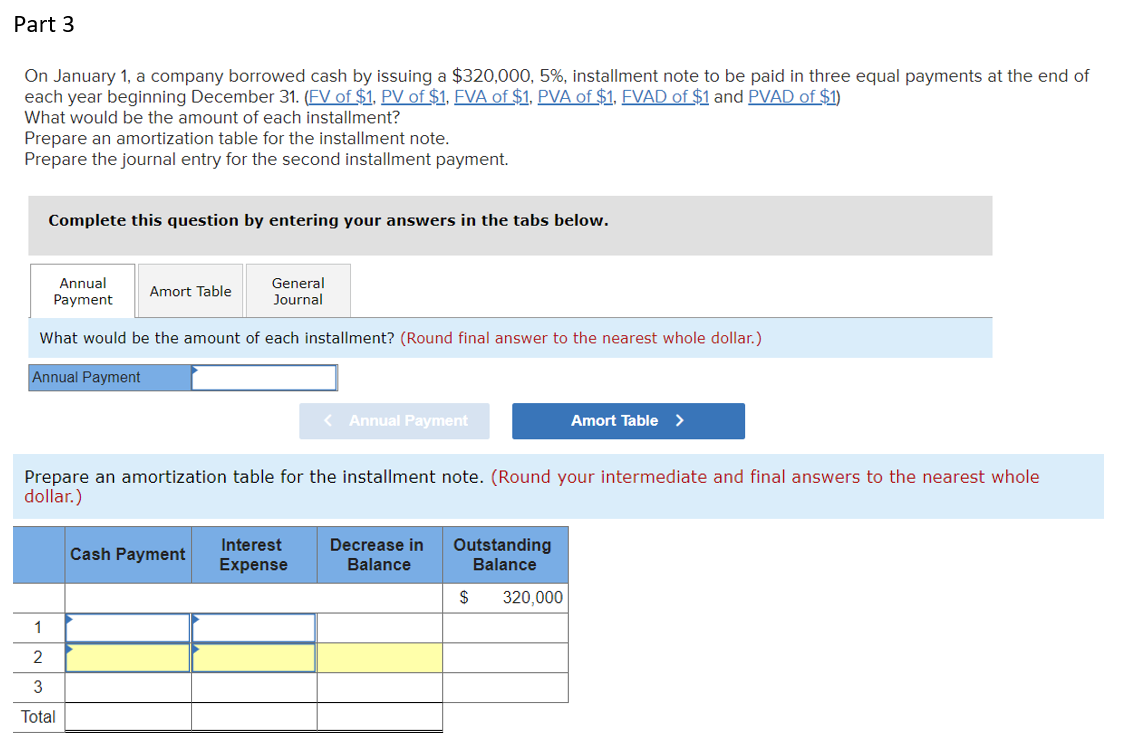

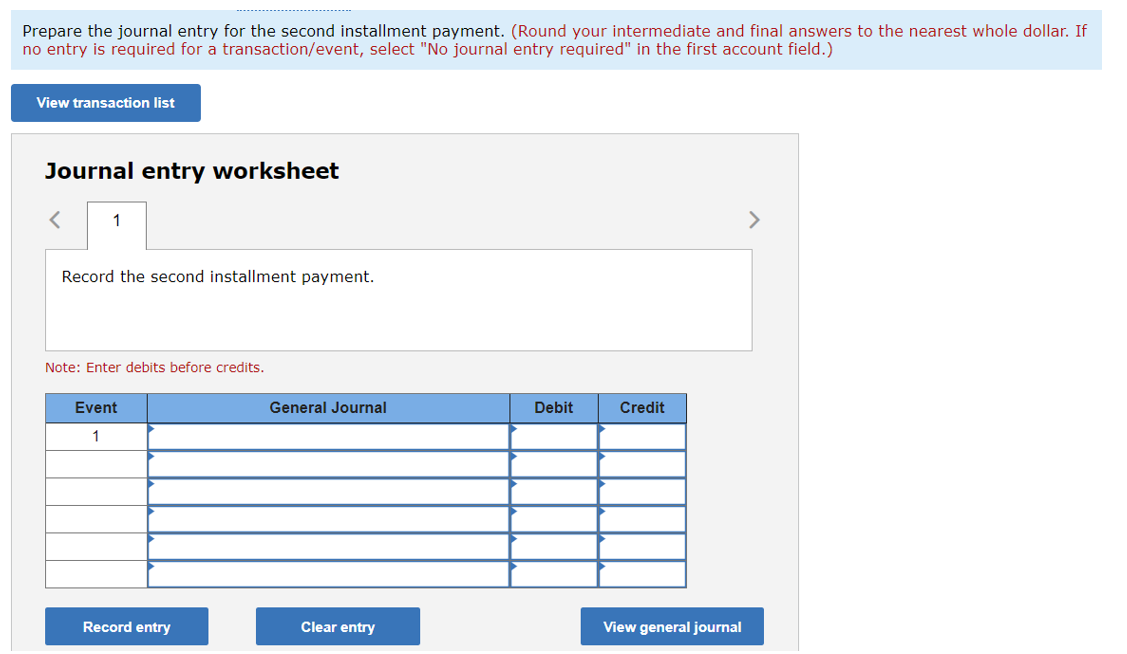

Complete all three parts Part 1 On June 30, year 8, Adonis Co. had outstanding 4%, $4,000,000 face value bonds, originally issued at 98, maturing on June 30, year 13. Interest was payable semiannually every June 30 and December 31. Adonis did not elect the fair value option for reporting its financial liabilities. On June 30, year 8, after amortization was recorded for the period, the unamortized bond discount and bond issue costs were $40,000 and $30,000 respectively. On that date, Adonis acquired all its outstanding bonds on the open market at 97 and retired them. At June 30, year 8, what amount should Adonis recognize as gain before income taxes on redemption of bonds? Multiple Choice $10,000 O O $50,000 $110,000 O O O $130,000 Part 2 On May 1 of the current year, Cassandra Corp. issued $600,000 of 4% bonds payable at par with interest payment dates of April 1 and October 1. In its income statement for the current year ended December 31, what amount of interest expense should Cassandra report? Multiple Choice $10,000 $4,000 $14,000 O O $16,000 Part 3 On January 1, a company borrowed cash by issuing a $320,000, 5%, installment note to be paid in three equal payments at the end of each year beginning December 31. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) What would be the amount of each installment? Prepare an amortization table for the installment note. Prepare the journal entry for the second installment payment. Complete this question by entering your answers in the tabs below. Annual Payment Amort Table General Journal What would be the amount of each installment? (Round final answer to the nearest whole dollar.) Annual Payment Annual Payment Amort Table > Prepare an amortization table for the installment note. (Round your intermediate and final answers to the nearest whole dollar.) Cash Payment Interest Expense Decrease in Balance Outstanding Balance $ 320,000 1 2 3 Total Prepare the journal entry for the second installment payment. (Round your intermediate and final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the second installment payment. Note: Enter debits before credits. Event General Journal Debit Credit 1 Record entry Clear entry View general journal