Answered step by step

Verified Expert Solution

Question

1 Approved Answer

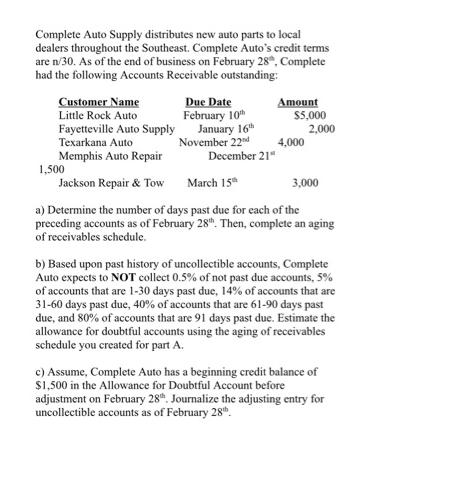

Complete Auto Supply distributes new auto parts to local dealers throughout the Southeast. Complete Auto's credit terms are n/30. As of the end of

Complete Auto Supply distributes new auto parts to local dealers throughout the Southeast. Complete Auto's credit terms are n/30. As of the end of business on February 28, Complete had the following Accounts Receivable outstanding: Customer Name Little Rock Auto Due Date February 10th January 16th November 22nd 1,500 December 21" Amount Fayetteville Auto Supply Texarkana Auto Memphis Auto Repair Jackson Repair & Tow 3,000 a) Determine the number of days past due for each of the preceding accounts as of February 28th. Then, complete an aging of receivables schedule. March 15 $5,000 2,000 4,000 b) Based upon past history of uncollectible accounts, Complete Auto expects to NOT collect 0.5% of not past due accounts, 5% of accounts that are 1-30 days past due, 14% of accounts that are 31-60 days past due, 40% of accounts that are 61-90 days past due, and 80% of accounts that are 91 days past due. Estimate the allowance for doubtful accounts using the aging of receivables schedule you created for part A. c) Assume, Complete Auto has a beginning credit balance of $1,500 in the Allowance for Doubtful Account before adjustment on February 28th. Journalize the adjusting entry for uncollectible accounts as of February 28th

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Customer Name Due Date Days Past Due Amount Little Rock Auto February 10th 18 5000 Texarkana Auto ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started