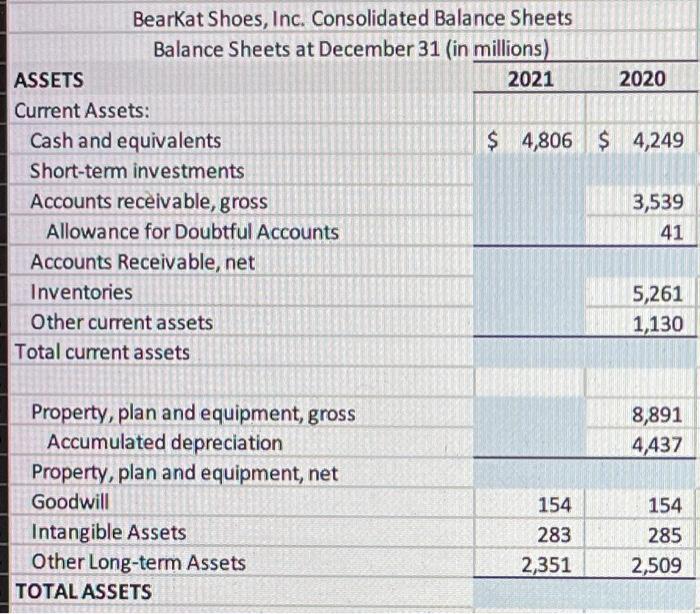

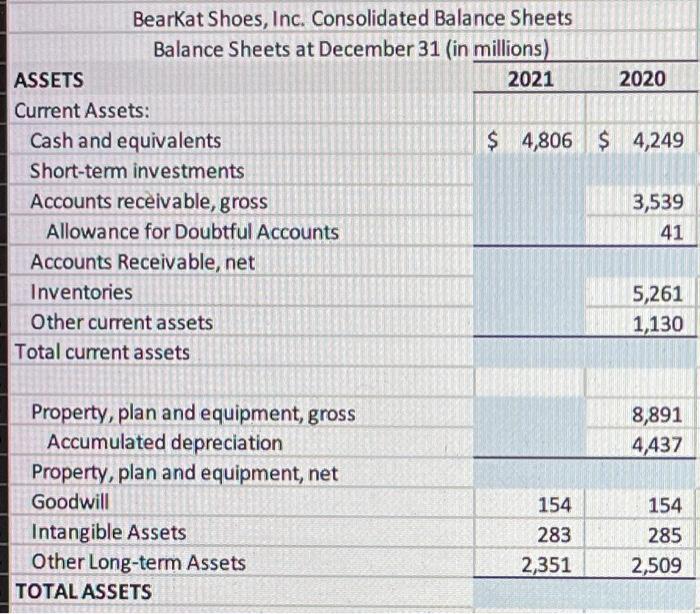

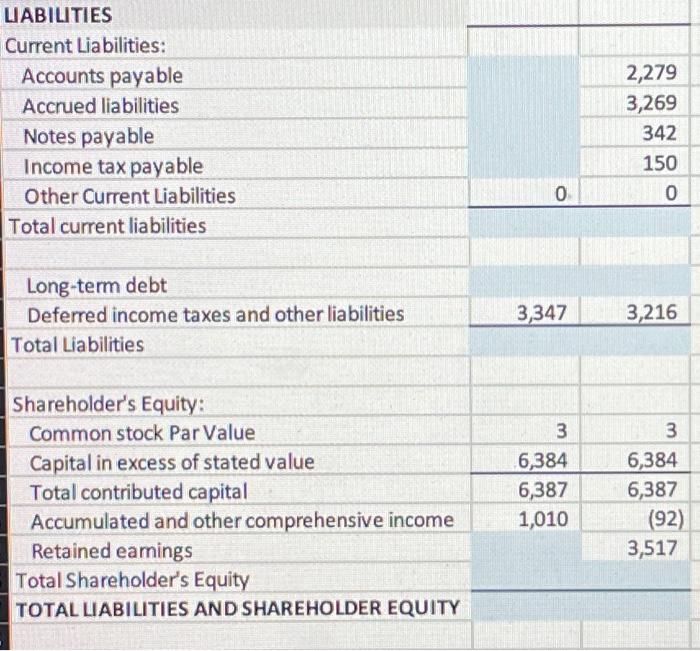

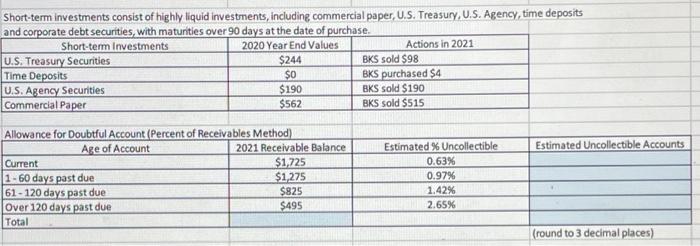

Complete blue shaded cells. please give detail to how it was solved. thanks

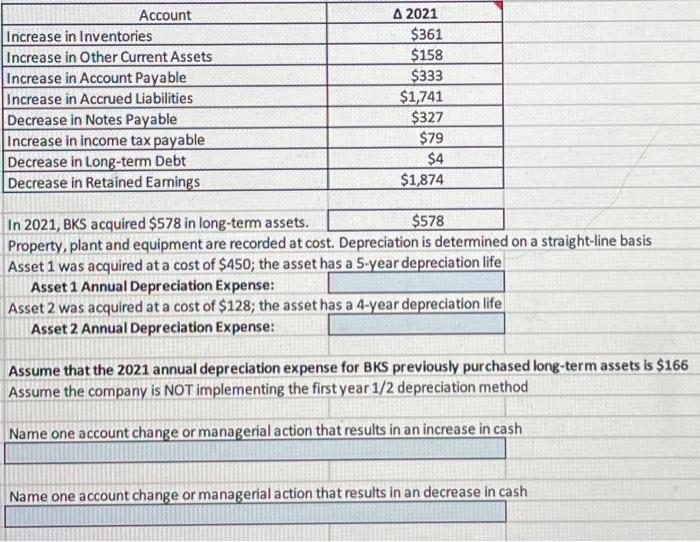

Bearkat Shoes, Inc. Consolidated Balance Sheets Balance Sheets at December 31 (in millions) ASSETS 2021 2020 Current Assets: Cash and equivalents $ 4,806 $4,249 Short-term investments Accounts receivable, gross 3,539 Allowance for Doubtful Accounts 41 Accounts Receivable, net Inventories 5,261 Other current assets 1,130 Total current assets 8,891 4,437 Property, plan and equipment, gross Accumulated depreciation Property, plan and equipment, net Goodwill Intangible Assets Other Long-term Assets TOTAL ASSETS 154 283 2,351 154 285 2,509 LIABILITIES Current Liabilities: Accounts payable Accrued liabilities Notes payable Income tax payable Other Current Liabilities Total current liabilities 2,279 3,269 342 150 0 0 Long-term debt Deferred income taxes and other liabilities Total Liabilities 3,347 3,216 3 Shareholder's Equity: Common stock Par Value Capital in excess of stated value Total contributed capital Accumulated and other comprehensive income Retained eamings Total Shareholder's Equity TOTAL LIABILITIES AND SHAREHOLDER EQUITY 6,384 6,387 1,010 3 6,384 6,387 (92) 3,517 Short-term investments consist of highly liquid investments, including commercial paper, U.S. Treasury, U.S. Agency, time deposits and corporate debt securities, with maturities over 90 days at the date of purchase. Short-term Investments 2020 Year End Values Actions in 2021 U.S. Treasury Securities $244 BKS sold $98 Time Deposits $0 BKS purchased $4 U.S. Agency Securities $190 BKS sold $190 Commercial Paper $562 BKS sold $515 Estimated Uncollectible Accounts Allowance for Doubtful Account (Percent of Receivables Method) Age of Account 2021 Receivable Balance Current $1,225 1-60 days past due $1,275 61 - 120 days past due $825 Over 120 days past due $495 Total Estimated % Uncollectible 0.63% 0.97% 1.42% 2.65% (round to 3 decimal places) Account Increase in Inventories Increase in Other Current Assets Increase in Account Payable Increase in Accrued Liabilities Decrease in Notes Payable Increase in income tax payable Decrease in Long-term Debt Decrease in Retained Earnings A 2021 $361 $158 $333 $1,741 $327 $79 $4 $1,874 In 2021, BKS acquired $578 in long-term assets. $578 Property, plant and equipment are recorded at cost. Depreciation is determined on a straight-line basis Asset 1 was acquired at a cost of $450; the asset has a 5-year depreciation life Asset 1 Annual Depreciation Expense: Asset 2 was acquired at a cost of $128; the asset has a 4-year depreciation life Asset 2 Annual Depreciation Expense: Assume that the 2021 annual depreciation expense for BKS previously purchased long-term assets is $166 Assume the company is NOT implementing the first year 1/2 depreciation method Name one account change or managerial action that results in an increase in cash Name one account change or managerial action that results in an decrease in cash Bearkat Shoes, Inc. Consolidated Balance Sheets Balance Sheets at December 31 (in millions) ASSETS 2021 2020 Current Assets: Cash and equivalents $ 4,806 $4,249 Short-term investments Accounts receivable, gross 3,539 Allowance for Doubtful Accounts 41 Accounts Receivable, net Inventories 5,261 Other current assets 1,130 Total current assets 8,891 4,437 Property, plan and equipment, gross Accumulated depreciation Property, plan and equipment, net Goodwill Intangible Assets Other Long-term Assets TOTAL ASSETS 154 283 2,351 154 285 2,509 LIABILITIES Current Liabilities: Accounts payable Accrued liabilities Notes payable Income tax payable Other Current Liabilities Total current liabilities 2,279 3,269 342 150 0 0 Long-term debt Deferred income taxes and other liabilities Total Liabilities 3,347 3,216 3 Shareholder's Equity: Common stock Par Value Capital in excess of stated value Total contributed capital Accumulated and other comprehensive income Retained eamings Total Shareholder's Equity TOTAL LIABILITIES AND SHAREHOLDER EQUITY 6,384 6,387 1,010 3 6,384 6,387 (92) 3,517 Short-term investments consist of highly liquid investments, including commercial paper, U.S. Treasury, U.S. Agency, time deposits and corporate debt securities, with maturities over 90 days at the date of purchase. Short-term Investments 2020 Year End Values Actions in 2021 U.S. Treasury Securities $244 BKS sold $98 Time Deposits $0 BKS purchased $4 U.S. Agency Securities $190 BKS sold $190 Commercial Paper $562 BKS sold $515 Estimated Uncollectible Accounts Allowance for Doubtful Account (Percent of Receivables Method) Age of Account 2021 Receivable Balance Current $1,225 1-60 days past due $1,275 61 - 120 days past due $825 Over 120 days past due $495 Total Estimated % Uncollectible 0.63% 0.97% 1.42% 2.65% (round to 3 decimal places) Account Increase in Inventories Increase in Other Current Assets Increase in Account Payable Increase in Accrued Liabilities Decrease in Notes Payable Increase in income tax payable Decrease in Long-term Debt Decrease in Retained Earnings A 2021 $361 $158 $333 $1,741 $327 $79 $4 $1,874 In 2021, BKS acquired $578 in long-term assets. $578 Property, plant and equipment are recorded at cost. Depreciation is determined on a straight-line basis Asset 1 was acquired at a cost of $450; the asset has a 5-year depreciation life Asset 1 Annual Depreciation Expense: Asset 2 was acquired at a cost of $128; the asset has a 4-year depreciation life Asset 2 Annual Depreciation Expense: Assume that the 2021 annual depreciation expense for BKS previously purchased long-term assets is $166 Assume the company is NOT implementing the first year 1/2 depreciation method Name one account change or managerial action that results in an increase in cash Name one account change or managerial action that results in an decrease in cash