Answered step by step

Verified Expert Solution

Question

1 Approved Answer

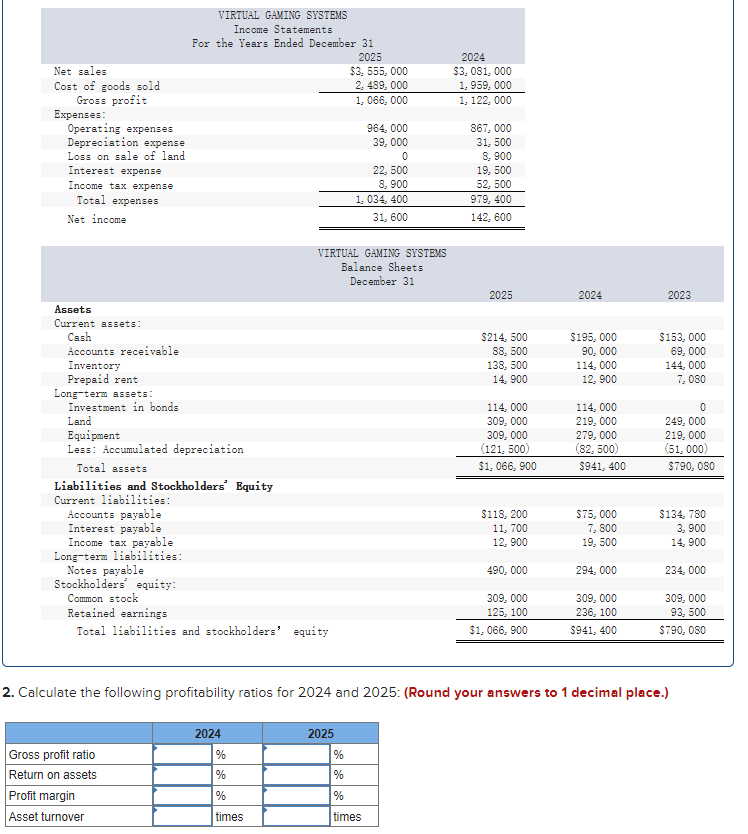

Complete both tables VIRTUAL GAMING SYSTEMS Income Statements For the Years Ended December 31 2025 $3, 555, 000 2, 489, 000 1. 066, 000 964,

Complete both tables

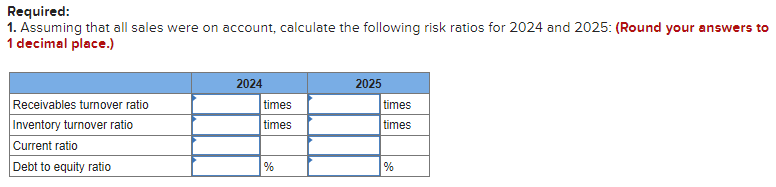

VIRTUAL GAMING SYSTEMS Income Statements For the Years Ended December 31 2025 $3, 555, 000 2, 489, 000 1. 066, 000 964, 000 39, 000 0 22, 500 8,900 1, 034, 400 31, 600 VIRTUAL GAMING SYSTEMS Balance Sheets December 31 2024 $3,081, 000 1,959, 000 1, 122, 000 867, 000 31, 500 8, 900 19, 500 52, 500 979, 400 142, 600 2025 2024 Assets Current assets: Cash $195, 000 Accounts receivable $214, 500 88, 500 90, 000 Inventory 138, 500 114, 000 Prepaid rent 14, 900 12, 900 Long-term assets: Investment in bonds. 114, 000 114, 000 Land 309, 000 219, 000 Equipment 309, 000 279, 000 Less: Accumulated depreciation (121, 500) (82, 500) Total assets $1,066, 900 $941, 400 Liabilities and Stockholders' Equity Current liabilities: Accounts payable $118, 200 $75,000 $134, 780 Interest payable 11, 700 7,800 3, 900 12, 900 19, 500 14, 900 Income tax payable Long-term liabilities: 490, 000 294, 000 234, 000 Notes payable Stockholders equity: Common stock 309, 000 309, 000 309,000 Retained earnings 125, 100 236, 100 93, 500 Total liabilities and stockholders' equity $1,066, 900 $941, 400 $790, 080 2. Calculate the following profitability ratios for 2024 and 2025: (Round your answers to 1 decimal place.) 2024 2025 Gross profit ratio Return on assets Profit margin Asset turnover Net sales Cost of goods sold Gross profit Expenses: Operating expenses Depreciation expense Loss on sale of land. Interest expense Income tax expense Total expenses Net income % % % times % % % times 2023 $153, 000 69,000 144, 000 7, 080 0 249,000 219,000 (51, 000) $790, 080 Required: 1. Assuming that all sales were on account, calculate the following risk ratios for 2024 and 2025: (Round your answers to 1 decimal place.) 2024 2025 Receivables turnover ratio times Inventory turnover ratio times Current ratio Debt to equity ratio % times times %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started