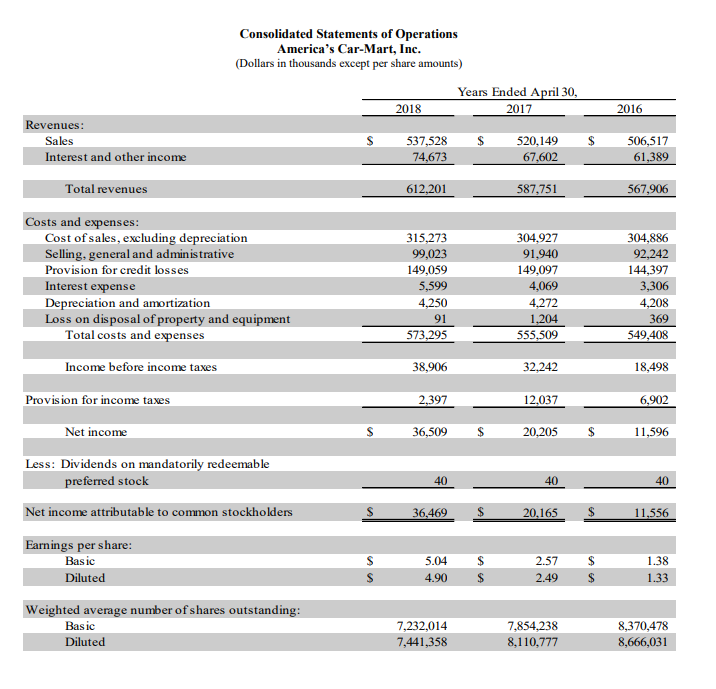

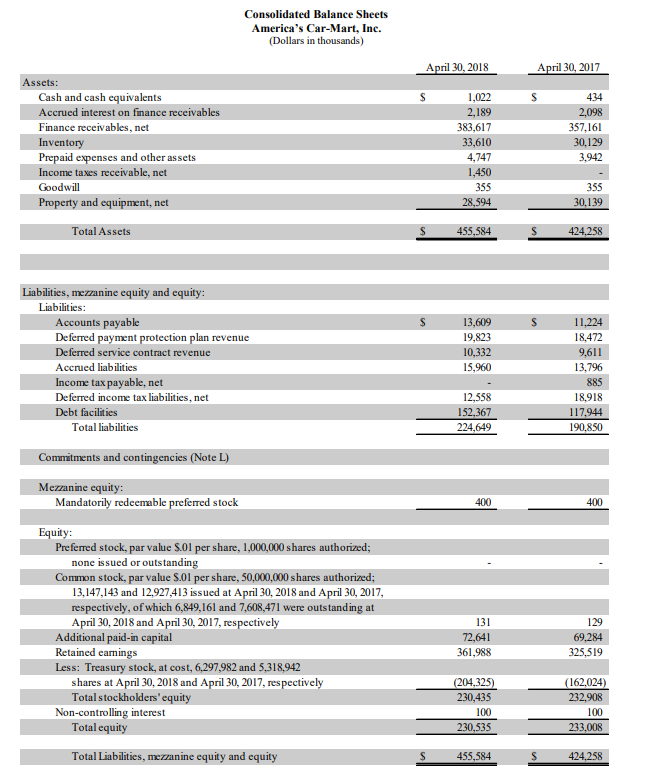

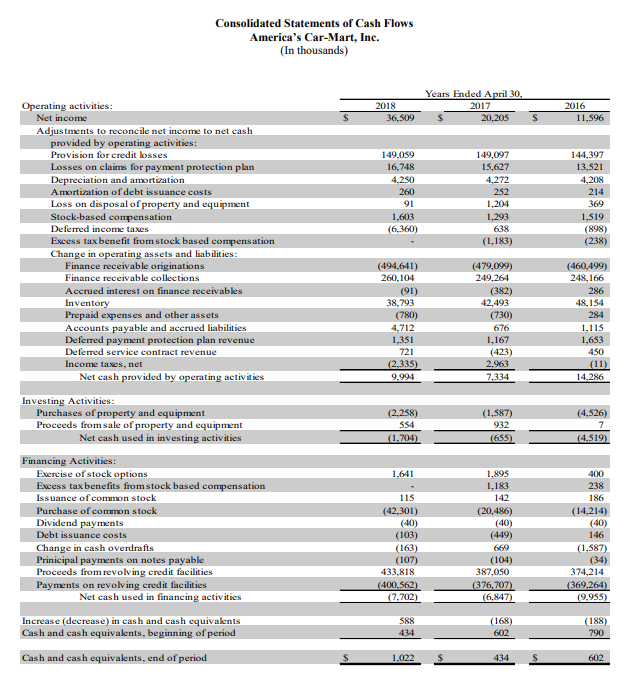

Complete comprehensive ratio analysis ( debt-to-equity, asset-to-equity ratio and current ratio) for the three years.

Data:

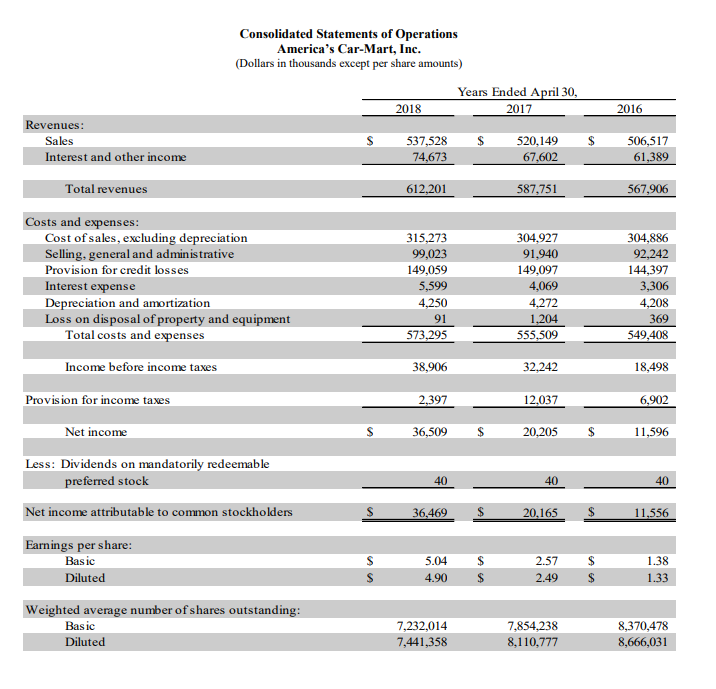

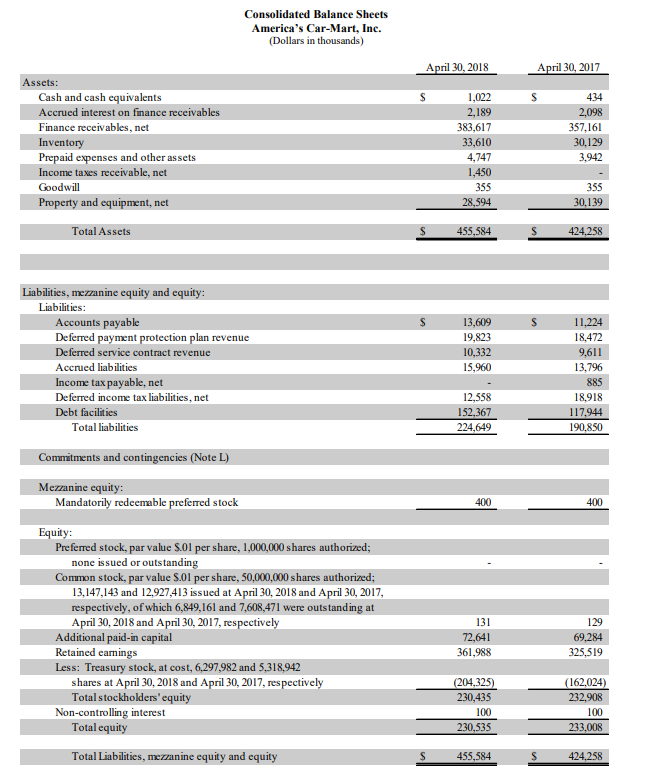

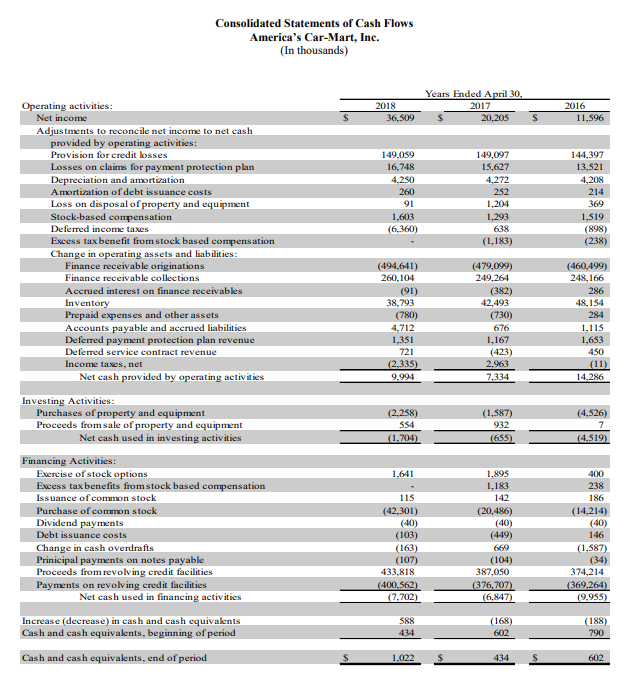

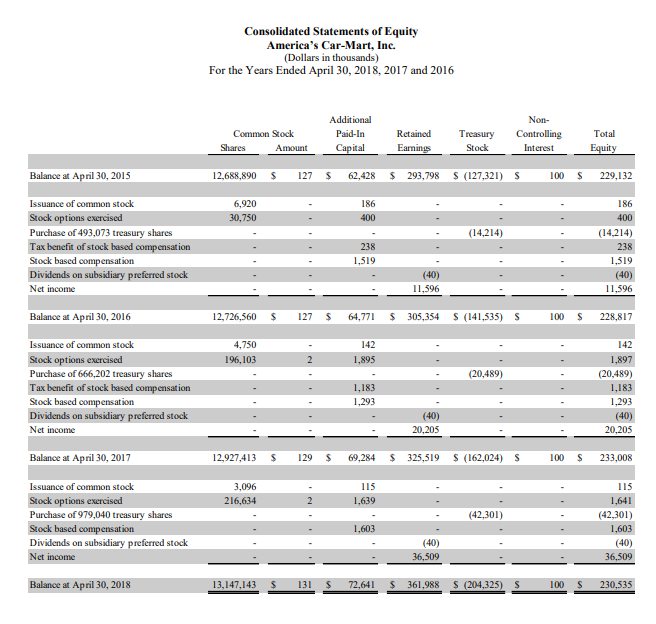

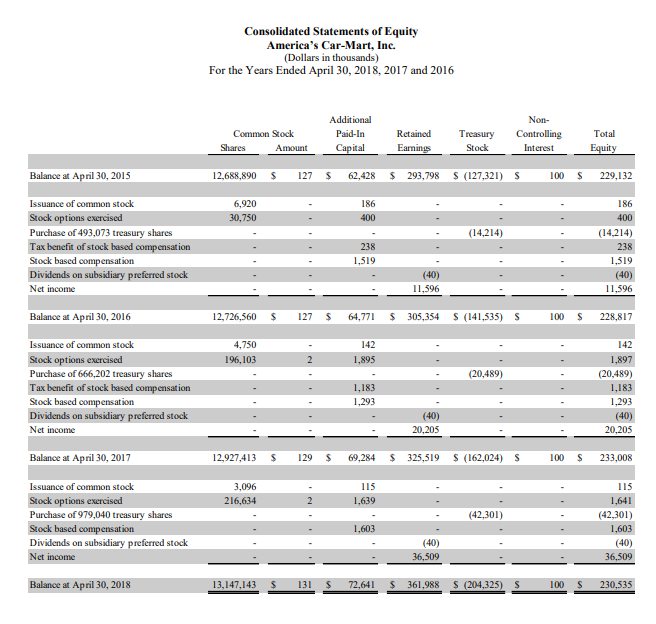

Consolidated Statements of Operations America's Car-Mart, Inc Dollars in thousands except per share amounts) Years Ended April 30 2017 2018 2016 Revenues: Sales Interest and other income 37,528S 520,149 S506,517 61,389 74,673 67 Total revenues 612,201 587,751 567,906 Costs and expenses 304,886 92,242 144,397 Cost of sales, excluding depreciation Selling, general and adminis trative Provision for credit losses Interest expense Depreciation and amortization Loss on disposal of property and equipment 315,273 99,023 149,059 5,599 4,250 304,927 91,940 149,097 4,069 4272 4,208 369 549.408 Total costs and expenses 573,295 38,906 2,397 6,509S 555,509 Income before income taxes 32,242 18,498 Provision for income taxes 12.037 6,902 Net income 20.205S 11,596 Less: Dividends on mandato redeemable preferred stock 40 40 40 Net income attributable to common stockholden 36462 S 20.165 -556 $ Earnings per share Basic Diluted 2.57 S 2.49 1.38 1.33 5.04 Weighted average number ofshares outstanding Bas ic Diluted 7,232,014 7,441,358 7,854,238 8,110,777 8,370,478 8,666,031 Consolidated Balance Sheets America's Car-Mart, Inc. (Dollars in thousands) April 30, 2018 April 30, 2017 Cash and cash equivalents Accrued interest on finance receivables Finance receivables, net Inventory Prepaid expenses and other assets Income taxes receivable, net Goodwill Property and equipment, net 1,022 2,189 383,617 610 4,747 1,450 355 28,594 434 2,098 357,161 3,942 355 Total Assets 455,584 424.258 Liabilities, mezzanine equity and equity: Liabilities Accounts payable Deferred payment protection plan revenue Deferred service contract revenue Accrued liabilities Income tax payable, net Deferred income tax liabilities, net Debt facilities 13,609 19,823 10,332 15,960 11,224 18,472 9,611 13,796 885 18,918 17,944 90.850 12,558 152,367 224,649 Total liabilities Commitments and contingencies (Note L) Mezzanine equity Mandatorily redeemable preferred stock Equity: Preferred stock, par value S.01 per share, 1,000,000 shares auth none is sued or outstanding Common stock, par value S.01 per share, 50,000,000 shares authorized; 13,147,143 and 12,927413 issued at April 30, 2018 and April 30, 2017 respectively, of which 6,849,161 and 7,608,471 were outstanding at April 30, 2018 and April 30, 2017, respectivey Additional paid-in capital Retained eanings Less: Treasury stock, at cost, 6,297,982 and 5,318,942 131 72,641 361,988 129 69,284 325,519 shares at April 30, 2018 and April 30, 2017, respectively Total stockholders'equity Total equity Total Liabilities, mezzanine equity and equity 230,435 100 535 232,908 100 233,008 Non-controlling interest 455,584 Consolidated Statements of Cash Flows America's Car-Mart, Inc. (In thousands) Years Ended April Operating activities 36,509 S 20,205 S Adjustments to reconcile net income to net cash provided by operating Provision for eredit losses 149,097 15,627 144,397 13,521 149.059 Depreciation and amortization 4.250 Amortization of debt issuance costs 214 Loss on disposal of property and equipment 1,204 1,603 (6.360) Defered income taxes Excess tax benefit from stock based c Change in operating 638 (1,183) (898) assets and liabilities Finance receivable originations Finance receivable collections Accrued interest on finance receivables (494,641) 260,104 249,264 248,166 (382) 38,793 4.712 721 42,493 48,154 284 Prepaid expenses and other assets Accounts payable and accrued liabilities Deferred service contract revenue Income taxes, net 676 167 (423) 1,653 450 Net eash provided by operating activities 9.994 14,286 Investing Activities Purchases of property and equipment Proceeds fromsale of property and equipment (1,587) Net cash used in investing activities Evereise ofstock options Excess tax benefits from stock based compensation Iss uance of common stock Purchase of common stock Dividend payments Debt issuance costs Change in eash overdrafts Prinicipal payments on notes payable Proceeds fromrevolving credit facilities Payments on revolving credit facilities 1.641 1,895 183 142 400 186 (20,486) (40) (40) (40) 146 ( 163) (107) 433,818 669 (104) 387,050 74,214 Net cash used in finaneing activities 7.702 (6.847 9,955 188) Increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning ofperiod 434 602 Cash and cas h equivalents, end of period 1,022 S 434 S Consolidated Statements of Equity America's Car-Mart, Inc. (Dollars in thousands) For the Years Ended April 30, 2018, 2017 and 2016 Additional Paid-In Capital Non- Total Common Stock Shares Retained Earming Treasury Controlling Amount Stock Interest Balance at April 30, 2015 12,688,890 127 62,428 293,798 (127,32) S 100 229,132 6,920 30,750 186 400 186 Issuance of common stock Stock options exercised Purchase of 493,073 treasury shares Tax benefit of stock basc Stock based compensation Dividends on subsidiary preferred stock Net income (14,214) (14,214) 238 1,519 (40) 1,596 238 1,519 (40) 11,596 Balance at April 30, 2016 12,726,560 127 64,77 305,354 (4,53 S 100 228,817 142 4,750 196,103 142 Stock options exercised Purchase of 666,202 treasury shares Tax benefit of stock based compensation Stock based compensation Dividends on subsidiary preferred stock Net income (20,489) (20,489) 1,18 1,293 (40) 1,293 (40) Balance at April 30, 2017 12,927,413 129 S69,284 325,519 (162,024) S 100 233,008 Issuance of common stock Stock options exercised Purchase of 979,040 treasury shares Stock based compensation Dividends on subsidiary preferred stock 3,096 216,634 115 115 1,641 (42,301) (42,301) (40) (40) 36,509 36,509- Balance at April 30, 2018 3,147,143 131 S 72,641 S361,988 S (204,325) S100S230,535 Consolidated Statements of Operations America's Car-Mart, Inc Dollars in thousands except per share amounts) Years Ended April 30 2017 2018 2016 Revenues: Sales Interest and other income 37,528S 520,149 S506,517 61,389 74,673 67 Total revenues 612,201 587,751 567,906 Costs and expenses 304,886 92,242 144,397 Cost of sales, excluding depreciation Selling, general and adminis trative Provision for credit losses Interest expense Depreciation and amortization Loss on disposal of property and equipment 315,273 99,023 149,059 5,599 4,250 304,927 91,940 149,097 4,069 4272 4,208 369 549.408 Total costs and expenses 573,295 38,906 2,397 6,509S 555,509 Income before income taxes 32,242 18,498 Provision for income taxes 12.037 6,902 Net income 20.205S 11,596 Less: Dividends on mandato redeemable preferred stock 40 40 40 Net income attributable to common stockholden 36462 S 20.165 -556 $ Earnings per share Basic Diluted 2.57 S 2.49 1.38 1.33 5.04 Weighted average number ofshares outstanding Bas ic Diluted 7,232,014 7,441,358 7,854,238 8,110,777 8,370,478 8,666,031 Consolidated Balance Sheets America's Car-Mart, Inc. (Dollars in thousands) April 30, 2018 April 30, 2017 Cash and cash equivalents Accrued interest on finance receivables Finance receivables, net Inventory Prepaid expenses and other assets Income taxes receivable, net Goodwill Property and equipment, net 1,022 2,189 383,617 610 4,747 1,450 355 28,594 434 2,098 357,161 3,942 355 Total Assets 455,584 424.258 Liabilities, mezzanine equity and equity: Liabilities Accounts payable Deferred payment protection plan revenue Deferred service contract revenue Accrued liabilities Income tax payable, net Deferred income tax liabilities, net Debt facilities 13,609 19,823 10,332 15,960 11,224 18,472 9,611 13,796 885 18,918 17,944 90.850 12,558 152,367 224,649 Total liabilities Commitments and contingencies (Note L) Mezzanine equity Mandatorily redeemable preferred stock Equity: Preferred stock, par value S.01 per share, 1,000,000 shares auth none is sued or outstanding Common stock, par value S.01 per share, 50,000,000 shares authorized; 13,147,143 and 12,927413 issued at April 30, 2018 and April 30, 2017 respectively, of which 6,849,161 and 7,608,471 were outstanding at April 30, 2018 and April 30, 2017, respectivey Additional paid-in capital Retained eanings Less: Treasury stock, at cost, 6,297,982 and 5,318,942 131 72,641 361,988 129 69,284 325,519 shares at April 30, 2018 and April 30, 2017, respectively Total stockholders'equity Total equity Total Liabilities, mezzanine equity and equity 230,435 100 535 232,908 100 233,008 Non-controlling interest 455,584 Consolidated Statements of Cash Flows America's Car-Mart, Inc. (In thousands) Years Ended April Operating activities 36,509 S 20,205 S Adjustments to reconcile net income to net cash provided by operating Provision for eredit losses 149,097 15,627 144,397 13,521 149.059 Depreciation and amortization 4.250 Amortization of debt issuance costs 214 Loss on disposal of property and equipment 1,204 1,603 (6.360) Defered income taxes Excess tax benefit from stock based c Change in operating 638 (1,183) (898) assets and liabilities Finance receivable originations Finance receivable collections Accrued interest on finance receivables (494,641) 260,104 249,264 248,166 (382) 38,793 4.712 721 42,493 48,154 284 Prepaid expenses and other assets Accounts payable and accrued liabilities Deferred service contract revenue Income taxes, net 676 167 (423) 1,653 450 Net eash provided by operating activities 9.994 14,286 Investing Activities Purchases of property and equipment Proceeds fromsale of property and equipment (1,587) Net cash used in investing activities Evereise ofstock options Excess tax benefits from stock based compensation Iss uance of common stock Purchase of common stock Dividend payments Debt issuance costs Change in eash overdrafts Prinicipal payments on notes payable Proceeds fromrevolving credit facilities Payments on revolving credit facilities 1.641 1,895 183 142 400 186 (20,486) (40) (40) (40) 146 ( 163) (107) 433,818 669 (104) 387,050 74,214 Net cash used in finaneing activities 7.702 (6.847 9,955 188) Increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning ofperiod 434 602 Cash and cas h equivalents, end of period 1,022 S 434 S Consolidated Statements of Equity America's Car-Mart, Inc. (Dollars in thousands) For the Years Ended April 30, 2018, 2017 and 2016 Additional Paid-In Capital Non- Total Common Stock Shares Retained Earming Treasury Controlling Amount Stock Interest Balance at April 30, 2015 12,688,890 127 62,428 293,798 (127,32) S 100 229,132 6,920 30,750 186 400 186 Issuance of common stock Stock options exercised Purchase of 493,073 treasury shares Tax benefit of stock basc Stock based compensation Dividends on subsidiary preferred stock Net income (14,214) (14,214) 238 1,519 (40) 1,596 238 1,519 (40) 11,596 Balance at April 30, 2016 12,726,560 127 64,77 305,354 (4,53 S 100 228,817 142 4,750 196,103 142 Stock options exercised Purchase of 666,202 treasury shares Tax benefit of stock based compensation Stock based compensation Dividends on subsidiary preferred stock Net income (20,489) (20,489) 1,18 1,293 (40) 1,293 (40) Balance at April 30, 2017 12,927,413 129 S69,284 325,519 (162,024) S 100 233,008 Issuance of common stock Stock options exercised Purchase of 979,040 treasury shares Stock based compensation Dividends on subsidiary preferred stock 3,096 216,634 115 115 1,641 (42,301) (42,301) (40) (40) 36,509 36,509- Balance at April 30, 2018 3,147,143 131 S 72,641 S361,988 S (204,325) S100S230,535