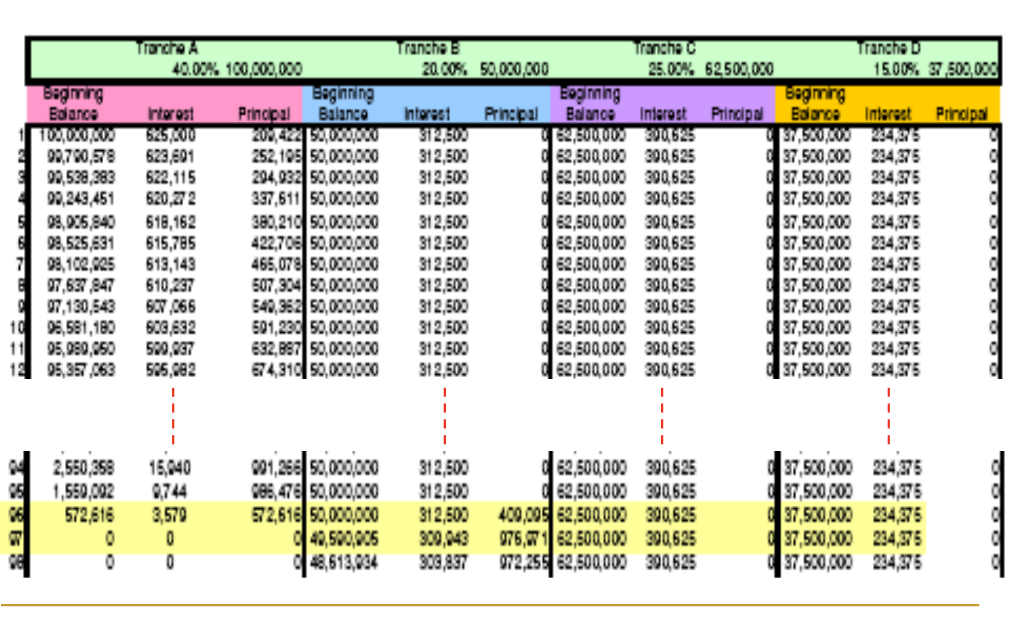

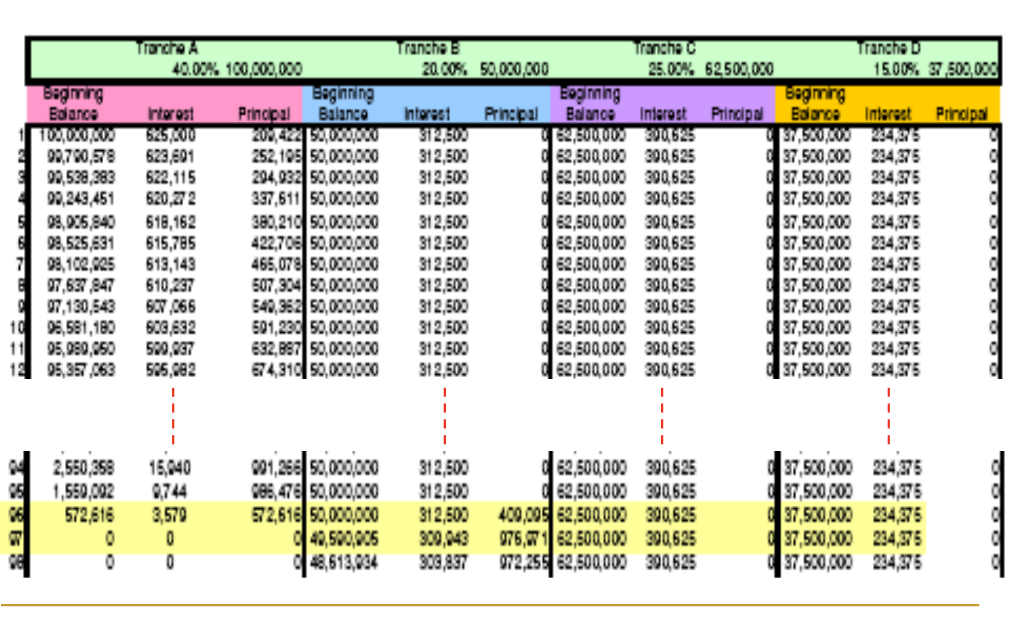

Complete dynamic model for 4 tranches (waterfall structure) as described in class

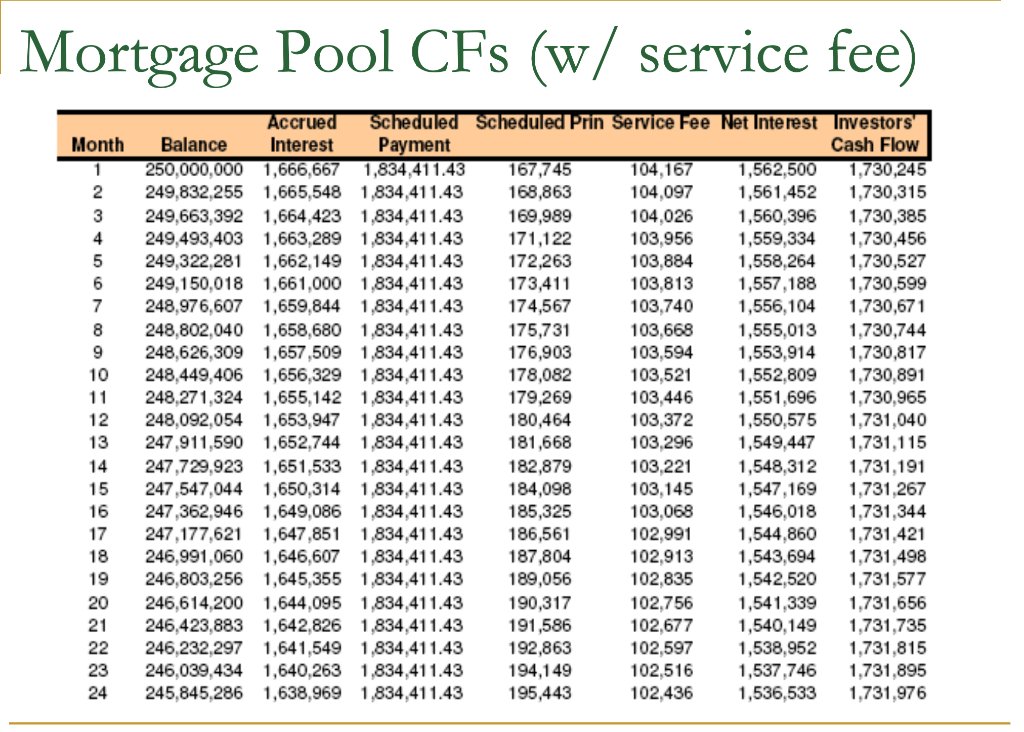

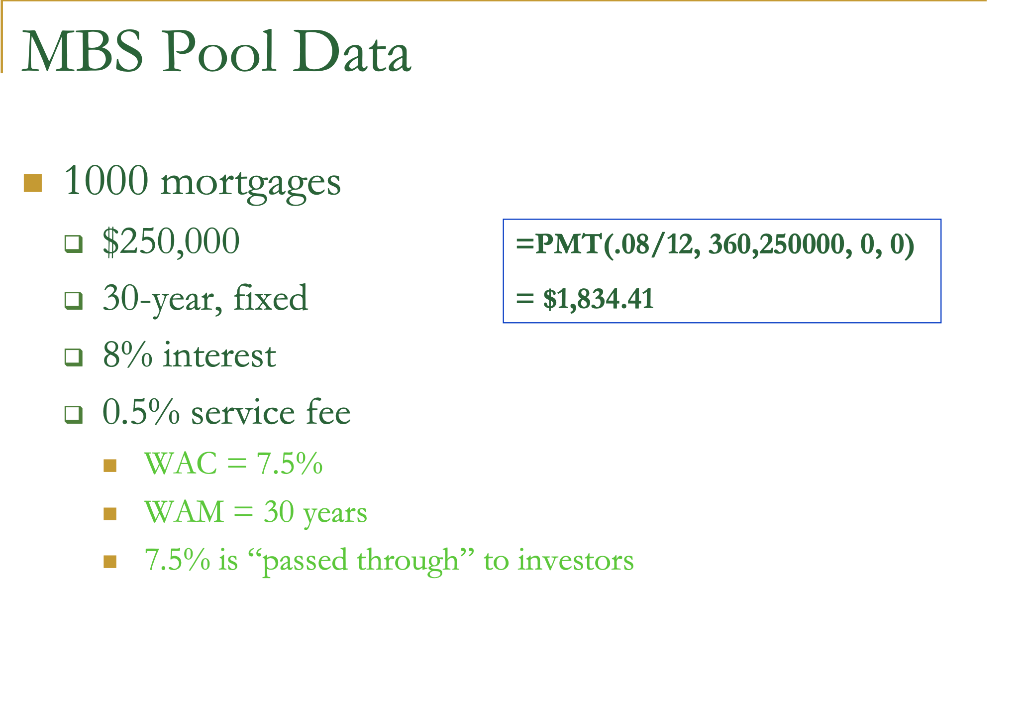

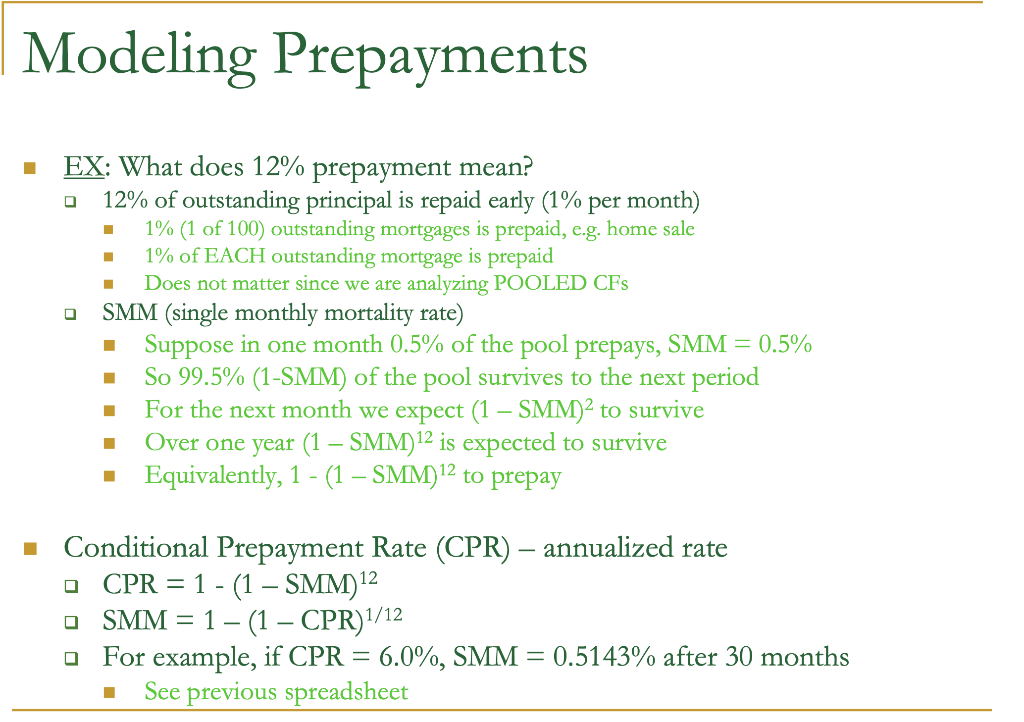

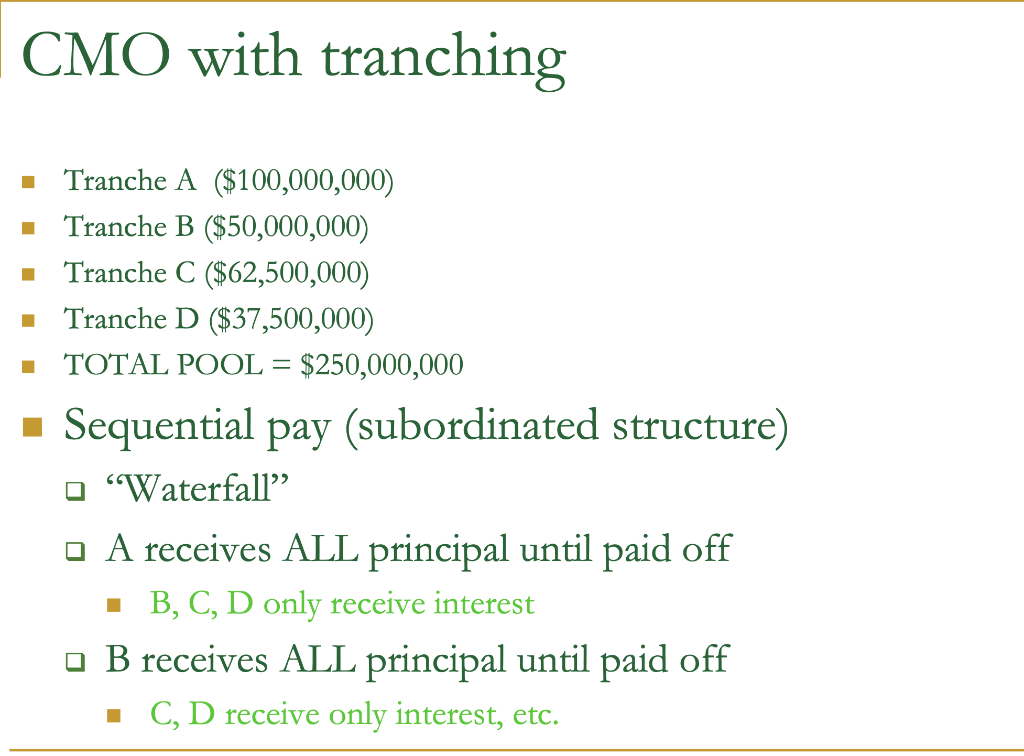

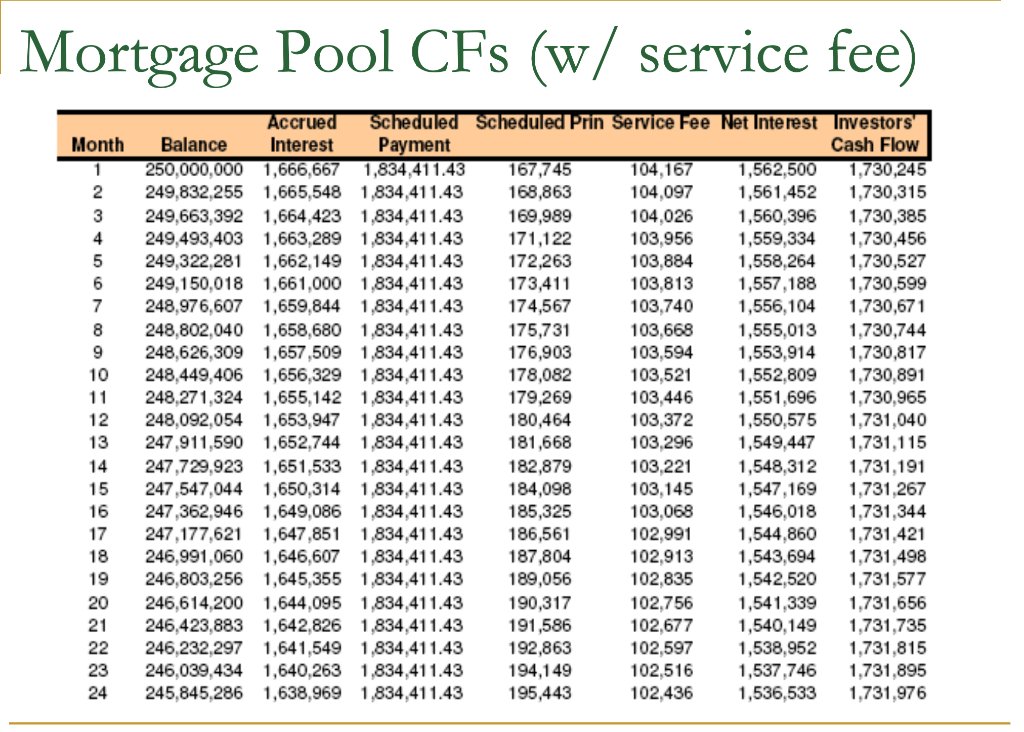

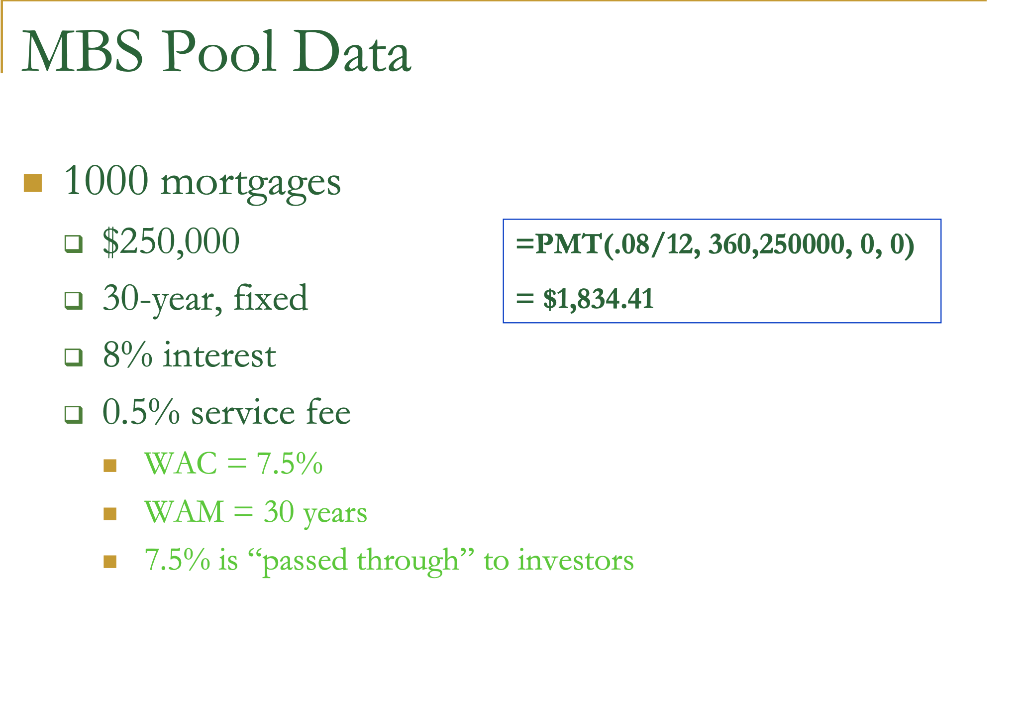

Mortgage Pool CFs (w/ service fee) MBS Pool Data 1000 mortgages $250,00030-year,fixed=PMT(.08/12,360,250000,0,0)=$1,834.41 8% interest 0.5% service fee - WAC=7.5% - WAM =30 years - 7.5% is "passed through" to investors Modeling Prepayments EX: What does 12% prepayment mean? 12% of outstanding principal is repaid early ( 1% per month) - 1%(1 of 100) outstanding mortgages is prepaid, e.g. home sale - 1% of EACH outstanding mortgage is prepaid Does not matter since we are analyzing POOLED CFs a SMM (single monthly mortality rate) Suppose in one month 0.5% of the pool prepays, SMM =0.5% So 99.5% (1-SMM) of the pool survives to the next period - For the next month we expect (1SMM)2 to survive - Over one year (1SMM)12 is expected to survive - Equivalently, 1 - (1-SMM 12 to prepay Conditional Prepayment Rate (CPR) - annualized rate CPR=1(1SMM)12 SMM=1(1CPR)1/12 For example, if CPR =6.0%,SMM=0.5143% after 30 months See previous spreadsheet CMO with tranching - Tranche A ($100,000,000) - Tranche B ($50,000,000) - Tranche C ($62,500,000) - Tranche D $37,500,000) - TOTAL POOL =$250,000,000 Sequential pay (subordinated structure) "Waterfall"' A receives ALL principal until paid off - B,C,D only receive interest - B receives ALL principal until paid off - C, D receive only interest, etc. Mortgage Pool CFs (w/ service fee) MBS Pool Data 1000 mortgages $250,00030-year,fixed=PMT(.08/12,360,250000,0,0)=$1,834.41 8% interest 0.5% service fee - WAC=7.5% - WAM =30 years - 7.5% is "passed through" to investors Modeling Prepayments EX: What does 12% prepayment mean? 12% of outstanding principal is repaid early ( 1% per month) - 1%(1 of 100) outstanding mortgages is prepaid, e.g. home sale - 1% of EACH outstanding mortgage is prepaid Does not matter since we are analyzing POOLED CFs a SMM (single monthly mortality rate) Suppose in one month 0.5% of the pool prepays, SMM =0.5% So 99.5% (1-SMM) of the pool survives to the next period - For the next month we expect (1SMM)2 to survive - Over one year (1SMM)12 is expected to survive - Equivalently, 1 - (1-SMM 12 to prepay Conditional Prepayment Rate (CPR) - annualized rate CPR=1(1SMM)12 SMM=1(1CPR)1/12 For example, if CPR =6.0%,SMM=0.5143% after 30 months See previous spreadsheet CMO with tranching - Tranche A ($100,000,000) - Tranche B ($50,000,000) - Tranche C ($62,500,000) - Tranche D $37,500,000) - TOTAL POOL =$250,000,000 Sequential pay (subordinated structure) "Waterfall"' A receives ALL principal until paid off - B,C,D only receive interest - B receives ALL principal until paid off - C, D receive only interest, etc