Question

Complete each deliverable below as directed in the case study: Labor Forecast/Schedule including name, job type, and scheduled hours for each employee Labor Costs spreadsheet,

Complete each deliverable below as directed in the case study:

- Labor Forecast/Schedule including name, job type, and scheduled hours for each employee

- Labor Costs spreadsheet, including calculations

- Food and Beverage Cost of Sales spreadsheet, including calculations

- Profit: Simplified pro forma profit and loss statement, including calculations for food, beverage, other gross revenues less applicable cost of sales for each, and labor cost to determine gross operating profit (GOP)

- The summary and explanation of three strategies that could be implemented to maximize revenue and reduce costs for banquet events at the hotel is thorough and demonstrates best practices.

INSTRUCTIONS

Labor Forecast/Schedule

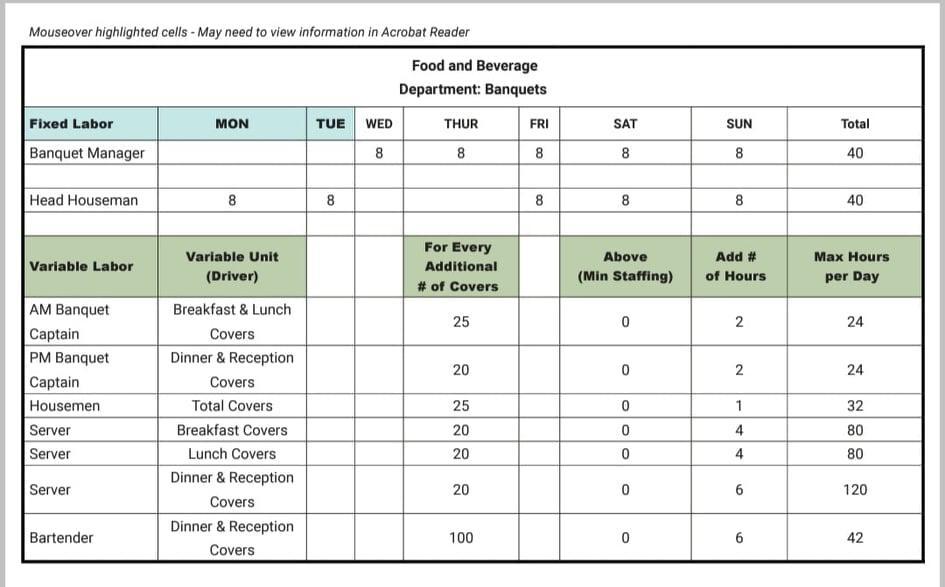

Based on the "Banquet Labor Standard" spreadsheet, create a staffing schedule for the banquet service staff. Your staffing schedule should include the following:

- A schedule is created in Excel or Google Sheets.

- The first column should be “Names.” You can invent these names.

- The second column should be the job type.

- Separate employees by job type.

- Write the scheduled hours for each employee for the event.

Labor Costs

Add a Labor Costs tab to the Labor Forecast/Schedule spreadsheet you created. Based on the hours scheduled, determine the labor cost for Vince and Beth’s wedding. The following are the salary and wage rates for the service staff:

- Banquet Manager: $60,000/year

- Head Houseman: $17.00/hour

- Banquet Housemen: $13.00/hour

- Banquet Captain: $15.00/hour

- Banquet Server: $11.00/hour

- Banquet Bartender: $11.00/hour

Service charge is reported as 100% revenue, typically Other Food and Beverage Revenue. The amount of service charge directly payable to the banquet service staff is 60%. This represents additional labor costs.

Food and Beverage Cost of Sales

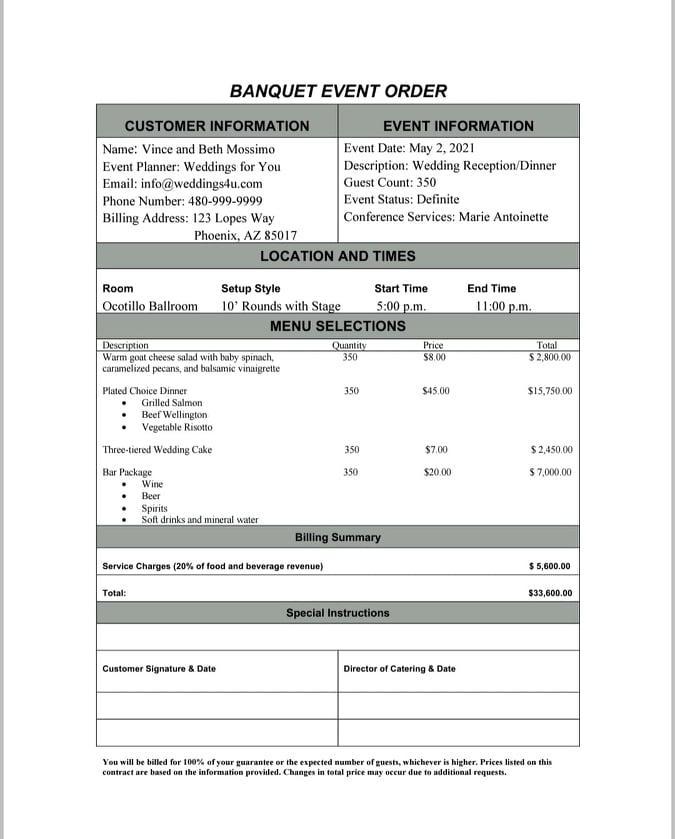

Add a Food and Beverage Cost of Sales tab to the Labor Forecast/Schedule spreadsheet you created. Calculate the food and beverage cost of sales.

- Food costs are estimated at 25% of food sales.

- Beverage costs are estimated at 18% of sales.

You will require 32 hours of kitchen production labor to prepare the food at $15.00/hour.

Profit

Add a P&L tab to the Labor Forecast/Schedule spreadsheet you created. Using the principles of the Uniform System of Accounts for the Lodging Industry (USALI) and Generally Accepted Accounting Principles (GAAP), create a simplified pro forma profit and loss (P&L) statement for Vince and Beth’s wedding to determine if this is a profitable event. A simplified P&L statement should include the following:

- Food revenue less applicable cost of sales

- Beverage revenue less applicable cost of sales

- Other gross revenues less applicable cost of sales

- Labor cost

- Gross Operating Profit (GOP)

In a 250-word summary, explain three strategies you would implement to maximize revenue and reduce costs for banquet events at your hotel.

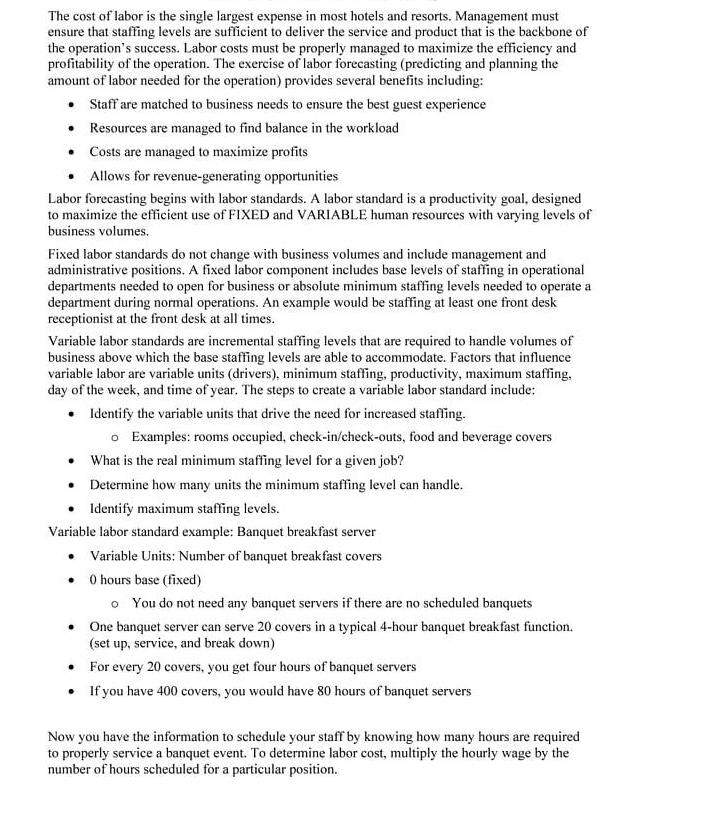

The cost of labor is the single largest expense in most hotels and resorts. Management must ensure that staffing levels are sufficient to deliver the service and product that is the backbone of the operation's success. Labor costs must be properly managed to maximize the efficiency and profitability of the operation. The exercise of labor forecasting (predicting and planning the amount of labor needed for the operation) provides several benefits including: Staff are matched to business needs to ensure the best guest experience Resources are managed to find balance in the workload Costs are managed to maximize profits Allows for revenue-generating opportunities Labor forecasting begins with labor standards. A labor standard is a productivity goal, designed to maximize the efficient use of FIXED and VARIABLE human resources with varying levels of business volumes. Fixed labor standards do not change with business volumes and include management and administrative positions. A fixed labor component includes base levels of staffing in operational departments needed to open for business or absolute minimum staffing levels needed to operate a department during normal operations. An example would be staffing at least one front desk receptionist at the front desk at all times. Variable labor standards are incremental staffing levels that are required to handle volumes of business above which the base staffing levels are able to accommodate. Factors that influence variable labor are variable units (drivers), minimum staffing, productivity, maximum staffing, day of the week, and time of year. The steps to create a variable labor standard include: Identify the variable units that drive the need for increased staffing. o Examples: rooms occupied, check-in/check-outs, food and beverage covers What is the real minimum staffing level for a given job? Determine how many units the minimum staffing level can handle. Identify maximum staffing levels. Variable labor standard example: Banquet breakfast server Variable Units: Number of banquet breakfast covers O hours base (fixed) o You do not need any banquet servers if there are no scheduled banquets One banquet server can serve 20 covers in a typical 4-hour banquet breakfast function. (set up, service, and break down) For every 20 covers, you get four hours of banquet servers If you have 400 covers, you would have 80 hours of banquet servers Now you have the information to schedule your staff by knowing how many hours are required to properly service a banquet event. To determine labor cost, multiply the hourly wage by the number of hours scheduled for a particular position.

Step by Step Solution

3.49 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Open pricing Open pricing refers to creating different prices for reservations made by different guest segments at different time periods through diff...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started