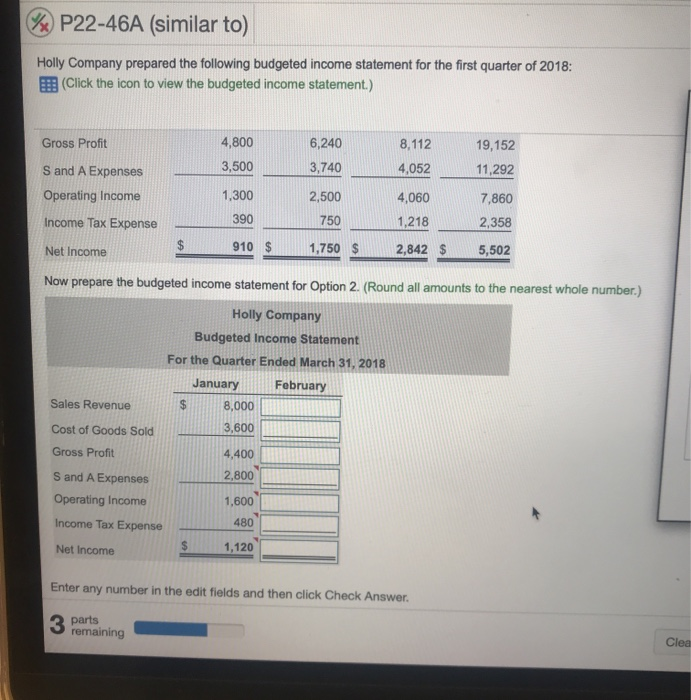

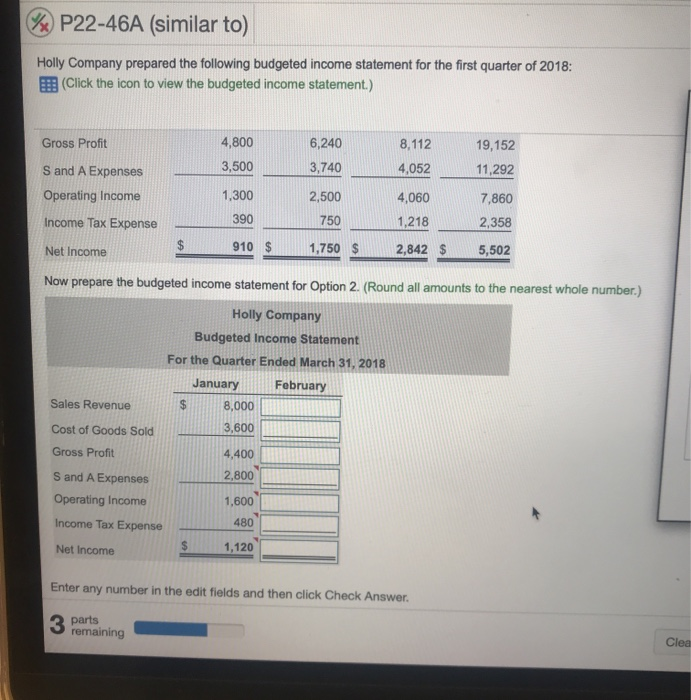

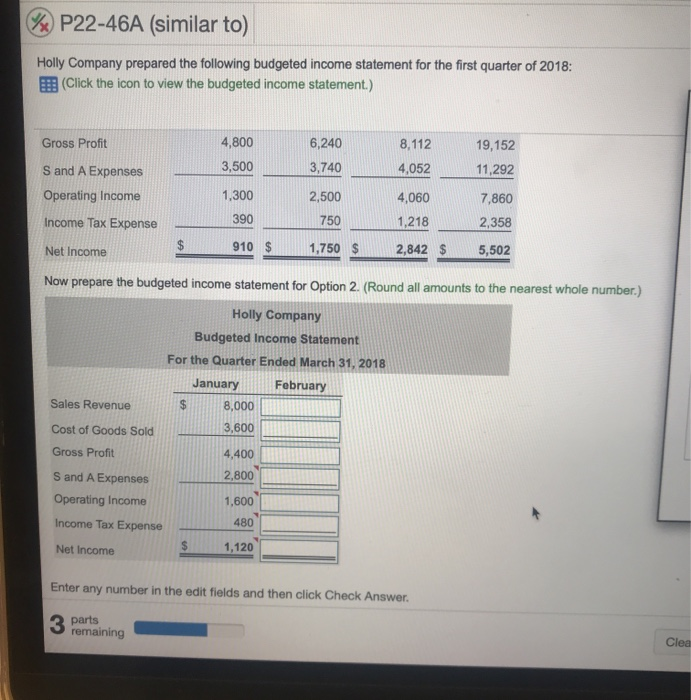

Complete Feb. March. & Total

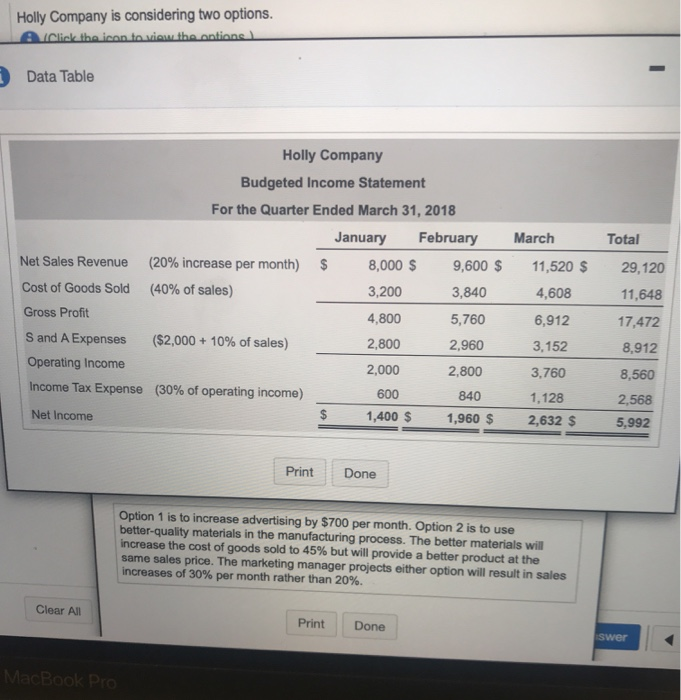

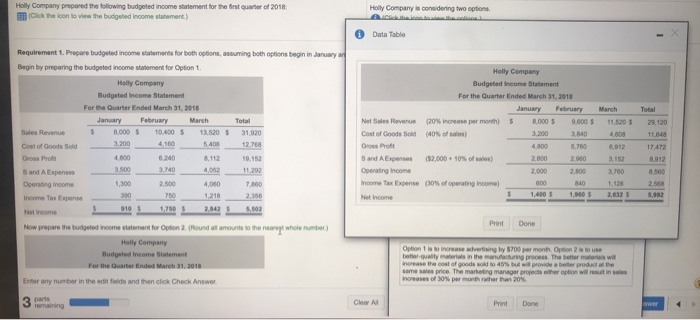

VP22-46A (similar to) Holly Company prepared the following budgeted income statement for the first quarter of 2018: (Click the icon to view the budgeted income statement. 4,800 Gross Profit 6,240 8,112 19,152 3,500 3,740 S and A Expenses 4,052 11,292 Operating Income 1,300 2,500 4,060 7,860 390 750 1,218 Income Tax Expense 2,358 $ 910 $ 1,750 $ 2,842 $ 5,502 Net Income Now prepare the budgeted income statement for Option 2. (Round all amounts to the nearest whole number.) Holly Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January February Sales Revenue $ 8,000 3,600 Cost of Goods Sold Gross Profit 4.400 S and A Expenses 2,800 Operating Income 1,600 Income Tax Expense 480 $ 1,120 Net Income Enter any number in the edit fields and then click Check Answer. 3 parts remaining Clea Holly Company prepared the following budgeted income statement for the first quater of 2018: (Click the icon to view the budgeled income statement) Holly Company is considening two options ACHkibe icon toaieneins Data Table Requirement 1. Propare budgeted income statements for both options, assuming both options begin in January an Begin by preparing the budgeted income statement for Option 1. Holly Company Holly Company Budgeted Income Statement Budgeted Income Statement For the Quarter Ended March 31, 2018 For the Quarter Ended March 31, 201 January February March Total (20 % increase per month) January February March Total Net Sales Revenue 8,000 S 9.600 s 11,520 $ 29.120 Sales Revenue 8,000 10.400 S Cost of Goods Sold (40 % of sales) 13.520 S 31,920 3.840 4608 3.200 11.648 3,200 4,160 5.408 12.768 Cost of Goods Sold Gross Proft 4,800 5.760 6,912 17,472 Gross Pro 4,800 6,240 S and A Expenses ($2,000+ 10% of sales) 2960 8.112 19,152 2.800 3.152 8912 3.500 3,740 4,052) 11.292 Openating Income 2,000 S and A Expenses 2.800 3,760 8,560 Income Tax Expense (30% of openating income) 1,128 Operating Income 1.300 2500 4.080 7,860 600 840 2.568 2,358 1,400 S 1,960 S 2,632 5 5,992 390 750 1,218 Income Tax Expense Net Income 1750 910 2.542 ,502 Net Income Print Done Now prepare the budgeted income statement for Option 2. (Round all amounts to the nearet whole number) Holly Company Option 1 is to increase advertising by $700 per month Option 2 is to use better-quality materials in the manufacturing process. The belter materials wil inorease the cost of goods sold to 45% bul wi provide a beller product at the same sales price. The marketing manager projects ether option will resut in sales inoreases of 30% per month rher han 20% Budgeted Income Statement For the Quarter Ended March 31, 2018 Enter any number in the edit fields and then click Check Answer 2 parts remaining Clear Al Print Done Wer