Question

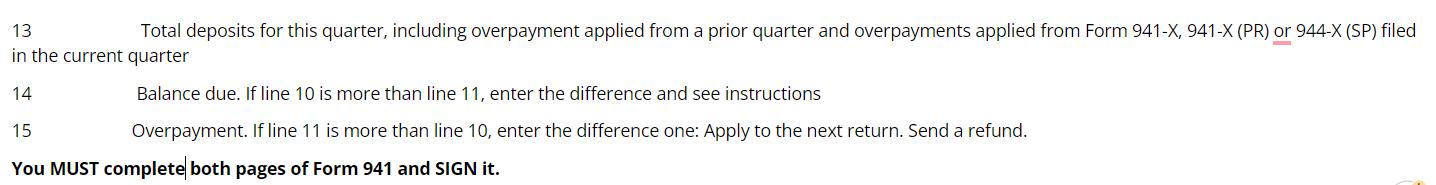

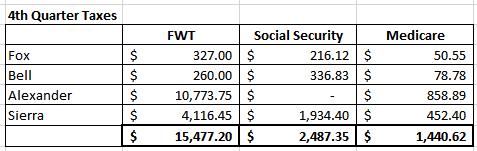

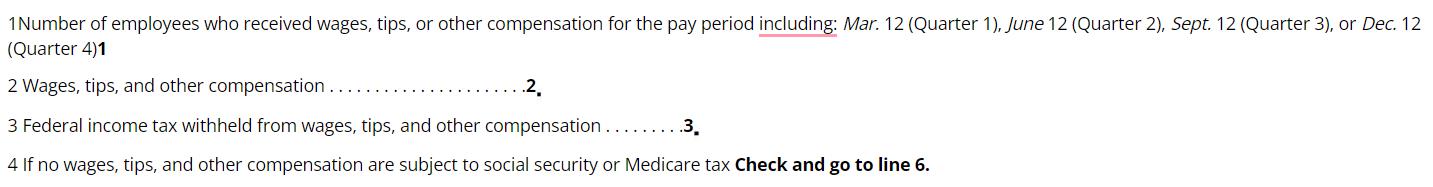

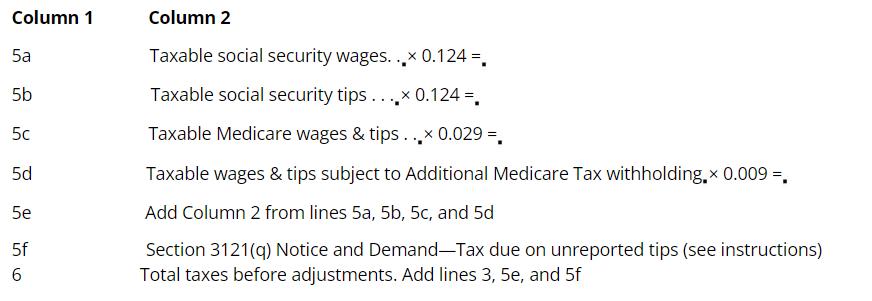

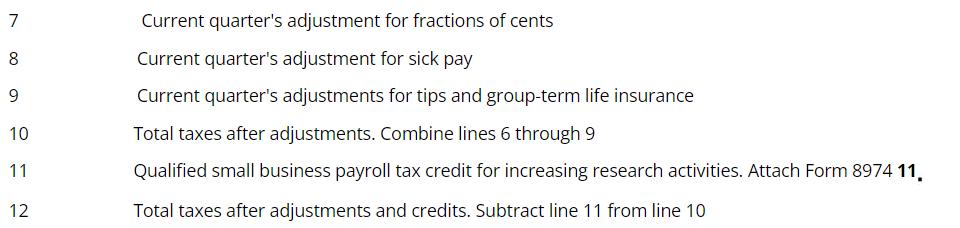

Complete Form 941 for the 4th quarter for TCLH Industries (which is located at 202 Whitmore Avenue, Durham, NC 27701; Employer Identification #44-4444444). Assume that

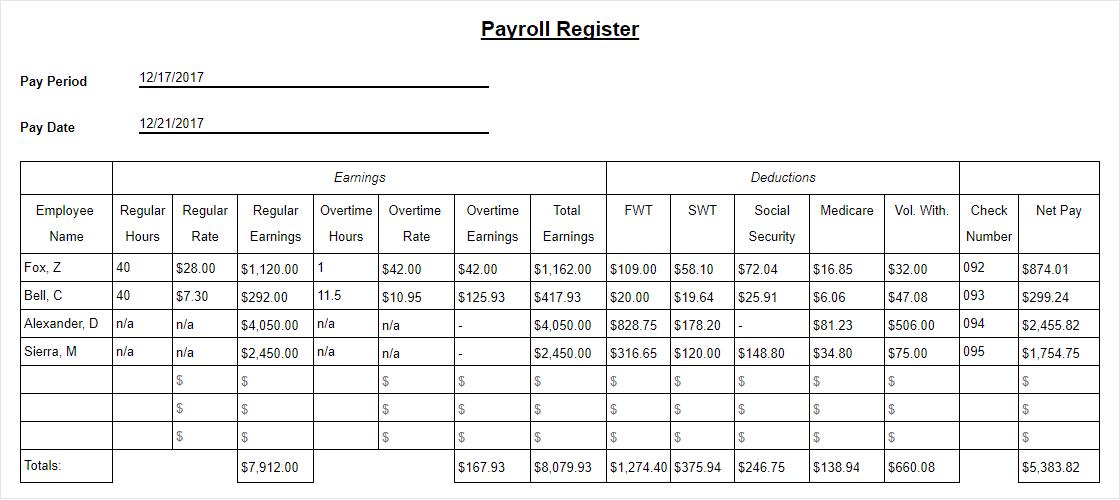

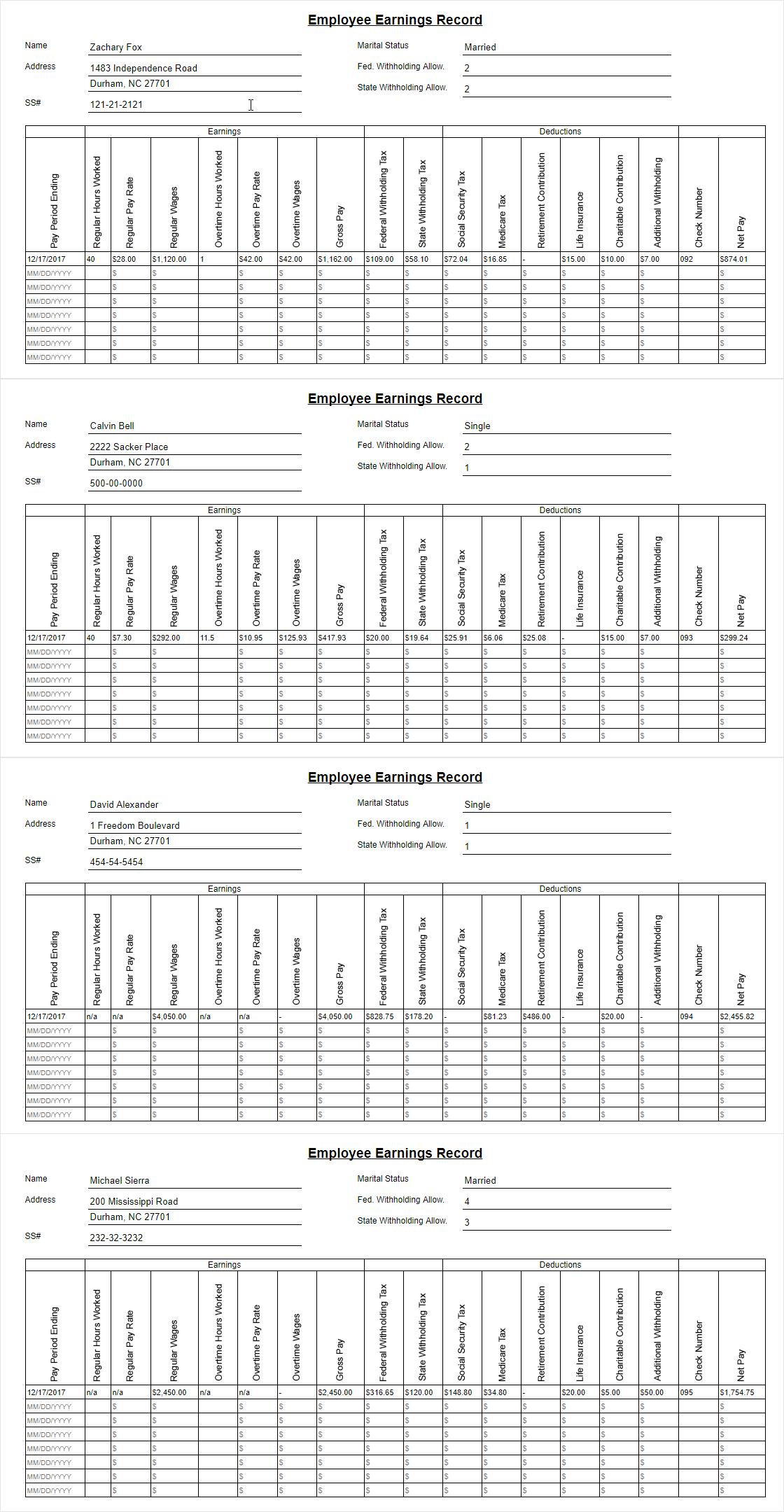

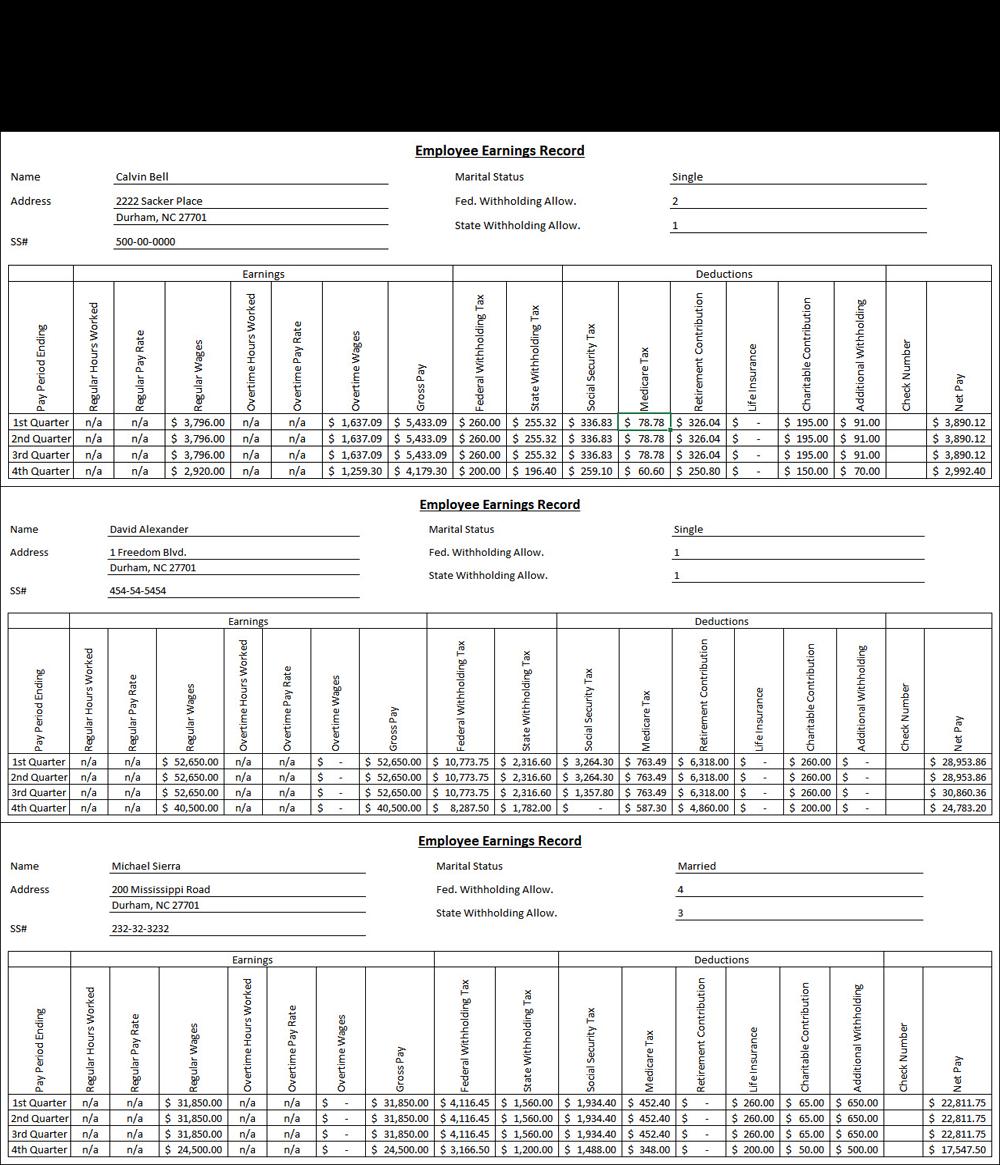

Complete Form 941 for the 4th quarter for TCLH Industries (which is located at 202 Whitmore Avenue, Durham, NC 27701; Employer Identification #44-4444444). Assume that all necessary deposits were made on a timely basis (new businesses in their first year of operations are automatically monthly depositors), and that the employer made deposits equal to the total amount owed for the quarter. Furthermore, note that the company had four pay periods during both October and November, and five pay periods during December. The company does not have a third-party designee, nor does it use a paid preparer. All forms are signed by the CEO of the company, Michael Sierra (phone number: 919-555-7485), and the form is submitted on the due date.

Pay Period Pay Date Employee Name Fox, Z Bell, C Alexander, D n/a Sierra, M n/a Totals: Earnings Regular Regular Regular Overtime Overtime Earnings Hours Hours Rate Rate $28.00 $1,120.00 1 $7.30 n/a 40 12/17/2017 40 12/21/2017 n/a $ $ $ $292.00 11.5 $4,050.00 n/a $2,450.00 n/a $ $ $ $7,912.00 $42.00 $10.95 n/a n/a $ $ $ $ Payroll Register Overtime Total Earnings Earnings $ $167.93 $42.00 $1,162.00 $109.00 $58.10 $125.93 $417.93 $20.00 $19.64 $4,050.00 $828.75 $178.20 $2,450.00 $316.65 $120.00 $148.80 $ $ $ $8,079.93 $ $ FWT $ $ $ SWT $ $1,274.40 $375.94 $ Deductions $72.04 $25.91 $ Social Security $ Medicare Vol. With $16.85 $6.06 $81,23 $34.80 $ $ $ $246.75 $138.94 092 $32.00 $47.08 093 $506.00 094 $75.00 095 $ $ $ Check Number $660.08 $874.01 $299.24 $2,455.82 $1,754.75 $ Net Pay $ $ $5,383.82

Step by Step Solution

3.62 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

I can help you complete Form 941 for the 4th quarter for TCLH Industries Please note that this form is typically filled out using electronic filing methods You can use the information provided to comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started