Question

Complete Hedging Problem using following given info: Value of Tek's receivables = 4,000,000 Payable due in = 90 days Given: Spot rate is $1.2000/

Complete Hedging Problem using following given info:

Value of Tek's receivables = €4,000,000

Payable due in = 90 days

Given: ▪ Spot rate is $1.2000/€

▪ 3-month forward rate is $1.2180/€

▪ Tek's cost of capital is 9.8%

▪ Tek's short-term investment rate is 5.25% p. a.

▪ 3-month euro borrowing rate is 4.2% p.a.

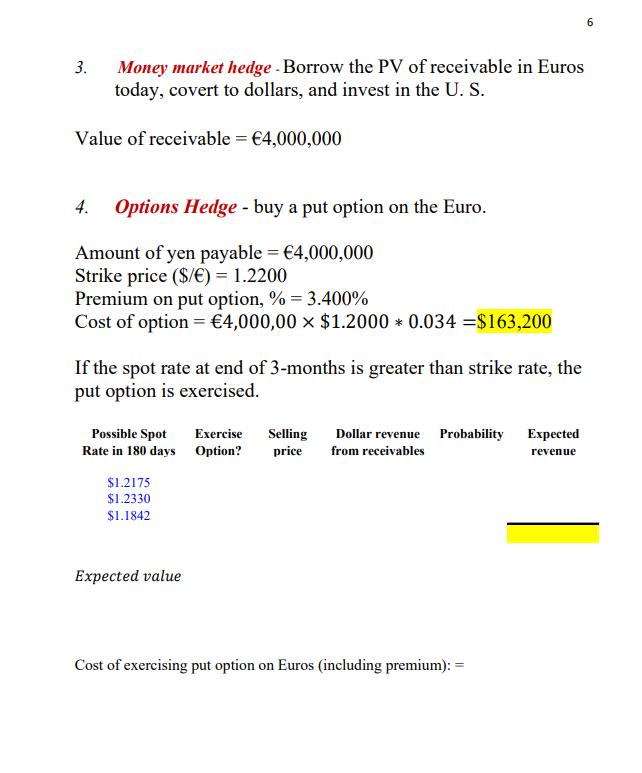

▪ 3- month euro put option strike price = $1.2200/€

▪ Option premium = 3.4%

▪ The expected spot rate can be estimated from the following information:

Possible Spot Rate in 90 days Probability

$1.2175/€ 25%

$1.2330/€ 60%

$1.1842/€ 15%

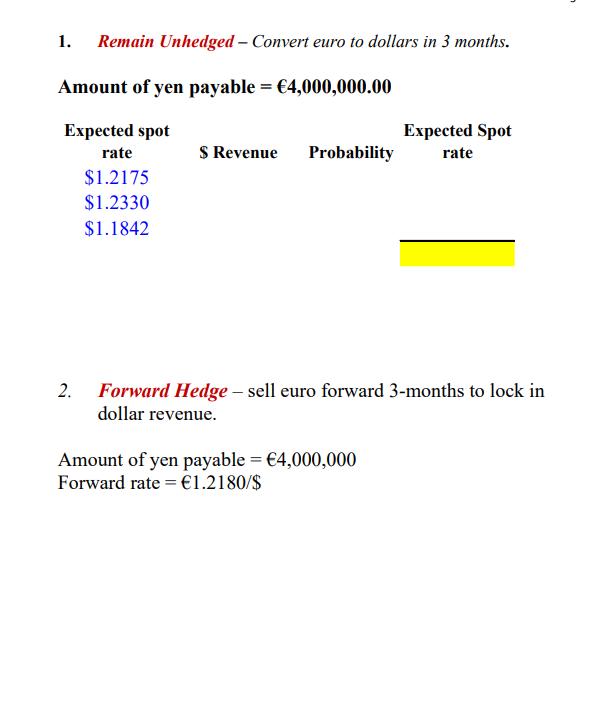

1. Remain Unhedged - Convert euro to dollars in 3 months. Amount of yen payable = 4,000,000.00 Expected spot rate $1.2175 $1.2330 $1.1842 $ Revenue Probability Expected Spot rate 2. Forward Hedge - sell euro forward 3-months to lock in dollar revenue. Amount of yen payable = 4,000,000 Forward rate = 1.2180/$

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Remain Unhedged Expected Revenue 4000000 12175025 12330060 11842015 4849500 2 Forward Hedge ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started