Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete in a spreadsheet As the Cost Accountant/Manager of Bradley Motorcycle Manufacturing Company, you have been provided with the following information about your Company for

Complete in a spreadsheet

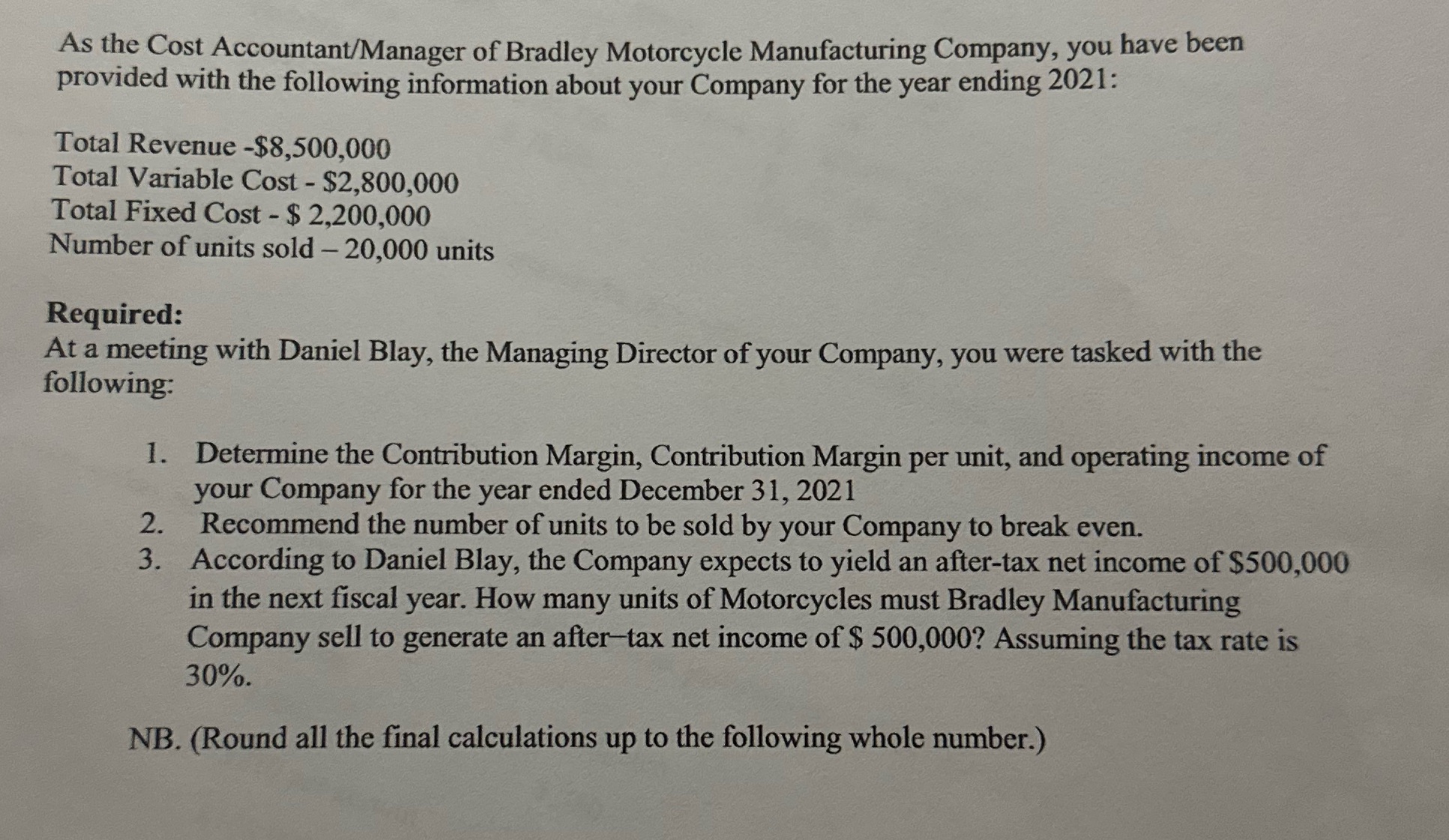

As the Cost Accountant/Manager of Bradley Motorcycle Manufacturing Company, you have been provided with the following information about your Company for the year ending 2021: Total Revenue -$8,500,000 Total Variable Cost - $2,800,000 Total Fixed Cost - $2,200,000 Number of units sold - 20,000 units Required: At a meeting with Daniel Blay, the Managing Director of your Company, you were tasked with the following: 1. Determine the Contribution Margin, Contribution Margin per unit, and operating income of your Company for the year ended December 31, 2021 2. Recommend the number of units to be sold by your Company to break even. 3. According to Daniel Blay, the Company expects to yield an after-tax net income of $500,000 in the next fiscal year. How many units of Motorcycles must Bradley Manufacturing Company sell to generate an after-tax net income of $ 500,000? Assuming the tax rate is 30%. NB. (Round all the final calculations up to the following whole number.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started