Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete in Excel This project's purpose is to form a portfolio with 2 risky assets (2 common stock and risk free asset (1-year Treasury Bills,

Complete in Excel

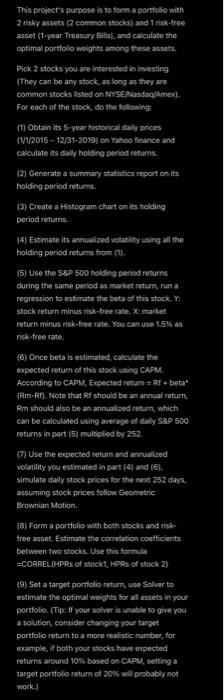

This project's purpose is to form a portfolio with 2 risky assets (2 common stock and risk free asset (1-year Treasury Bills, and calculate the optimal portfolio weights among these assets. Pick 2 stocks you are interested in investing They can be any stock, as long as they are common stocks listed on NYSE:Nasdamex). For each of the stock, do the following (1) Obtain its 5-year historically prices (1/14/2015 - 12/31-2019) on Yahoo finance and calculate its daily holding period returns. (2) Generate a summary statistics report on its holding period retums. (3) Create a Histogram chart on its holding period returns. (9) Estimate its annualized volatility using all the hoiding period returns from (5) Use the S&P 500 holding period returns during the same period as market return, runa regression to estimate the beta of this stock. Y: stock return minus risk-free rate : market return minus risk-free rate. You can use 15% as risk-free rate 16) Once beta is estimated, calculate the expected return of this stock using CAPM. According to CAPM Expected return = Rt. beta (RM-R1). Note that should be an annual return, Rm should also be an annualized return, which can be calculated using average of day S&P 500 returns in part (5) multiplied by 252 (7) Use the expected return and analized volatility you estimated in part (4) and (6). simulate daily stock prices for the next 252 days, assuming stock prices follow Geometric Brownian Motion (8) Forma portfolio with both stocks and risk free asset. Estimate the correlation coefficients between two stocks. Use this formula =CORREL(HPRs of stockt, HORS of stock 2) (9) Set a target portfolio return, use Solver to estimate the optimal weights for all assets in your portfolio (Tip: If your solver is unable to give you a solution, consider changing your target portfolio return to a more realistic number, for example, if both your stocks have expected returns around 10% based on CAPM setting a target portfolio return of 20% will probably not work) This project's purpose is to form a portfolio with 2 risky assets (2 common stock and risk free asset (1-year Treasury Bills, and calculate the optimal portfolio weights among these assets. Pick 2 stocks you are interested in investing They can be any stock, as long as they are common stocks listed on NYSE:Nasdamex). For each of the stock, do the following (1) Obtain its 5-year historically prices (1/14/2015 - 12/31-2019) on Yahoo finance and calculate its daily holding period returns. (2) Generate a summary statistics report on its holding period retums. (3) Create a Histogram chart on its holding period returns. (9) Estimate its annualized volatility using all the hoiding period returns from (5) Use the S&P 500 holding period returns during the same period as market return, runa regression to estimate the beta of this stock. Y: stock return minus risk-free rate : market return minus risk-free rate. You can use 15% as risk-free rate 16) Once beta is estimated, calculate the expected return of this stock using CAPM. According to CAPM Expected return = Rt. beta (RM-R1). Note that should be an annual return, Rm should also be an annualized return, which can be calculated using average of day S&P 500 returns in part (5) multiplied by 252 (7) Use the expected return and analized volatility you estimated in part (4) and (6). simulate daily stock prices for the next 252 days, assuming stock prices follow Geometric Brownian Motion (8) Forma portfolio with both stocks and risk free asset. Estimate the correlation coefficients between two stocks. Use this formula =CORREL(HPRs of stockt, HORS of stock 2) (9) Set a target portfolio return, use Solver to estimate the optimal weights for all assets in your portfolio (Tip: If your solver is unable to give you a solution, consider changing your target portfolio return to a more realistic number, for example, if both your stocks have expected returns around 10% based on CAPM setting a target portfolio return of 20% will probably not work) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started