Question

Complete Individual Federal Income Tax Return (Form 1040) for the year ending December 31, 2020. Alternatively, you can show your work by inputting relevant information

Complete Individual Federal Income Tax Return (Form 1040) for the year ending December 31, 2020. Alternatively, you can show your work by inputting relevant information into the Tax Formula studied in class. You may use the Internal Revenue web-site (www.irs.gov) or any other internet source to download any forms you will need (but you will not be penalized for not using the forms). Do not worry about tax rates/ tax credits as we did not discuss them comprehensively in class.

SHOW ALL YOUR WORK so that I can give you points even if your final answer is incorrect. Your final answer might be off due to miscalculations and other small error, and I would like to give you partial credit for everything that you learned and can apply.

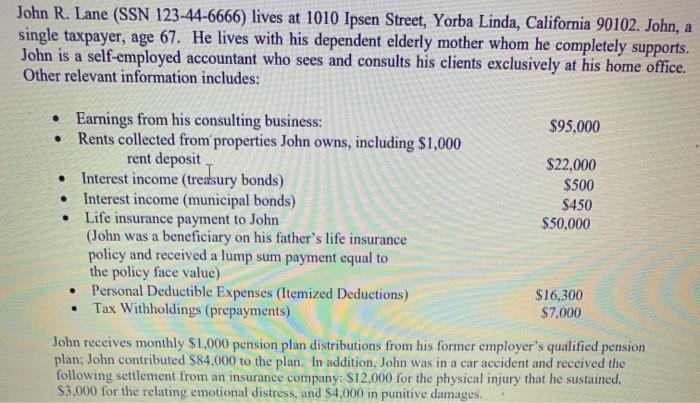

John R. Lane (SSN 123-44-6666) lives at 1010 Ipsen Street, Yorba Linda, California 90102. John, a single taxpayer, age 67. He lives with his dependent elderly mother whom he completely supports. John is a self-employed accountant who sees and consults his clients exclusively at his home office. Other relevant information includes: . . Earnings from his consulting business: $95.000 Rents collected from properties John owns, including $1,000 rent deposit $22,000 Interest income (treasury bonds) $500 Interest income (municipal bonds) $450 Life insurance payment to John $50,000 (John was a beneficiary on his father's life insurance policy and received a lump sum payment equal to the policy face value) Personal Deductible Expenses (Itemized Deductions) $16,300 Tax Withholdings (prepayments) $7.000 John receives monthly $1.000 pension plan distributions from his former employer's qualified pension plan: John contributed $84,000 to the plan. In addition, John was in a car accident and received the following settlement from an insurance company: S12.000 for the physical injury that he sustained. $3,000 for the relating emotional distress, and $4,000 in punitive damages . John R. Lane (SSN 123-44-6666) lives at 1010 Ipsen Street, Yorba Linda, California 90102. John, a single taxpayer, age 67. He lives with his dependent elderly mother whom he completely supports. John is a self-employed accountant who sees and consults his clients exclusively at his home office. Other relevant information includes: . . Earnings from his consulting business: $95.000 Rents collected from properties John owns, including $1,000 rent deposit $22,000 Interest income (treasury bonds) $500 Interest income (municipal bonds) $450 Life insurance payment to John $50,000 (John was a beneficiary on his father's life insurance policy and received a lump sum payment equal to the policy face value) Personal Deductible Expenses (Itemized Deductions) $16,300 Tax Withholdings (prepayments) $7.000 John receives monthly $1.000 pension plan distributions from his former employer's qualified pension plan: John contributed $84,000 to the plan. In addition, John was in a car accident and received the following settlement from an insurance company: S12.000 for the physical injury that he sustained. $3,000 for the relating emotional distress, and $4,000 in punitive damages

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started