Complete M6-19 and M6-21.

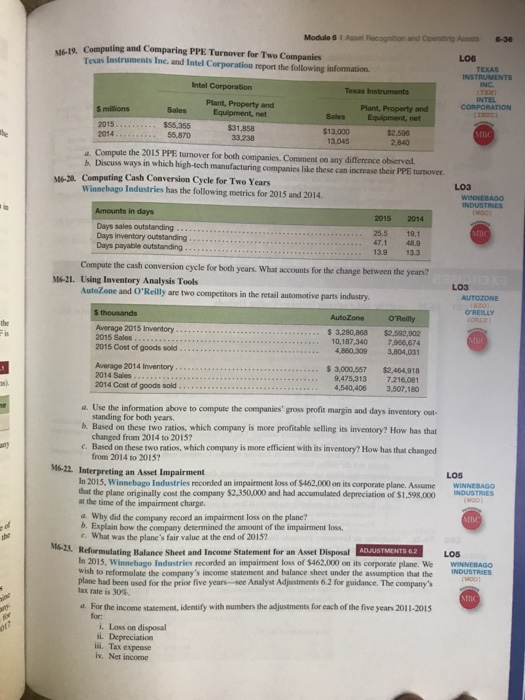

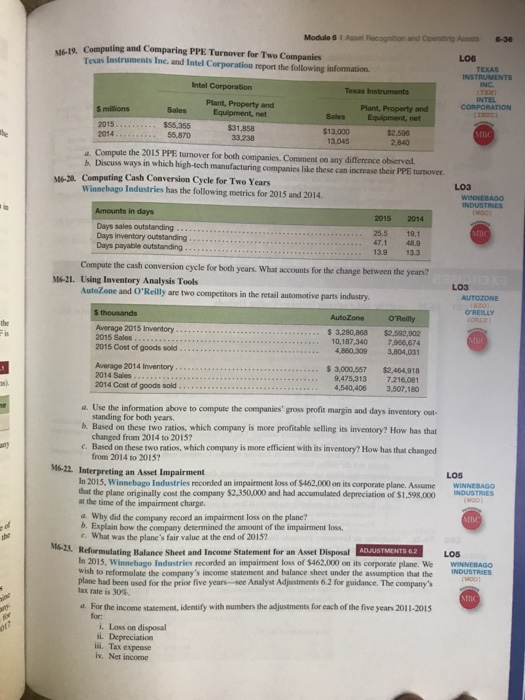

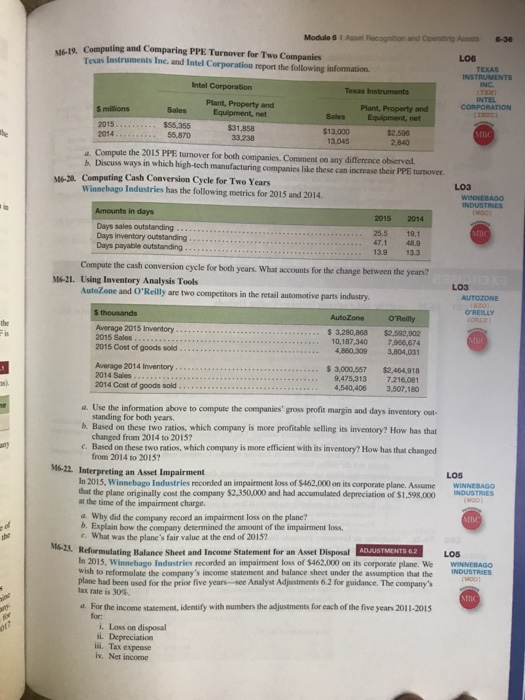

Module 6 1 Asset Recognition and Operating Assets 6-36 10. Computing and Comparing PPE Turnover for Two Companies Tesas Instruments Inc. and Intel Corporation report the following information NSTRUMENTS Intel Corporation Plant, Property and Plant, Property and SalesEquipment, net $13,000 13.045 $55,355 $31,858 33.238 $2.,590 2,840 2014 a. Compute the 2015 PPE turnover for both companies. Comment on any difference observed b. Discuss ways in which high-lech manufacturing companies like these can increase their PPE turnover. M6-20 Computing Cash Conversion Cyele for Two Years LO3 Winnebago Industries has the following metrics for 2015 and 2014. INDUSTRIES in days Days sales outstanding Days inventory outstanding Days payable outstanding 2015 2014 25.5 19.1 7.1 489 13.9 13.3 Compute the cash conversion cycle for both years. What accounts for the change between the years? M6-21. Using Inventory Analysis Tools LO3 AutoZone and O'Reilly are two competitors in the retail automotive parts industry AutoZone 'Reilly 3,280,868 $2,592,902 10,187.340 796 674 the Average 2015 Invertory 2015 Sales 2015 Cost of goods sold 4,860,309 3,804,031 s 3,000.567 $2,464,918 ,475,313 7.216081 4,540,406 3,507.180 Average 2014 inventory 2014 Sales 2014 Cost of goods sold a. Use the information above to compute the companies' gross profit margin and days inventory out standing for both years. b. Based on these two ratios, which company is more profitable selling its inventory? How has that changed from 2014 to 2015? c. Based on these two ratios, which company is more efficient with its inventory? How has that changed from 2014 to 2015 M6-22 Interpreting an Asset Impairment LO5 In 2015, Winnebago Industries recorded an impairment loss of $462.000 on its corporate plane. Assume Uhat the plane originally cost the company $2.350,000 and had accumulated depreciation of $1,598,000 at the time of the impairment charge. WINNESG INDUSTRIES a. Why did the company record an impairment loss on the plane? b. Explain how the company determined the amount of the impairment loss, c. What was the plane's fair value at the end of 20157 Reformulating Balance Sheet and Income Statement for an Asset Disposal ADJUSTMENTS 62 In 2015, Winnebago Industries recorded an impairment loss of $462,000 on its corporate plane. We WINNEBAGO wish to reformulate the company's income statement and balance sheet under the assumption that the INDUSTRIES LOS puene hesd boen used for the prisr five yeans sor Analyst Adjusimacents 6.2 for guidance. The companys tax rate is 30% a. For the income statement, identify with numbers the adjustments for each of the five years 2011-2015 for: i. Loss on disposal ini. Tax expense iv. Net income