Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete Moab Incorporated's Form 4 7 9 7 for the year 2 0 2 3 . Note: Input all the values as positive numbers. Use

Complete Moab Incorporated's Form for the year

Note: Input all the values as positive numbers. Use tax rules regardless of year on tax form.

Department of the Treasury

Internal Revenue Service

Names shown on return

Sales ol dusimess rioperty

Also Involuntary Conversions and Recapture

Amounts

Under Sections and Fb

Attach to your tax return.

Go to

wwwirs.govForm for instructions and the latest information.

Attachment Sequence No

Identifying number Enter as

a Enter the gross proceeds from sales or exchanges reported to you for on FormsB or S or

substitute statement that you are including on line or See instructions

b Enter the total amount of gain that you are including on lines and due to the partial dispositions of MACRS assets

c Enter the total amount of loss that you are including on lines and due to the partial dispositions of MACRS assets

Part

Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other

Than Casualty or TheftMost Property Held More Than Year see instructions

line below and skip lines and If line is a gain and you didn't have any prior ye

recaptured in an earlier year, enter the gain from line as a longterm capital gain on

skap lines and below.

Nonrecaptured net section losses from prior years. See instructions.

Subtract line from line If zero or less, enter If line is zero, enter the gain fr

more than zero, enter the amount from line on line below and enter the gain from

Schedule D filed with your return. See instructions

Part II

Ordinary gains and losses not included on lines through include propertions

Ordinary gains and losses not included on lines through include property held year or less

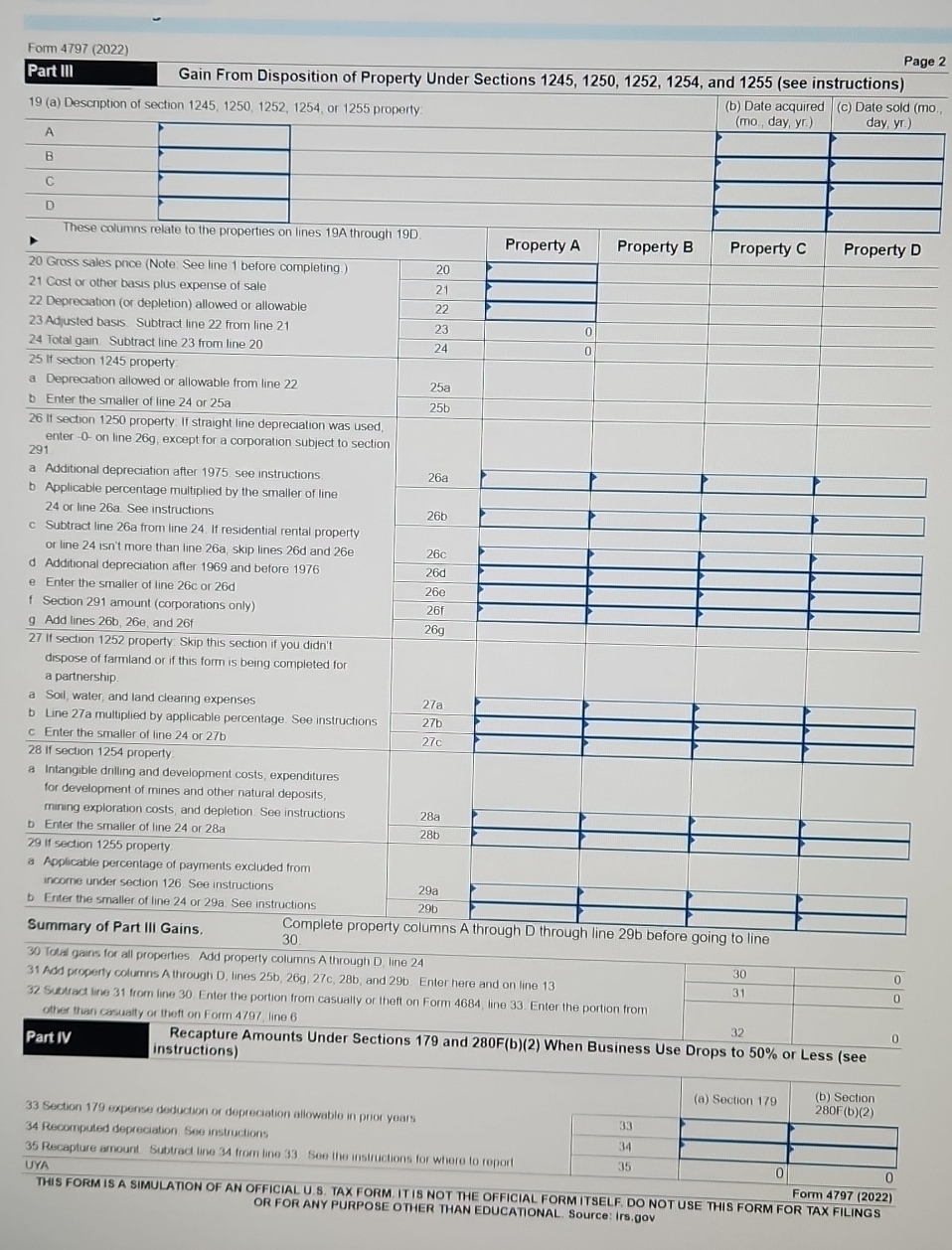

Gain From Disposition of Property Under Sections and see instructions

a Description of section or property:

b Date acquired

c Date sold mo

mo day, yr

day, yr

These columns relate to the properties on lines A through D

Gross sales price Note See line before completing.

Cost or other basis plus expense of sale

Depreciation or depletion allowed or allowable

Adjusted basis. Subtract line from line

Total gain. Subtract line from line

If section property.

a Deprecation allowed or allowable from line

b Enter the smaller of line or a

if section property. If straight line depreciation was used,

enter on line g except for a corporation subject to section

a Additional depreciation after see instructions.

b Applicable percentage multiplied by the smaller of line

or line a See instructions

c Subtract line a from line If residential rental property

or line isn't more than line a skip lines d and e

d Additional depreciation affer and before

e Enter the smaller of line c or d

f Section amount corporations only

g Add lines be and

if section property: Skip this section if you didn't

dispose of farmland or if this form is being completed for

a partnership.

a Soll, water, and land clearing expenses

b Line a multiplied by applicable percentage. See instructions

C Enter the smaller of line or b

If section property.

a Intangible drilling and development costs, expenditures

for development of mines and other natural deposits,

mining exploration costs, and depletion. See instructions

b Enter the smaller of line or a

if section property.

a Applicable percentage of payments excluded from

income under section See instructions

b Enter the smaller of line or a See instructions

table

Summary of Part Ill Gains.

Complete property columns A through D through line b before going to line

Total gains for all properties. Add property columns A through D line

Add property columns A through D lines bgcb and b Enter here and on line

subtract line from line Enter the portion from casually or theft on Form line Enter the portion from

other than casualty or theft on Form line

Recapture Amounts Under Sections and Fb When Business Use Drops to or Less see

instructions

Section expense doduction or depreciation allowable in prior years

Recaptare arnount Subtract tine from line Soe lie instructions for where to reporl

THIS FORM IS A SIMULATION OF AN OFFICIAL US TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT FORT

OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. Source: Irs. gov

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started