.

.

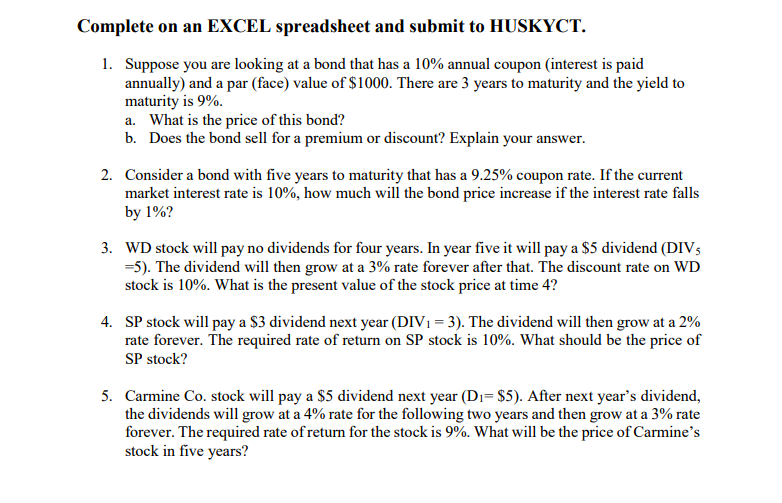

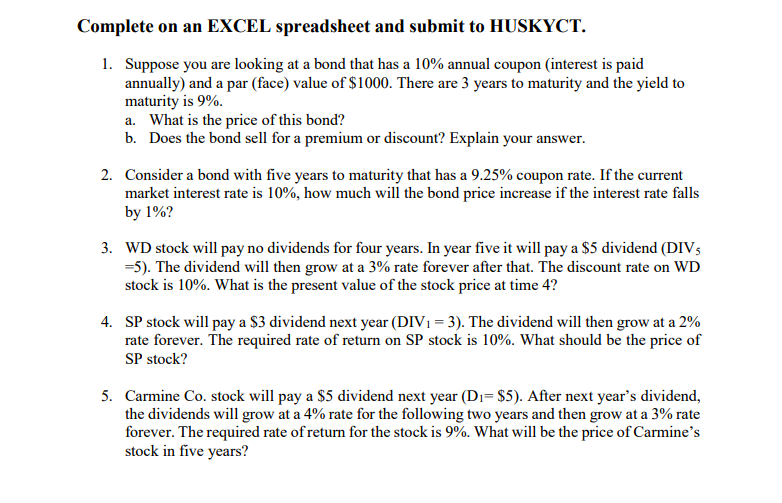

Complete on an EXCEL spreadsheet and submit to HUSKYCT. 1. Suppose you are looking at a bond that has a 10% annual coupon (interest is paid annually) and a par (face) value of $1000. There are 3 years to maturity and the yield to maturity is 9% a. What is the price of this bond? b. Does the bond sell for a premium or discount? Explain your answer. 2. Consider a bond with five years to maturity that has a 9.25% coupon rate. If the current market interest rate is 10%, how much will the bond price increase if the interest rate falls by 1%? 3. WD stock will pay no dividends for four years. In year five it will pay a $5 dividend (DIV 5 =5). The dividend will then grow at a 3% rate forever after that. The discount rate on WD stock is 10%. What is the present value of the stock price at time 4? 4. SP stock will pay a $3 dividend next year (DIV1 = 3). The dividend will then grow at a 2% rate forever. The required rate of return on SP stock is 10%. What should be the price of SP stock? 5. Carmine Co. stock will pay a $5 dividend next year (Di=$5). After next year's dividend, the dividends will grow at a 4% rate for the following two years and then grow at a 3% rate forever. The required rate of return for the stock is 9%. What will be the price of Carmine's stock in five years? Complete on an EXCEL spreadsheet and submit to HUSKYCT. 1. Suppose you are looking at a bond that has a 10% annual coupon (interest is paid annually) and a par (face) value of $1000. There are 3 years to maturity and the yield to maturity is 9% a. What is the price of this bond? b. Does the bond sell for a premium or discount? Explain your answer. 2. Consider a bond with five years to maturity that has a 9.25% coupon rate. If the current market interest rate is 10%, how much will the bond price increase if the interest rate falls by 1%? 3. WD stock will pay no dividends for four years. In year five it will pay a $5 dividend (DIV 5 =5). The dividend will then grow at a 3% rate forever after that. The discount rate on WD stock is 10%. What is the present value of the stock price at time 4? 4. SP stock will pay a $3 dividend next year (DIV1 = 3). The dividend will then grow at a 2% rate forever. The required rate of return on SP stock is 10%. What should be the price of SP stock? 5. Carmine Co. stock will pay a $5 dividend next year (Di=$5). After next year's dividend, the dividends will grow at a 4% rate for the following two years and then grow at a 3% rate forever. The required rate of return for the stock is 9%. What will be the price of Carmine's stock in five years

.

.