Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Complete part A-D many thanks! Q11 (20 marks) Suppose you are analyzing stocks of two famous FinTech companies, FTA and MMB. Following are some information

Complete part A-D many thanks!

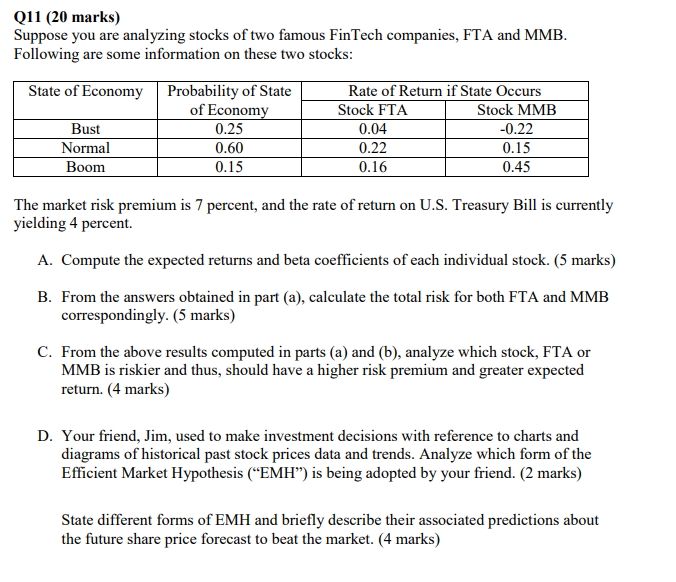

Q11 (20 marks) Suppose you are analyzing stocks of two famous FinTech companies, FTA and MMB. Following are some information on these two stocks: State of Economy Probability of State of Economy Bust 0.25 Normal Boom 0.15 Rate of Return if State Occurs Stock FTA Stock MMB 0.04 -0.22 0.22 0.15 0.16 0.45 0.60 The market risk premium is 7 percent, and the rate of return on U.S. Treasury Bill is currently yielding 4 percent. A. Compute the expected returns and beta coefficients of each individual stock. (5 marks) B. From the answers obtained in part (a), calculate the total risk for both FTA and MMB correspondingly. (5 marks) C. From the above results computed in parts (a) and (b), analyze which stock, FTA or MMB is riskier and thus, should have a higher risk premium and greater expected return. (4 marks) D. Your friend, Jim, used to make investment decisions with reference to charts and diagrams of historical past stock prices data and trends. Analyze which form of the Efficient Market Hypothesis (EMH) is being adopted by your friend. (2 marks) State different forms of EMH and briefly describe their associated predictions about the future share price forecast to beat the market. (4 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started