Answered step by step

Verified Expert Solution

Question

1 Approved Answer

complete question in the picture uploaded kindly solve plz UPL Ltd is determining the cash flow for a project involving replacement of Old machine by

complete question in the picture uploaded kindly solve plz

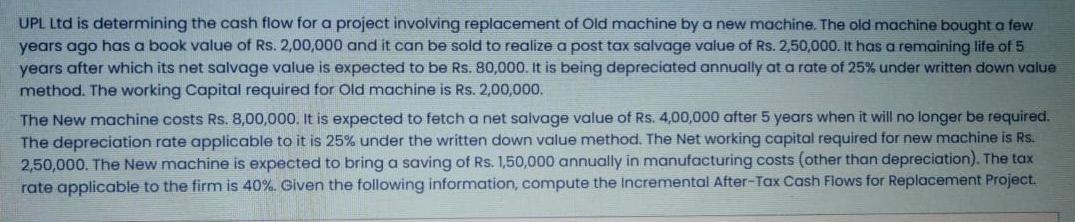

UPL Ltd is determining the cash flow for a project involving replacement of Old machine by a new machine. The old machine bought a few years ago has a book value of Rs. 2,00,000 and it can be sold to realize a post tax salvage value of Rs. 2,50,000. It has a remaining life of 5 years after which its net salvage value is expected to be Rs. 80,000. It is being depreciated annually at a rate of 25% under written down value method. The working Capital required for Old machine is Rs. 2,00,000, The New machine costs Rs. 8,00,000. It is expected to fetch a net salvage value of Rs. 4,00,000 after 5 years when it will no longer be required. The depreciation rate applicable to it is 25% under the written down value method. The Net working capital required for new machine is Rs. 2,50,000. The New machine is expected to bring a saving of Rs. 1,50,000 annually in manufacturing costs (other than depreciation). The tax rate applicable to the firm is 40%. Given the following information, compute the incremental After-Tax Cash Flows for Replacement ProjectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started