Answered step by step

Verified Expert Solution

Question

1 Approved Answer

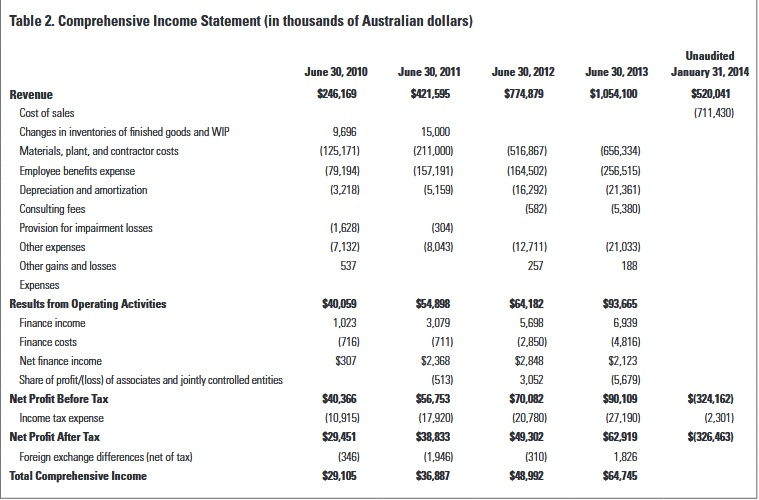

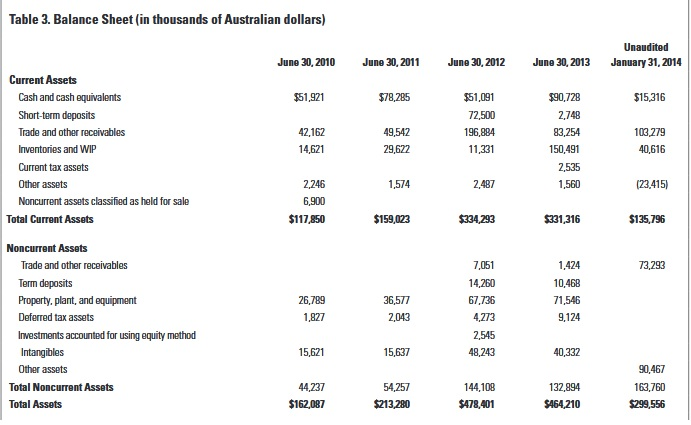

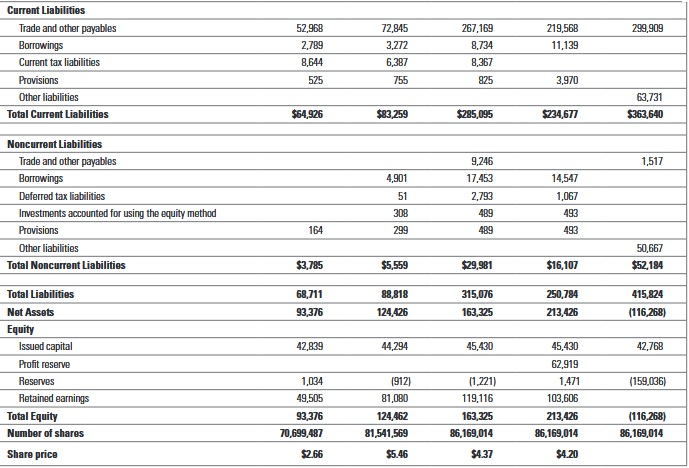

Complete ratio analysis for the years 2010 through 2014, calculating the following ratios (2 marks each). Use the unaudited data for 2014. For any ratios

- Complete ratio analysis for the years 2010 through 2014, calculating the following ratios (2 marks each). Use the unaudited data for 2014. For any ratios that use an average of 2 years in the formula, you can assume that the 2010 ending balance approximates the 2010 average. (The ratios that use an average of 2 years in the formula include accounts receivable turnover, inventory turnover, return on assets, and return on equity.) You are not given the 2009 data to calculate the average for 2010, so you can assume that the average for 2010 is equal to the year-end balance. Show your calculations for each ratio or complete in Excel worksheet using formulas:

- Current ratio

- Receivables turnover

- Days sales in receivables

- Inventory turnover

- Inventory holding period

- Rate of return on net sales

- Rate of return on total assets

- Rate of return on stockholders equity

- Asset turnover

- EPS

- Debt ratio

- Times interest earned

- Provide a discussion of the companys performance in terms of liquidity, profitability, and leverage. Be sure to discuss each ratio. In your discussion, identify the key indicators that showed the downfall of Forge Group. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started